Stock Market Live Updates: Disney hits record high

Markets went from red to green as Fed Chair Jerome Powell testified before the Joint Economic Committee.

Earlier, markets were in the red. Analysts were pointing to persistent uncertainty despite President Trump’s claim that a trade deal with China is “close.”

Follow Yahoo Finance here for up-to-the-minute briefings on the financial markets, breaking news and other topics of interest to investors and traders. Please check back for continuing coverage.

-

4:01 p.m. ET Stocks close mostly higher

Stocks closed mixed Wednesday, as Disney’s record high pushed the Dow to a record close.

S&P 500 (^GSPC): +0.07%, or 2.2 points

Dow (^DJI): +0.33%, or 92.1 points

Nasdaq (^IXIC): -0.05%, or 3.99 points

10-year Treasury yield (^TNX): -2.3 bps to 1.886%

WTI crude oil prices: (CL=F): +0.6% to $57.17 per barrel

Gold (GC=F): +0.76% to $1,464.70 per ounce

3:19 p.m. ET: Peloton shares rise on report cheaper products to come in 2020

Shares of fitness equipment-maker Peloton rose 6% on a Bloomberg report that the company will add a treadmill and rowing machine to its offerings in 2020, and at lower price points.

-

3:18 p.m. ET: Disney hits record high

Fueled by optimism about streaming platform Disney+, Disney stock hit a record high Wednesday, Bloomberg reports, making the biggest jump in 7 months, according to Yahoo Finance calculations. Disney is now valued at more than $265 billion, about twice that of rival Netflix, according to Bloomberg.

-

2:11 p.m. ET: Groups oppose Google buying Fitbit

A coalition nine of privacy and consumer groups asked the U.S. to stop Google’s $2.1 billion acquisition of Fitbit in a letter to the Federal Trade Commission, the AP reports.

-

1:59 p.m. ET: U.S.-China trade talks stall on farm purchases

According to The Wall Street Journal, China is unwilling to commit to a number on farm repurchases in ongoing trade talks with the U.S. Markets sold off following the report.

“Mr. Trump has said China has agreed to buy up to $50 billion in U.S. soybeans, pork and other agricultural products annually. But China is leery of putting a numerical commitment in the text of a potential agreement, according to the people.”

-

12:34 p.m. ET: Powell unlikely to grant Trump’s wish for negative rates

During his testimony earlier today, Fed Chair Powell said negative interest rates “would certainly not be appropriate in the current environment.”

As Yahoo Finance Fed reporter Brian Cheung observed, this flies in the face of what President Donald Trump said on Tuesday to the Economic Club of New York: “We are actively competing with nations who openly cut interest rates so that now many are actually getting paid when they pay off their loan, known as negative interest. Whoever heard of such a thing? Give me some of that. Give me some of that money. I want some of that money.“

-

12:30 p.m. ET: Powell’s appearance before the Joint Economic Committee concludes

Markets are modestly higher at the moment.

S&P 500 (^GSPC): +3.2 points, or 0.1%

Dow (^DJI): +58.7 points, or 0.2%

Nasdaq (^IXIC): +3.7 points, or 0.0%

-

12:07 p.m. ET: Disney+ signed up 10 million accounts since yesterday

Disney (DIS) shares are surging after the company announced its streaming service Disney+ signed up 10 million accounts since launching yesterday. Shares jumped nearly 2% after the news.

-

12:04 p.m. ET: Powell on federal debt and deficits

“You don’t need to balance the budget or pay down the debt… You just need to get the economy growing faster than the debt,” Powell said.

Follow the testimony on Yahoo Finance’s YouTube page.

-

11:33 a.m. ET: Powell says “we don’t have that kind of room” to cut rates

Powell notes that the Fed has been able to cut rates by on average about 500 basis points in a “typical post-war recession.” He noted that we currently “don’t have that kind of room” with the fed funds rate at about 1.5%.

Watch Powell’s full response to the question about how to deal with recessions.

