Longshot 2020 presidential candidate has a radical plan to solve the student loan crisis

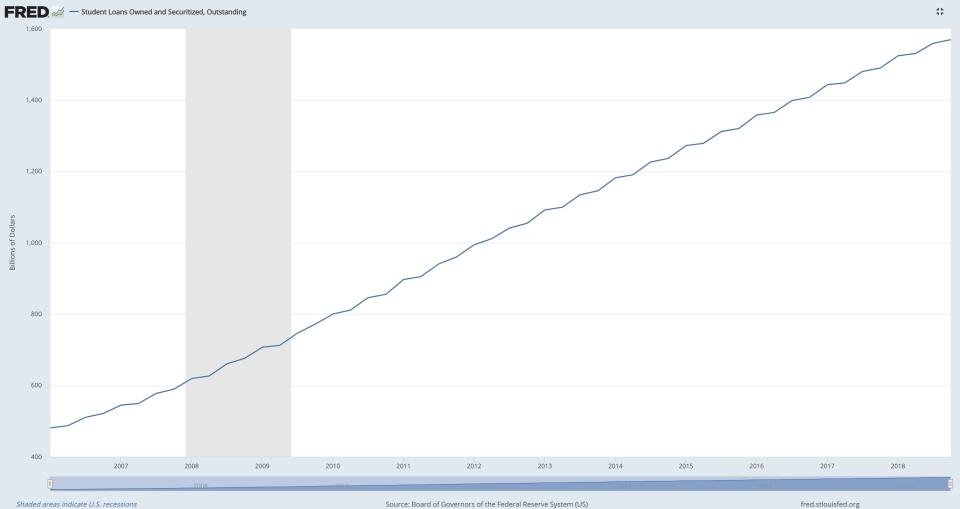

The $1.5 trillion student loan debt crisis has been building over decades, and one presidential hopeful has a simple and radical solution: to cancel all student debt.

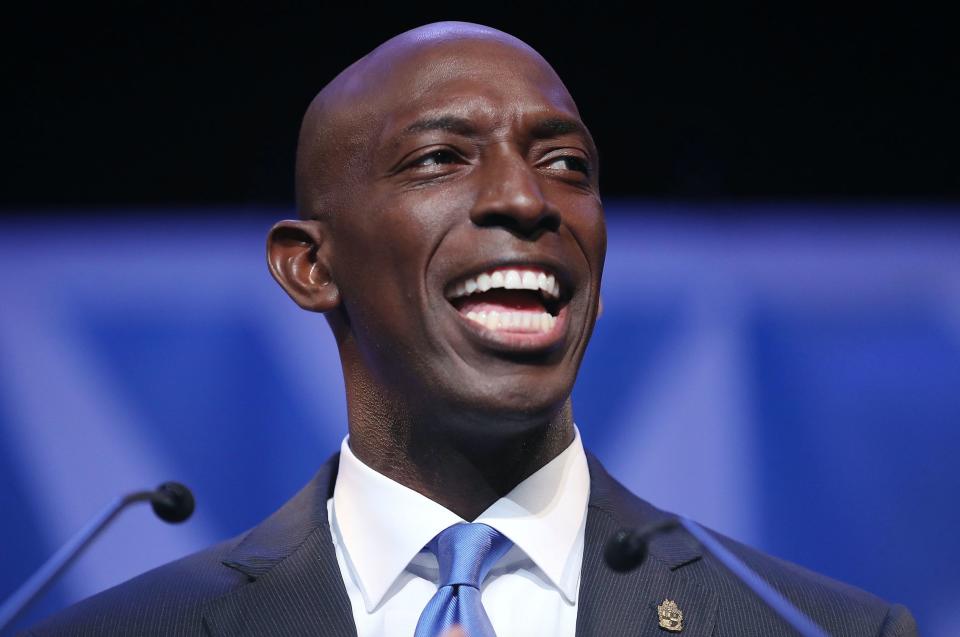

“Americans are not going to have the same opportunity to achieve the American dream,” Wayne Messam, mayor of Florida’s Miramar City (population:140,000) and a longshot 2020 candidate, told Yahoo Finance. He noted that in addition to rising healthcare costs, “this crippling student loan debt that 44 million Americans are dealing with [is] slowing down our economy.”

