Stocks fall as Trump's re-election odds drop: analyst

Investors are laser focused on the impact of the elections on their portfolios as President Trump’s odds of winning reelection continue to align with stock prices.

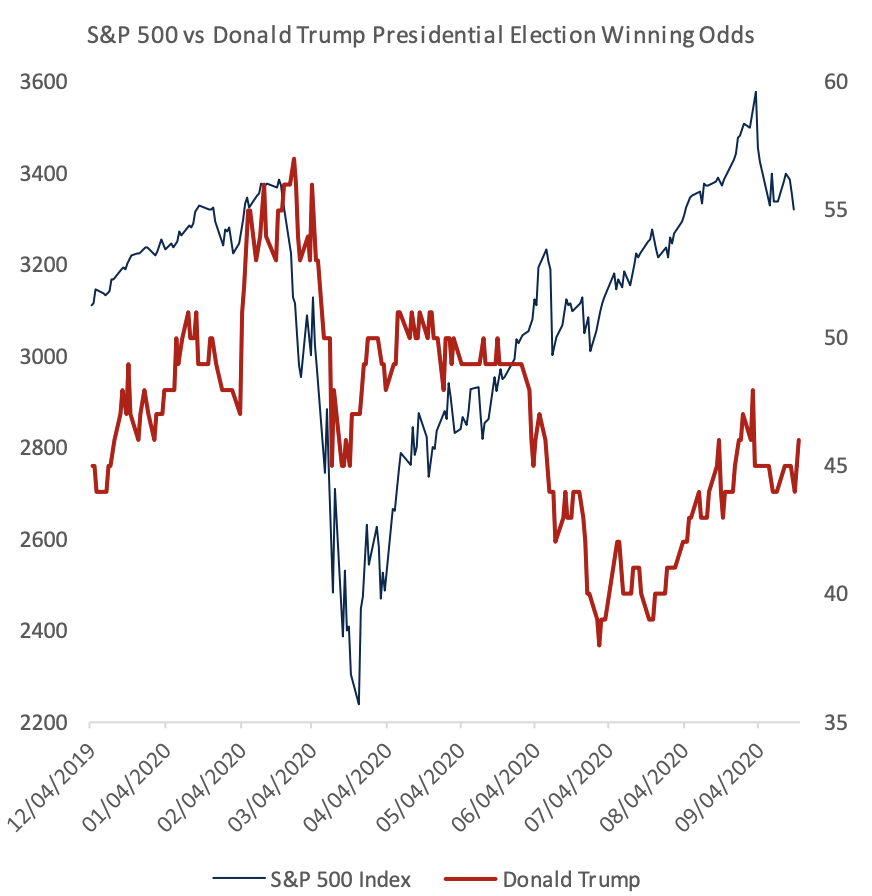

“The U.S. election clearly matters to the stock market again,” wrote Lori Calvasina, RBC Capital Markets Head of U.S. Equity Strategy in a new report. “Since last summer, S&P 500 performance has mostly moved in sync with expectations regarding Trump’s re-election in the betting markets.”

National polls show Joe Biden likely to win on Election Day. He’s ahead of Trump by 9 points – 52% to 43%, according to a recent poll. Trump has been trailing his rival over the summer and so far through September. Betting markets expect Biden to hold on to his lead in November.

RBC’s report shows that when Trump’s odds of winning the White House improve, stocks move higher.

It’s worth noting that the relationship between Trump’s odds of winning in the betting markets and S&P 500 performance was severed briefly in May and June. Trump’s odds of winning dropped, yet the S&P 500 climbed to its highest level since March as the U.S. economy started to recover from the coronavirus shutdown.

Starting in July, the market resumed its upward trajectory, along with Trump’s odds of getting re-elected, with the S&P 500 closing at a record high of 3,389 on Aug. 18.

The recent slight dip in Trump’s odds has been reflected in the recent market drop-off: September has been a tough month for investors with the S&P 500 down 6%.

Investors can expect further volatility as several factors that could spell a major reversal of fortune for either candidate have yet to be worked out.