Highlight: Is the Fed prepared to deal with a recession? Fed Chair Jerome Powell: “We’re looking hard at ways to make sure that we can use our tools even after rates go to zero. Ultimately fiscal policy has been a key part of the countercyclical reaction as well.” More: pic.twitter.com/1V0IQyTgPa

— Yahoo Finance (@YahooFinance) November 13, 2019

-

11:31 a.m. ET: Powell says low wage growth a “puzzle”

In response to a question about low wage growth, Powell said some of it may be explained by slack in the labor market. He also pointed to automation, globalization, and the declining presence of labor unions.

“It’s a bit of a puzzle why we haven’t seen more of an uptick on wages,” he said.

-

11:07 a.m. ET: Powell appears before Joint Economic Committee

Rep. Carolyn Maloney (D-NY), vice chair of the Joint Economic Committee, offers opening remarks. She notes that job growth is currently slower than it was during the Obama administration.

-

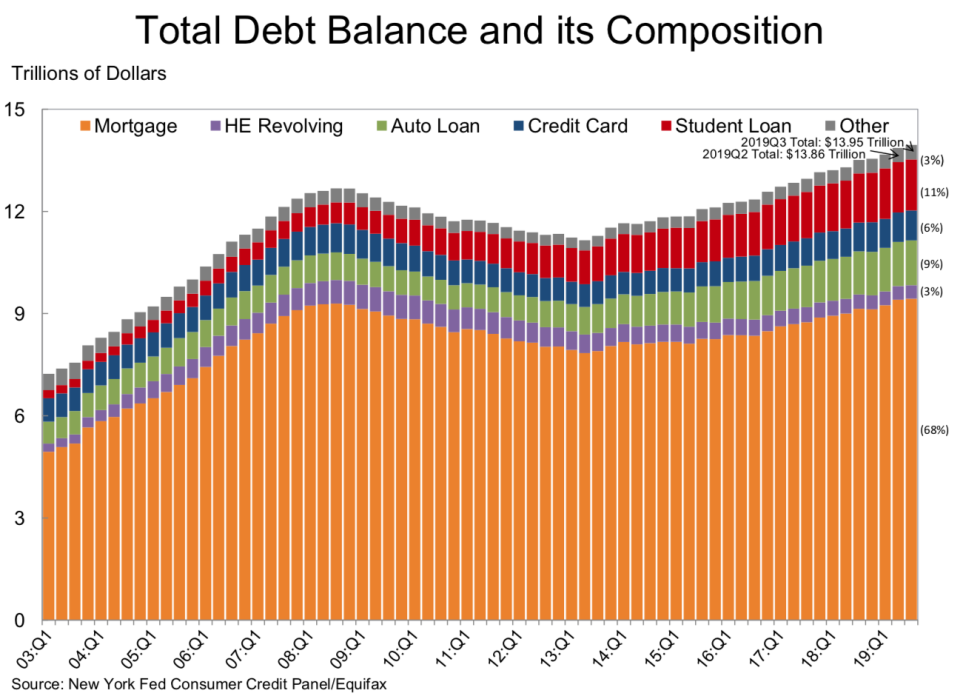

11:00 a.m. ET: Household debt rose to $13.95 trillion in Q3

From the NY Fed: “...total household debt increased by $92 billion, or 0.7 percent, to $13.95 trillion in the third quarter of 2019. It was the twenty-first consecutive quarterly increase, and the total is now $1.3 trillion higher, in nominal terms, than the previous peak of $12.68 trillion in the third quarter of 2008.“

Mortgage, auto loan, credit card, and student loan balances all gained. Home equity loan balances declined modestly.

-

10:40 a.m. ET: Dow turns positive

After trading lower for much of the morning, the Dow had turned positive. The S&P 500 and Nasdaq are well off their lows.

-

10:32 a.m. ET: Trump being forced out of office unlikely, Nomura argues

From Nomura economist Lewis Alexander (emphasis added): “It is now highly likely that the US House of Representative will pass articles of impeachment against President Trump. The House has already passed a bill laying out the process that the House will follow... We expect a vote on articles of impeachment in the full House before end-December. The trial in the Senate is expected to follow in January. We continue to think the probability of Trump being forced out of office is very low. For that to change we would have to see a significant shift in public opinion, particularly among Republicans.”

-

10:14 a.m. ET: Trump impeachment inquiry opening statements are underway

House Intelligence Committee Chairman Adam Schiff (D-Calif) is giving opening statements. Follow live coverage of the hearing on Yahoo News.

