Can Strong Cloud Growth Propel Alibaba's (BABA) Q3 Earnings?

Alibaba Group Holding Limited’s BABA expanding core commerce and cloud portfolio are expected to positively reflect on fiscal third-quarter results, slated to release on Feb 13.

Alibaba’s cloud business has fast emerged as a major contributor to top-line growth.

In the last reported quarter, revenues from its core commerce segment were up 40% year over year to RMB101.2 billion (US$14.5 billion). Revenues from the cloud computing segment also increased 64% from the prior-year quarter to RMB9.3 billion (US$1.3 billion).

The Zacks Consensus Estimate for fiscal third-quarter total core commerce is pegged at $20.1 billion, indicating an improvement of 20.8% from the year-ago reported figure.

The consensus mark for revenues from the cloud computing segment is US$1.5 billion, indicating an improvement of 16.4% from the year-ago reported figure.

Click here to know how the company’s overall fiscal third-quarter results are expected to be.

Let’s Delve Deeper

Innovation in data technology, widespread application of big data, and increasing validation for Taobao and Tmall portals are likely to have expanded revenues from this segment in the to-be-reported quarter.

Revenues from this segment have been impressive over the last few quarters. Sales growth is likely to have accelerated, driven by an increase in the number of paying customers and improved revenue mix of higher valued-added services.

During the quarter, Alibaba rolled out a number of products based on emerging technologies of Artificial Intelligence, Machine Learning and Internet of Things to cater to rising demand for cloud architecture, along with data analytics and security in the retail industry.

These products, which are expected to develop a collaborative management platform across various businesses, should have driven its revenues in the to-be-reported quarter.

Markedly, cloud revenues are expected to have increased in the quarter, owing to an increase in spending from enterprise customers. The company has been continually adding new features to cloud offerings for driving customer spending.

The company’s customer base expanded in the Asia-Pacific (APAC) region, driven by portfolio strength. The expanding clientele is likely to have driven net sales of this segment in the quarter.

Alibaba’s cloud computing business has been gaining a lot of traction. It is a dominant force in China but has also gained traction in other regions. The company has opened new data centers across the world. These factors are anticipated to reflect on its upcoming results.

Given the dominant position of Alibaba’s cloud business in China and aggressive international expansion strategies, cloud computing is expected to have been one of the major growth drivers for the quarter to be reported.

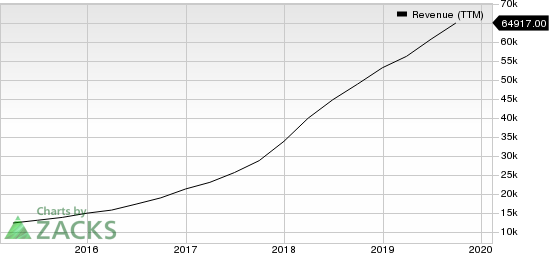

Alibaba Group Holding Limited Revenue (TTM)

Zacks Rank & Other Key Picks

Currently, Alibaba carries a Zacks Rank #1 (Strong Buy). Other top-ranked stocks in the broader technology sector include Itron, Inc. ITRI, Splunk Inc. SPLK and Agilent Technologies A. While Itron and Splunk Inc sport a Zacks Rank #1, Agilent carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for Itron, Splunk, and Agilent is currently projected at 25%, 31.2% and 12.5%, respectively.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Click to get this free report Itron, Inc. (ITRI) : Free Stock Analysis Report Agilent Technologies, Inc. (A) : Free Stock Analysis Report Splunk Inc. (SPLK) : Free Stock Analysis Report Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research