The states where Americans rely on Social Security the most

Most workers try to plan for retirement, but in the US, many fall short of their financial goals. According to the Economic Policy Institute, nearly half of families have no retirement savings, and as they near retirement, 50- to 55-year-olds had a median savings of just $8,000 in 2013.

With this statistic it is no surprise that more and more retired Americans are relying on Social Security benefits to live. The Social Security Administration estimates these benefits represent about 33% of the income of the elderly, but a new study says that reliance on Social Security depends on where you live.

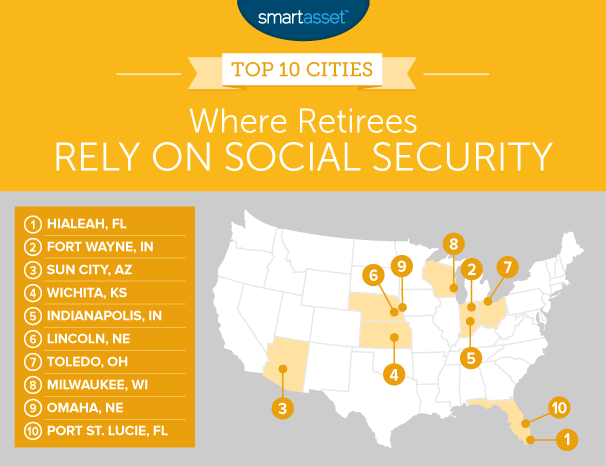

SmartAsset, a personal finance technology company, looked at data for 100 American cities, and compared the average household retirement income for people over 65 to how much they received in Social Security. The results reveal that retirees in Midwest cities are taking full advantage of the government program.

“Seven out of the top 10 cities that rely more heavily on Social Security are in the Midwest,” said AJ Smith, vice president of financial education at SmartAsset.

Some of the Midwestern cities in the top 10 include Fort Wayne, Ind. (where Social Security makes up 53% of retirement overall income); Wichita, Kan. (49.94%); Lincoln, Neb. (49.42%); and Milwaukee, Wis. (48.94%).

One reason for this is that the cost of living in the Midwest is lower, so people need less money to cover expenses in retirement. Housing in the Midwest is also more affordable. Take Omaha, where the Census Bureau reports that 75% of over-65 households own their home and only 34% of those households are burdened by their housing costs.

The city where retirees rely the most on Social Security is Hialeah, Fla., where Social Security makes up 54% of combined retirement and Social Security income.

Social Security benefits

In 2017, nearly 62 million Americans received Social Security benefits. From that number, 42 million were retired workers who got an average of $1,369 a month.

That means the average retiree will get about $16,428 a year in Social Security benefits, while a couple will get $32,856. Not a big number when you consider expenses like food, transportation and growing medical costs. Fidelity estimates the average 65-year-old will spend $137,000 on medical expenses over the course of their retirement, while a couple will spend $275,000.

In other words, you’re probably going to need more money than Social Security can provide. Contributing to your company’s 401(k) is the easiest way to start saving for retirement. If your job doesn’t offer a 401(k) plan, workers under 50 can open up an IRA and contribute up to $5,500 a year. If you’re over 50, that limit rises to $6,500. The maximum contribution is higher for those over 50 because the IRS allows those workers to make a “catch-up” $1,000 contribution to their IRA or Roth IRA. If you haven’t done this by now, there’s still time. Catch-up contributions must be made by the tax filing deadline, which is April 17, 2018.

Brittany is a reporter at Yahoo Finance. Follow her on Twitter.

Chase Sapphire Reserve cutting 100k sign-up bonus in half

Is Chase Sapphire Reserve the best travel credit card ever?

Here’s how Amex Platinum’s new perks compare to Chase Sapphire Reserve