Internal memo highlights Navient's alleged hidden agenda with student loan borrowers

The Consumer Financial Protection Bureau (CFPB) is suing Navient over allegations that the student loan servicer systematically encouraged student loan borrowers into forbearance — adding billions of dollars in interest on top of existing loans in the process — and a recently unsealed batch of court documents highlights the practice.

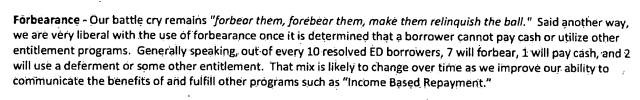

“Our battle cry remains ‘forbear them, forbear them, make them relinquish the ball,’” a Navient executive stated in the 2010 memo. “Said another way, we are very liberal with the use of forbearance once it is determined that a borrower cannot pay cash or utilize other entitlement programs.”

The 2010 memo was written by Matt Bailer, who was then a senior director at Sallie Mae, Navient’s former parent company.

“We need to point [the borrowers] to the optimal solution based on their unique circumstances (optimal solution for the student and the firm),” the exec added.

The statement emerged among court documents unsealed in August. The court documents are part of the CFPB’s lawsuit against Navient that was announced in 2017.

"For years, Navient failed consumers who counted on the company to help give them a fair chance to pay back their student loans," then-CFPB Director Richard Cordray said in a statement announcing the lawsuit. "At every stage of repayment, Navient chose to shortcut and deceive consumers to save on operating costs. Too many borrowers paid more for their loans because Navient illegally cheated them and today's action seeks to hold them accountable."

The lawsuit alleges Navient deceived borrowers by “steering” them toward forbearance to boost the company’s bottom line. The memo stated that roughly 70% of student loan borrowers would choose forbearance, which involves a borrower being allowed to temporarily reduce the amount or stop the loan repayments while their loans accruing interest over time.

“The evidence unsealed… confirms that Navient's practices that added billions of dollars of debt to struggling borrowers emanated from the top echelon of the company,” Student Borrower Protection Center Executive Director Seth Frotman told Yahoo Finance in a statement.

“This follows a decade-long pattern of Navient ripping off servicemembers, disabled veterans, teachers, and American taxpayers,” Frotman added. “The time has come for policymakers to admit this company's practices are predatory and corrupt— it should not be given a single additional taxpayer dollar.”

‘Emanated from the top echelon of the company’

According to the lawsuit, Navient de-prioritized another option for people who are unable to pay back loans called Income Based Repayment (IBR) or an income-driven repayment plan.

Under IBR, a borrower’s repayment amount is a percentage of their discretionary income. Hence, borrowers can pay an amount based on their current income and household size, and the plan allows for fluctuations based on the hardship they’re experiencing. Payments can be as low as $0.

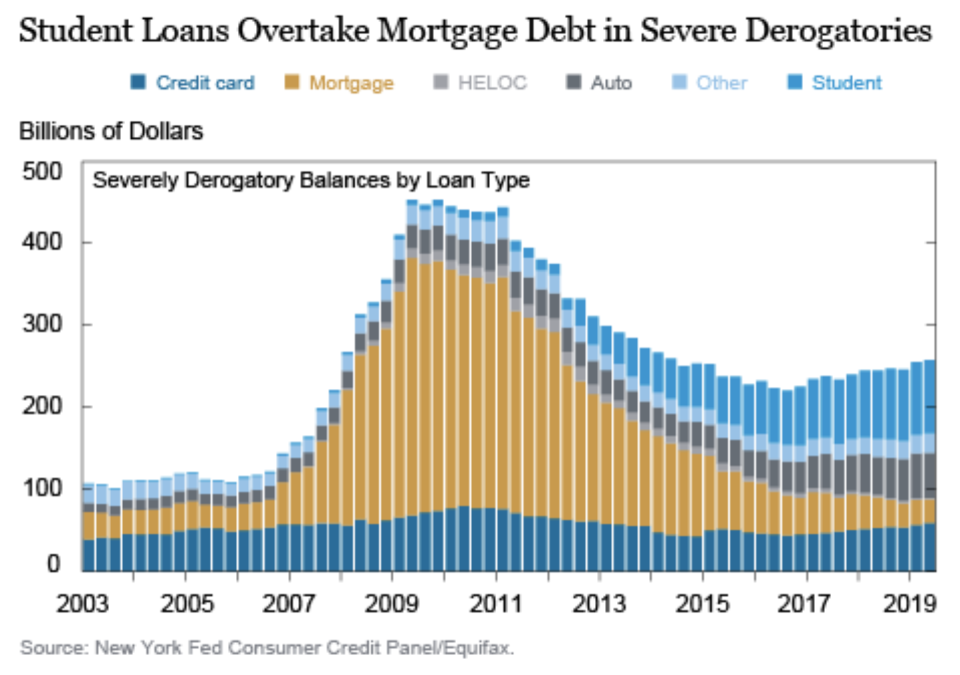

“The high use of forbearance is also associated with increased rates of borrower default,” the CFPB added in its lawsuit. Student loan defaults have “grown stunningly” over recent years, according to recent data.

New York Fed researchers noted in August that “in the second quarter of this year, the outstanding severely derogatory balance is comprised of 35 percent defaulted student loans, which have grown stunningly since 2012.”

Severely derogatory, the New York Fed explained, refers to “any stage of delinquency paired with a repossession, foreclosure, or ‘charge of’” (meaning that the lender has removed the debt from its books).”

The Navient memo asserted that the company emphasized forbearance over IBR to “improve [their] ability to communicate then benefits” of those IBR programs. Navient maintains that it followed the rules and was only trying to avoid more delinquencies and defaults.

“These documents clearly show that Navient educates our borrowers about income-driven and other repayment options — any suggestion otherwise is a distortion of the facts,” Mark Heleen, general counsel for Navient, told the Washington Post. “After a nearly six-year legal process, the CFPB has failed to produce a single student loan borrower to support their baseless claims against Navient.”

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

‘I was misled’: Public school teacher tells Congress about student debt nightmare

Weill Cornell makes medical school free for qualifying students

'The power of this is massive': Student debt help could be on the way with new bill

New Mexico is trying to make college free with 'an absolute game-changer'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.