Spotify poised to make a good chunk of money from Joe Rogan Experience

Forget Spotify’s second quarter earnings release out Wednesday for just a second. Perhaps more riveting — and important to investors in red-hot Spotify shares — are some of the early estimates starting to trickle in from the sell-side on the financial impact of Joe Rogan’s upcoming podcast on the platform.

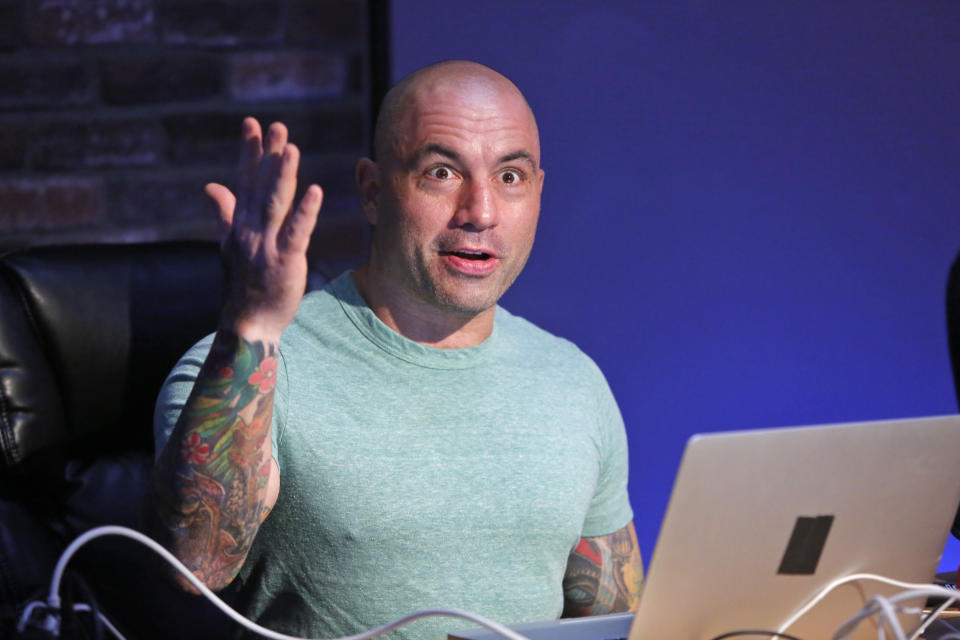

Spotify (SPOT) inked a deal for the Joe Rogan Experience back in mid-May for a rumored $100 million. The controversial Rogan — who has north of 8 million YouTube subscribers and consistently racks up 1 million views for his shows —will debut on Spotify on Sept. 1. It’s expected Rogan’s star power will fuel a boom in Spotify’s premium subscriptions and drive an infusion of ad dollars.

While Spotify hasn’t put out a financial estimate on Rogan’s podcast, Wells Fargo’s veteran media analyst Steven Cahall has taken a crack.

And it’s a doozy.

“In a bull case scenario with ad sales at 15% gross margin, we think The Joe Rogan Experience could generate around €50mm in profitability in the medium term. Combined with 4 million premium subs and nearly 7 billion ad impressions to draw off of, that seems a good deal for Spotify,” Cahall wrote in a new note to clients obtained by Yahoo Finance.

Even Cahall’s more bearish modeling has Spotify on the precipice of making a good chunk of money off Rogan’s podcast beyond year one.

“For an illustrative bear case let’s just say there are zero incremental premium subs from the podcast. Let’s also assume that the friction from being exclusive to SPOT reduces unique listeners from 8 million to 6 million. Under this modeling it still brings Spotify lots of ad impressions – 5.5 billion annually – but ad revenue might be ~€250 million p.a. vs >€500 million in the bull case. If we’re also under estimating Rogan and team’s costs and the gross margin on the ads as Spotify scales then it’s possible this will be gross profit dilutive initially,” Cahall writes.

With possible earnings power like that from Rogan — coupled with recent podcast deals with Michelle Obama, DC Comics and Kim Kardashian that come with their own strong earnings potential — it’s no small wonder Spotify’s stock has exploded about 90% inside of three months, per Yahoo Finance Premium data.

“We are pretty serious in the podcasting space,” Spotify CFO Paul Vogel told Yahoo Finance in an interview Wednesday.

As for second quarter earnings out Wednesday morning, they were obviously absent the Rogan boost. But all in well, a solid quarter considering the pressure on industry ad revenue amid the COVID-19 pandemic. Monthly active users rose 29% from the prior year to 299 million — the Street was looking for 298 million. Revenue of €1.89 billion fell short of Wall Street estimates by about 3% owning to pressure on ad spending.

Spotify sees third quarter monthly active users in a range of 312 million to 317 million, relatively in line with sell-side forecasts. Third quarter sales are pegged at €1.85 to €2.05 billion versus analyst estimates for €2.01 billion.

Shares took a breather after the results, falling about 4% in afternoon trading.

Now bring on Rogan.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.