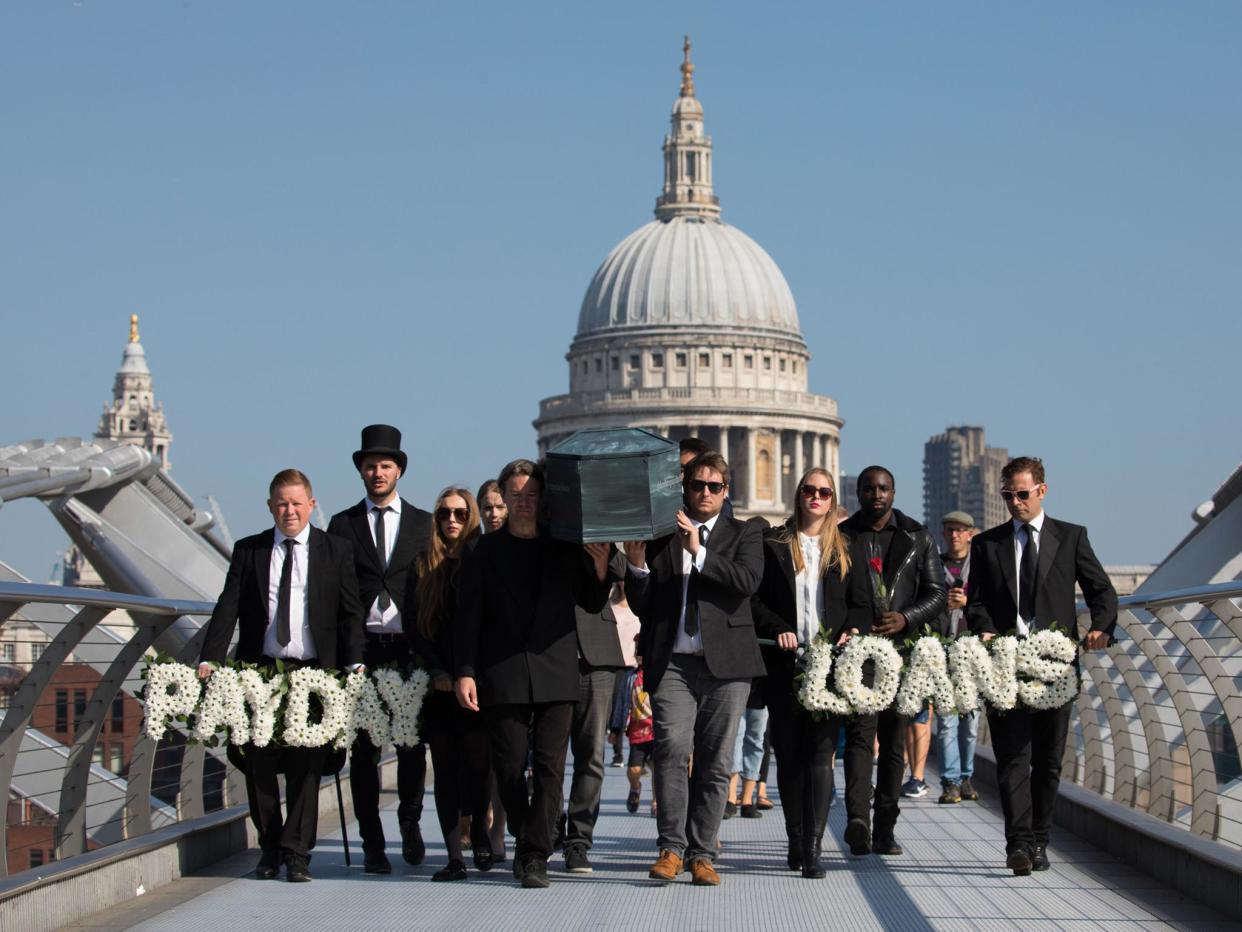

The state, not the Church, led to the rise of payday lenders like Wonga – shouldn’t it take some responsibility?

Sometimes I feel as though I want to say a little prayer for the Archbishop of Canterbury, Justin Welby. His – understandable – anger and frustrations at the burning injustices of our times seem to have turned the mind of this priest a little too turbulent. Having helped put it out of business, just as he threatened, he now wants to take Wonga over. That is a very silly idea.

To be fair, he is still cautious enough to wish to share out Wonga’s £400m of loans across a number of investors, including charities and others. However, he wants to bring in his own Church commissioners, who are supposed to look after the Church’s money (£7bn), and be independent of Welby.

It is odd. When Jesus threw the money changers out of the temple he didn’t then offer to help them with a management buyout. Getting the C of E into the lending game drags the Church, with little consultation or seemingly much thought into being a social “player” on an unprecedented scale, a mini-me DWP with a dog collar. It risks costly disaster.

First, there is a paradox. Wonga went bust because Welby was so successful in getting their astronomic interest rates capped, and encouraging the legal class actions about misselling of loans, plus the generally gruesome image the brand acquired. Fair enough. But that was how Wonga survived. If you then take that same dodgy loan book on in such circumstances, who says you are going to get a better, or even positive, return?

If the new Welby-Wonga loses money – then what? Who subsidises those losses? Hard up retired prelates shivering in their grace and favour homes? Seems an ungodly act.

Closely related, what will you do about reluctant payers? Send in the bailiffs? Horrid idea. The optics would be terrible. Families having their sofa, car or smartphones repossessed by burly agents of His Grace? In Christmas week? Imagine the PR team at Lambeth Palace fielding the calls. No time for vespers.

The nature of lending to the poor is that they do tend to default. The sky-high interest rates charged by payday lenders accounted for the high default rate and cost of recovering bad debts through the courts. If you charge modest interest on loans or merrily write them off then you’ll get even less back, and lose even more money. It’s a business.

The high street banks and building societies can’t be bothered to lend to the poor. After the financial crisis they were even more constrained and nervous about dishing out risky mortgages and loans – why the big banks got into trouble in the first place. The credit unions are too small and limited to make much difference. The recession and austerity added to the pressures. Hence the rise of Wonga and the rest, the food banks and the homelessness. Usury arose from the laws of supply and demand, as powerful as God’s law when you need to cover a gambling debt.

If there is an answer here, it is via the state, to try and find a system of social security that does not leave people desperate, driven to drink, drugs, gambling and debt. More broadly and vitally, we need a system that makes welfare irrelevant and creates a prosperous competitive economy and more jobs. It is a matter that can only be dealt with that way. Or maybe, I will concede, by voluntary work, charitable action and prayer. But, please God, not by turning the Church of England into a bank.