-

9:31 a.m. ET: Fed’s Powell: Policy is appropriate

From Powell’s prepared remarks to the Joint Economic Committee (emphasis added): “We see the current stance of monetary policy as likely to remain appropriate as long as incoming information about the economy remains broadly consistent with our outlook of moderate economic growth, a strong labor market, and inflation near our symmetric 2 percent objective.”

“However, noteworthy risks to this outlook remain. In particular, sluggish growth abroad and trade developments have weighed on the economy and pose ongoing risks.”

“In a downturn, it would also be important for fiscal policy to support the economy. However, as noted in the Congressional Budget Office's recent long-term budget outlook, the federal budget is on an unsustainable path, with high and rising debt: Over time, this outlook could restrain fiscal policymakers' willingness or ability to support economic activity during a downturn.”

-

9:30 a.m. ET: Wall Street opens lower

Here’s where markets were trading in the early session:

S&P 500 (^GSPC): -7 points, or 0.3%

Dow (^DJI): -69 points, or 0.2%

Nasdaq (^IXIC): -15 points, or 0.2%

-

9:19 a.m. ET: Trump impeachment process an opportunity for Democrats to step up

From Yahoo Finance’s The First Trade:

Highlight: "This is just the fourth time that Congress has seriously considered impeaching a president," @Jessicaasmith8 says as impeachment hearings begin today. "This is now a chance for Democratic lawmakers to really make their case to the American people." pic.twitter.com/A7MRQSE5Ch

— Yahoo Finance (@YahooFinance) November 13, 2019

-

8:59 a.m. ET: UBS sees the S&P 500 ending 2020 at 3,000

From UBS equity strategist Francois Trahan: “Downside to U.S. equities in H1'20, recovery in H2'20, year-end 2020 S&P 500 target at 3,000: We see the coming year as having two distinct phases for equities as markets transition from slowdown to recovery. We expect forward EPS to move lower for much of the coming year and end 2020 at $170.”

-

8:30 a.m. ET: Consumer price index

The consumer price index climbed 0.4% month over month or 1.8% year over year, which was a bit hotter than the 0.3% and 1.7% increase expected by economists. Excluding food and energy, core CPI rose by 0.2% and 2.3%, respectively (0.2%, 2.4% expected).

“We had expected to see some inflationary impact from the latest tranche of tariffs on Chinese imports imposed in early September, but prices of clothing and household furnishings declined in October,” Capital Economics’ Michael Pearce said. “Overall, today’s report suggests core inflation is leveling off close to the Fed’s 2% target. Barring a sharp slowdown in economic activity, that supports the Fed’s stance of leaving interest rates on hold for an extended period.”

-

7:40 a.m. ET: Analysts aren’t buying that a trade deal is “close”

During his speech to the Economic Club of New York, President Donald Trump said a trade deal is “close. A significant phase one trade deal with China could happen. It could happen soon.”

“If we don’t make a deal, we’re going to substantially raise those tariffs,” Trump added. “They’re going to be raised very substantially. And that’s going to be true for other countries that mistreat us too.”

Here’s Societe Generale currency strategist Kit Juckes: “On trade, his policy of encouragement laced with threatened retaliation to correct past injustices continues. A ‘Phase 1' trade deal with China could come soon but beyond that, there were plenty of warnings about the implications of the Chinese, and others, ‘mistreating' the US. There was no reassurance that import tariffs on European cars aren't coming. If I were an expert tango dancer, I'm sure I'd know what move comes next but as it is, it looks more like a random walk.”

Here’s UBS economist Paul Donovan: “The media focus on US President Trump's speech to economists was on the threat to ‘substantially’ increase taxes on US consumers of goods partially made in China. This was softened by the promise that a deal was ‘close’, and by supply chain shifts that help to evade the taxes. US President Trump suggested there was no uncertainty. That would seem to be challenged by quite a lot of evidence. UBS's survey of industry leaders shows trade policy is causing uncertainty, which is reducing and changing investment. That is unlikely to be repaired by a trade deal. Trust in the global trading order has been damaged.”

Dow futures (YM=F) are down 116 points or 0.4%.

-

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news