Starbucks, Intel, and Caterpillar — What you need to know in markets on Thursday

After tech stocks soared to a record high on Tuesday, Wednesday saw the sector lag markets while the Dow eked out a record close.

The blue chip Dow was the only one of the major indexes to finish in the green on Wednesday, adding 41 points to close at 26,252, while the S&P 500 lost less than 0.1% and the Nasdaq fell 0.6%.

On Thursday, the busy week of earnings will see a number of blue chip companies report, with Starbucks (SBUX), Caterpillar (CAT), 3M (MMM), Intel (INTC), and Biogen (BIIB) all set to report results.

Markets will also keep an eye on the dollar, which sank 0.8% on Wednesday after several White House officials, notably Treasury Secretary Steven Mnuchin, commented on the level of the greenback, which has given up almost half of its advance from 2014-15.

Mnuchin said at the World Economic Forum in Davos that the dollar is “not a concern of [the Trump administration’s] at all,” adding that, “a weaker dollar is good for us as it relates to trade and opportunities.” A weaker dollar is a benefit for U.S. exports, which could help close the trade deficit with China, among other major exporters, which has been a common point of emphasis for President Donald Trump.

In addition to more commentary out of Davos, markets will also have a few bits of economic data to parse, with the weekly report on initial jobless claims expected out as well as the December reading on new home sales.

Best start since ’87

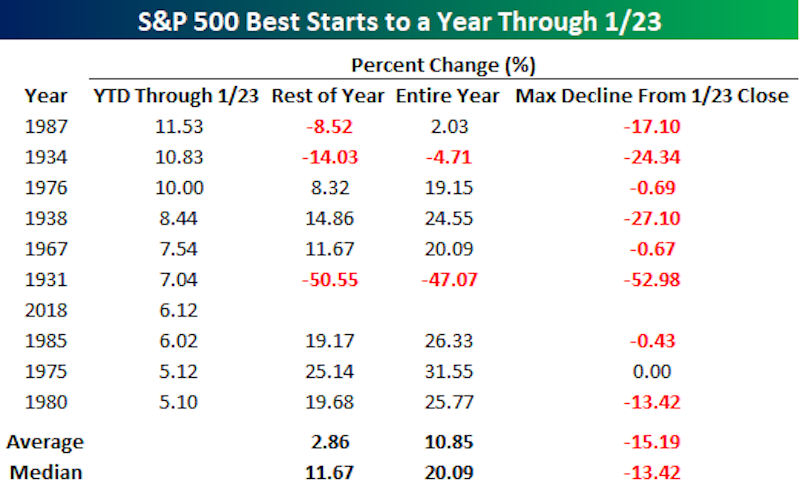

As of Tuesday’s close, the S&P 500 has had its best start since 1987.

Those steeped in market history, of course, know that this year has some very negative connotations. In October of 1987, the Dow fell 22% on “Black Monday.”

Bespoke Investment Group noted Wednesday that the 6.12% gain the benchmark index logged through Tuesday is the seventh-best start to a year through January 28 dating back to 1928.

And while some of the years with better performances through January 23 are some infamous depression years — 1931, 1934, and 1938 — the takeaway from how the top-10 years for stocks through this date fared is that stocks went up. As per usual.

But these hot-starting years also brought investors some turbulence, with the average loss from the January 23 high coming in at 15% peak-to-trough decline while the average full-year return is 10.85%.

These numbers, however, mostly just make clear that years in which the markets get off to a hot start are a lot like other years. As we noted last year, the stock market declines 10% from its yearly high three-quarters of the time and only twice in the last 89 years has the market not fallen at least 4.4% from an interim peak — 2017 was one of those years. And on average, the S&P 500 returns about 8% a year.

So while Wednesday saw a more mixed market picture, the theme of markets in the early days of 2018 has been a continuation of what we saw in 2017. There is little that seems to be standing in the way of stocks going up with plenty of buyers at-the-ready when equity markets pull back even a little.

And market history, while telling us that years which see stocks go up at the outset usually continue this trend, also tells us that these placid times for bullish investors are likely to end. When, and how, and why, of course, are the unknowns.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

One candidate for Amazon’s next headquarters looks like a clear frontrunner

Tax cuts are going to keep being a boon for the shareholder class

Auto sales declined for the first time since the financial crisis in 2017

Foreign investors might be the key to forecasting a U.S. recession

It’s been 17 years since U.S. consumers felt this good about the economy