Sometimes It Is Good to Buy the Biggest. But Should You Buy the Biggest Health Care ...

- By Robert Abbott

2016 Investor Day presentation, June 29, 2016

The McKesson Corp. (MCK), which distributes pharma products and medical supplies (and more), is the 11th largest company on the Fortune 500 list. It's currently a bargain, at least compared to what it used to be.

Warning! GuruFocus has detected 3 Warning Sign with MCK. Click here to check it out.

The intrinsic value of MCK

Does that make it a buy for value investors? And how does it compare with two other health wholesaling giants, Cardinal Health (BAH) and AmerisourceBerge (ABC)? Consider this chart comparison, with McKesson, the biggest by market cap (green line), Cardinal Health (blue line), and AmerisourceBergen (red line):

Let's look at the McKesson story and analyze some key financial issues.

History

1833: John McKesson and Charles Olcott of New York City start a business that imports and sells therapeutic drugs and chemicals, and wholesale.

1938: Becomes embroiled in what becomes known as the McKesson-Robbins scandal, which later leads to significant changes in auditing standards and securities regulations.

1990s (early): The company decides to focus on health care by selling unrelated businesses and buying General Medical, the largest distributor of medical-surgical supplies.

1998: Buys HBO & Company, the world's largest health care services company.

2010: Buys US Oncology, becoming the second-largest specialty company.

2013: Announces CommonWell Health Alliance(TM), a joint effort among health IT suppliers that supports universal access to health care data through interoperability.

2014: Buys a 50% stake in German peer Celesio for $8.3 billion to become one of the world's biggest health care companies.

2016: Agrees to buy the pharmaceutical distribution division of UDG Healthcare in Ireland, to buy more than 200 pharmacies operated by Sainsbury's in the United Kingdom, and to buy Rexall Health in Canada.

Historical information from the company website and Wikipedia.

McKesson has a long history in the industry, combined with many acquisitions, to become a giant in its field and one of the world's largest publicly traded companies.

McKesson's Business

The company provides a worldwide pharmaceutical distribution business and an information technology company (unless otherwise noted, the information in this section comes from McKesson's 10-K for 2016).

It distributes a comprehensive catalog of pharmaceutical products and medical supplies, and works with its customers to help them improve their health care operations.

Customers include: payers, healthcare providers, pharmacies, pharmaceutical companies and others across the health care industry.

Operations are divided into two segments for reporting purposes:

Distribution Solutions is the big one: it distributes both brand name and generic pharmaceutical drugs and other healthcare-related products worldwide, as well as a wide range of services that include practice management, clinical support. This segment also operates retail pharmacies in Europe and supports independent pharmacy networks in North America.

Technology Solutions delivers management technology solutions for clinical, patient care, financial, supply chain and strategic services, to healthcare organizations.

We note that the company depends heavily on a small number of big customers, "During 2016, sales to our 10 largest customers, including group purchasing organizations accounted for approximately 52.4% of our total consolidated revenues. Sales to our largest customer, CVS Health, accounted for approximately 20.3% of our total consolidated revenues."

Revenues

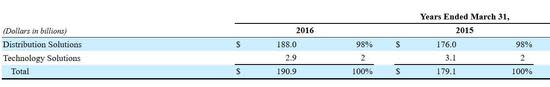

As this excerpt from the 10-K shows, Distribution Solutions brings in far more than the Technology Solutions segment:

And this excerpt shows a breakdown of revenue sources within Distribution Solutions:

Growth

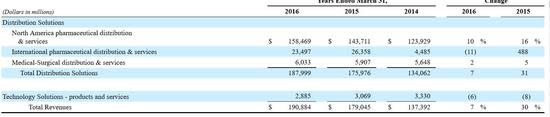

This chart shows how McKesson has grown its revenue over the past 20 years:

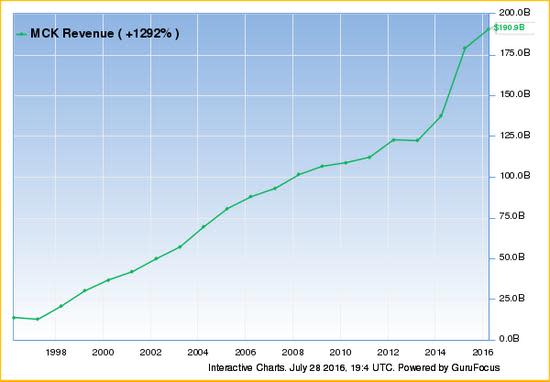

Next, we see how EBITDA (earnings before interest, taxes, depreciation and amortization) and earnings per share have grown over the same period:

Looking to fiscal 2017 and beyond, Chairman and CEO John Hammergren wrote in the 2016 Annual Report, "Our extensive assets, global scale, market knowledge and experienced management team put us in a unique position among our industry peers."

This graphic from its 2016 Investor Day presentation looks at the future this way:

Mario Gabelli (Trades, Portfolio) noted in a recent letter to shareholders, "In its core wholesaling business, the company has stabilized its performance after several contract losses, recently signing a large new contract with Walmart."