The first, of course, is the death of Justice Ruth Bader Ginsburg, which will no doubt start a contentious battle in the Senate as Trump pushes for a confirmation before Election Day.

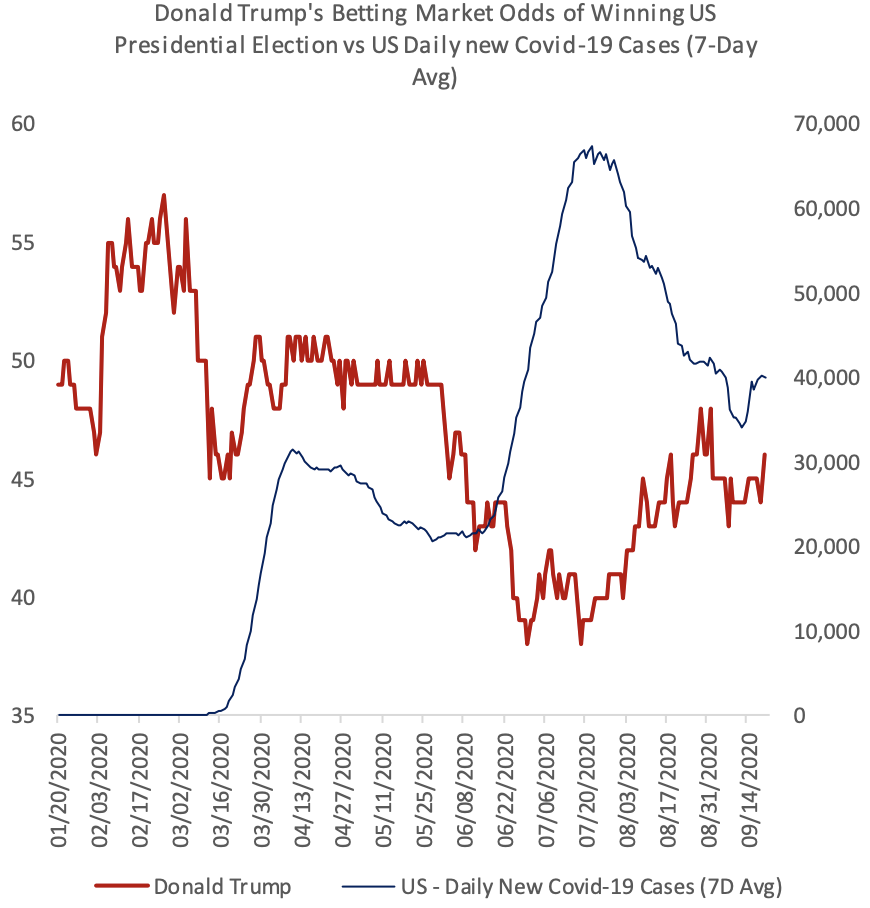

In spite of a downward trend in new coronavirus cases nationwide, Trump’s fortunes remain inextricably linked to the spread of the pandemic in the country.

“Expectations for Trump’s presidential re-election in the betting markets appear to have become linked with the broader trends in Covid-19 virus trends in the U.S., as measured by the 7-day moving average of new cases,” wrote Calvasina. “It is important to note that Trump’s odds were not affected by the initial outbreak but rather the duration and re-acceleration of infections throughout the U.S...around late May to early June. In July & August, Trump’s betting market odds increased as cases declined in the U.S.”

The biggest threat of all as it relates to the U.S. election’s impact on stocks is the possibility that election results will get contested and the country will have no clear winner on Nov. 3.

The last time a presidential election was contested was in 2000 when George W. Bush and Al Gore were vying for the White House. That year, the S&P 500 dropped about 12% from the close on Election Day through Dec. 20.

More from Sibile:

Why Black communities need to be ‘central’ to response to wildfire disasters

How California wildfires are uniting frenemies Trump and Newsom

We’ll ‘have a way’ to ban fracking in Biden administration: Sierra Club

Find live stock market quotes and the latest business and finance news