Messam’s plan would involve all loans that are either U.S. Treasury-backed or private and taken out for higher education at any point of time would be forgiven, giving borrowers a clean slate.

“The U.S. Department of Education owns about 95 percent of America’s student loan debt,” the plan states, “making the mechanics of complete debt cancellation for the majority of the loans relatively straightforward.”

The massive debt pile is “a balloon is really getting ready to burst,” Messam told Yahoo Finance. “And we need to do something about that.”

Messam announced his candidacy on March 28, joining Pete Buttigieg as the second mayor in the 2020 race.

‘Don’t think it’s fair’

The former Florida State University football player said that as the father of three college students, he knew the financial pain that comes with higher education.

“I don’t think it’s fair that the student and the parent has to bear all of this risk when it’s benefiting the entire economy,” said Messam.

The student loan debt crisis has become a national issue recently with another presidential candidate, Senator Elizabeth Warren (D-MA), heavily criticizing the Consumer Finance Protection Bureau for failing to keep student lenders in check.

“Student loans, lending discrimination, credit reporting companies, debt collectors… It seems pretty clear to me that you stopped enforcing the laws designed to protect consumers,” Warren told CFPB’s head Kathy Kraninger in a hearing last month.

Banking giant J.P. Morgan chief Jamie Dimon also chimed in on the topic earlier his week, criticizing the industry as being “irrational” amid “soaring college costs.”

“The impact of student debt is now affecting mortgage credit and household formation,” said Dimon. “Recent research shows that the burdens of student debt are now starting to affect the economy.”

Millennials saddled with debt are putting off key milestones like starting a family and buying homes as a result, a study from Bankrate.com found.

Student loans will be paid for by the ‘repealing of the Trump tax cuts’

Messam believes that his plan could be could be enacted in two steps.

“The $1.5 trillion will be paid for by the repealing of the Trump tax cuts that were given to corporations and the richest of Americans,” Messam said. President Donald Trump passed the cuts in 2017, hoping to pump fresh money into the economy. Corporations were the biggest beneficiaries.

“That was estimated to be about $2 trillion worth of tax cuts,” Messam continued. “That’s the first part of the answer of where that money will come from.”

The second part, he said, would be for the Department of Education to use that “revenue stream … to pay off the debt … as well as going to the private lenders to pay off any outstanding loan debt that would be owned by private lenders.”

That would essentially — in his opinion — wipe borrowers’ balances and give them a clean slate.

Messam believes that wiping all of the debt would “not only will it balance the scales in terms of having parents and students bear all of this costs … it would be an economic stimulus in the first year alone.”

‘A big pill to swallow’

Experts aren’t sold on the idea.

“I’m sure that the proposal or the idea has an appeal for people who have been burdened by student loan debt,” Bankrate.com Senior Economic Analyst Mark Hamrick told Yahoo Finance. “But when you talk about cancelling student debt, it’s obviously a big pill to swallow.”

Hamrick said that cancelling debt en masse would be “trading a less than optimal situation for one of comparable value or perhaps even worse,” adding that any efforts to repeal Trump’s tax cuts would be near impossible.

“First of all, you’re asking Congress to do a complete 180 of what’s already passed,” said Hamrick. “Not only is it politically unsustainable or unlikely, but also it would just be viewed as not workable.”

On top of that, “there is a notable variable that this plan fails to pinpoint,” Climb Credit CEO Angela Ceresnie told Yahoo Finance, which is “holding higher [education] institutions accountable for student outcomes.”

She added: “Canceling the current debt doesn’t stop future debt from accumulating. … The reality is that there are institutions hiking up tuition and maximizing the amount of government aid that they are receiving without delivering adequate career outcomes to their students. A one-time cancellation of current debt isn’t going to stop these institutions from burying the next generation in debt.”

And at the end of the day, “it might make for a good talking point,” Hamrick said, but “this is the wrong kind of medicine for the problem...

“The ill is $1.5 trillion in a student in a system that is somewhat broken system. It’s a rather simplistic idea that doesn’t really address long-term challenge.”

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

'Lousy system': U.S. official who resigned explains how the student debt crisis got so bad

Dimon: U.S. student loan debt is ‘now starting to affect the economy’

'The clock is ticking' on U.S. consumer loans — and that could mean a slowdown, Deutsche Bank warns

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.