Competitors

In its 10-K, McKesson says it operates in a highly competitive global environment. Its main competition comes from full-line, short-line and specialty distributors (at the national, regional, and local levels), service merchandisers, self-warehousing chain drug stores, manufacturers engaged in direct distribution, third-party logistics companies and large payer organizations.

Other big health care companies competing with McKesson include:

Cardinal Health Inc.: market cap $26.9 billion.

AmerisourceBergen Corp.: market cap $18.3 billion.

McKesson has a market cap of $43.7 billion, and also competes with smaller (relatively smaller) companies including Herbalife, Nu Skin Enterprises and the Aceto Corp.

Moat

In an excerpt from the 2016 Annual Report, Hammergren said, in polite terms, that McKesson is a big company, with the heft to go out and do things that few other corporations can. That includes the cashflow and financing wherewithal to buy up potential disruptors and competitors.

Because of acquisitions and partnerships, it can take advantage of economies of scale, spreading fixed costs across the broadest base in the industry.

With its retail connections, it should have the industry's best or near-best intelligence about consumer wants and needs. Its extensive reach throughout the industry should provide it with excellent information about structural changes in the industry.

Other

McKesson is headquartered in San Francisco, California.

It had about 68,000 full-time equivalent employees at the end of the last fiscal year, March 31.

Hammergren addressed the share price decline in the 2016 Annual Report, saying, "There were a number of contributing factors to this movement, including the softening of generics price inflation, some customer losses due to acquisition activity and general weakness in stock prices across the healthcare sector."

McKesson is a big, in fact the biggest, of the drug wholesaling companies. Its major business is the distribution of drugs and medical supplies. It operates in a very competitive environment but has advantages of size and increasing penetration in the global market. Despite its size, it wants to grow bigger still, and has the resources to do so.

Ownership

Vanguard Health Care Fund (Trades, Portfolio) is by far the biggest holder of McKesson among the gurus followed by GuruFocus, with 7,165,280 shares. Larry Robbins (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) are the second and third largest holders.

Institutional investors own almost all of this company, with 92.61% of its shares.

Insiders own 0.10% of the company, while the shorts hold 1.09%.

The overwhelming ownership by institutional investors should provide at least some confidence to prospective investors. While fund managers don't always get it right, they probably do better on average than the rest of us.

McKesson by the Numbers

Comments: This is a very big company, with a market cap of more than $43 billion. With a current share price well below its 52-week high, it has a P/E of just under 20 and an ROE that tops 25%. It pays a small dividend and bought back 3% of its shares last year.

Financial Strength

The GuruFocus system assigns McKesson a rating of 6 for financial strength and 8 for profitability and growth

The red icons under the Financial Strength heading show us why McKesson receives a mediocre rating: debt.

The correlation between debt and the other metrics underscores McKesson's use of long-term debt to partially fund its many acquisitions. For example, it used $1.6 billion of debt in its $2.16 buyout of US Oncology, $4.1 billion of new debt in acquiring Celesio, and reports say it will use a mix of cash and debt to buy Rexall Health.

Going back to the Profitability & Growth results above, note the margins:

Operating margin: 1.86%.

Net margin: 1.18%.

With margins like these, and a company of this size, management will need to keep finding more and bigger acquisitions.

McKesson has borrowed to continue its growth of the top and bottom lines; with its narrow margins, it needs as much scale as possible.

Valuation

More than the share price has come down; the P/E has changed. It was recently almost twice the level it is now.

The PEG ratio (P/E divided by the five-year EBITDA average) also plummeted, down to 1.36:

With a PEG ratio of 1.36, the share price is now in what is considered fair value territory, anything between 1.0 and 1.99.

On these measures, how does it compare with Cardinal Health and AmerisourceBergen?

MCK: 19.67, 1.36

CAH: 19.66, 2.11

ABC: 12.59 *

Note that PEG doesn't show for ABC, which has experienced losses.

While McKesson has had the biggest pullback of these three big health care companies, the others have a couple of negatives as well: Cardinal Health has a PEG ratio that indicates it is overvalued and AmerisourceBergen has negative earnings.

Conclusion

Earlier in the article, guru Mario Gabelli (Trades, Portfolio) is quoted as saying McKesson 's performance had stabilized. Let's now add another of his comments in that statement, "McKesson retains a balanced capital return policy that invests first in its core business but then returns a significant amount of cash to shareholders via dividends and share repurchases, which has helped the company post superior long term growth and returns." His assessment has been borne out by what we have seen here.

Of course, this company will not suit investors who stay away from companies with long-term debt. McKesson has taken on quite a bit in the past few years.

Otherwise, the McKesson Corp. still has the size, the strategy and the opportunities to continue delivering strong total returns to investors.

Disclosure: I do not own shares in any of the companies listed in this article and do not expect to buy any in the foreseeable future.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with MCK. Click here to check it out.

The intrinsic value of MCK