Both stocks and bonds could drop during the next bear market: trader

Let the Good Times Roll?

After an early hiccup in August, markets have fought off every challenge. From nukes to hurricanes, investors have stepped in pushing benchmarks to all-time highs. Given year-to-date performance throughout the world, geosynchronous growth is an understatement. With the exception of Canada, nearly every market in the world is up in both local currency and when priced in US dollars. All of the above begs the question: Just how long will the good times roll?

The desire to pull the rip cord (even if early) is tough to combat, especially as markets enter unchartered territory. No one wants to end up like Wylie Coyote who looks up and finds no parachute as he careens toward the canyon below.

The focus on indices further exacerbates the problem for advisors and portfolio managers. When investors follow sustained moves in either direction, they develop what I call, the floating index syndrome.

Bull Market: Most investors look to the S&P 500 (^GSPC, SPY) or Dow Jones Industrial Average (^DJI, DIA) as their benchmark for return.

Bear Market: Investors start comparing performance to CDs, T-bills (^IRX) and longer-term Treasurys (^TYX, ^TNX).

Perhaps the biggest challenge for asset allocators is the possibility—if not probability—that the next bear market may be one where both stocks and bonds go down.

As an on-the-line portfolio manager who, among other strategies, focuses on large cap U.S. equity, the siren song of the floating index is quite appealing. Believe me, there have been times I wanted to change my benchmark to the Russian OTC Oil Service Index, as the S&P 500 is driven by fewer and fewer names. As Apple (AAPL) continues its march toward a trillion dollar valuation—followed by Alphabet (GOOGL, GOOG), Microsoft (MSFT), Facebook (FB) and Amazon (AMZN)—you can easily come to the conclusion that not much else matters.

The truth is, it all matters. As powerful as these companies are there’s a lot more going on in the economy than any one acronym (i.e., FANG). Even within the S&P 500, there are 21 other companies that performed better than any of the Fab Five, with Vertex (VRTX), NVidia (NVDA) and Boeing (BA) as notable standouts (up year-to-date 109%, 69% and 60% respectively).

The big story this year isn’t Apple, Facebook or any of the names mentioned. International stocks with emerging markets leading the way are the front page headline. After a decade of underperformance with sentiment for the asset class in the toilet, emerging markets took center stage entering 2016 with any number of factors acting as an anchor.

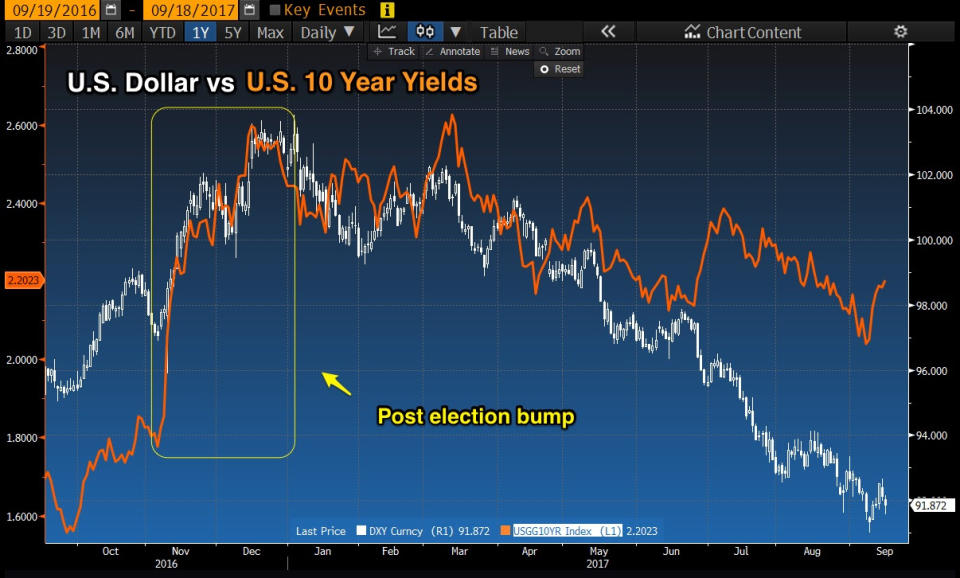

Post the election, the U.S. dollar was spiking higher along with yields — both of which had the potential of creating significant headwinds for emerging markets. Of course, with investors crowded to one side of the boat, just the opposite happened. Following a failed health care bill and several challenges for the administration, the dollar went into a 9-month slide — now at the lowest levels since early 2015. Add the fact that Fed rhetoric regarding the pace of hikes is becoming much more dovish, and today, fewer than 50% of economists expect another rate hike this year.

The good news for investors is that surging foreign markets is also great news for U.S. stocks. With 40% of S&P 500 revenue being derived overseas, strong international markets are an indication our customers are doing well, which is of course good news for U.S. multinationals.

Most investors who try to time the market get it wrong

I wasn’t ignoring Wylie Coyote’s problem but wanted to set the stage before rendering any advice. Look, there’s no shortage of concerns. Nearly every corner of the planet is a geopolitical nightmare and stock valuations are less than attractive. However, stocks don’t trade in a vacuum. Many alternative asset classes are even less attractive than stocks. Locking up the majority of funds in a 10-year Treasury yielding 2% hardly seems appealing.

Most investors who subjectively make decisions about market exposure will likely fail. If you get the exit right, what will be the trigger to get back in? For many it won’t come with the market down 10%. When the market is down 10%, it will feel like another 10% slide is just around the corner. Unfortunately, history has shown that most won’t get back in until we’re at another all-time high.

There’s no shortage of alternatives including tactical rules based strategies that can offer some downside protection. Unfortunately, there is no Holy Grail, and the best choice is usually a combination of strategies, including active, passive and tactical. Diversification among asset classes is critical. Few were looking at international markets earlier this year.

In the end, old fashioned diversification of both strategies and asset classes is the answer for many. Remember, you aren’t an index so don’t invest like one. The index risk profile continues to rise as more and more money pours into the largest stocks, the definition of a market cap weighted index.

Like the index, too many who haven’t saved enough place the bulk of their nest egg in whatever’s working best — a strategy that works right up until the time it doesn’t.

At the time of this article some funds managed by David were long SPY, TLT & BA.

————————————————-

Please contact your Belpointe investment advisor representative if there are any changes in your financial situation or investment objectives.

Investment advice is offered through Belpointe Asset Management, LLC. Past performance is no guarantee of future returns. Insurance products are offered through Belpointe Insurance, LLC and Belpointe Specialty Insurance, LLC. It is important to read our email disclosures available at this link: http://belpointe.com/disclosures.