Digital ads aren't working for big consumer brands

Wednesday’s disappointing results from the largest advertising agency in the world, WPP (WPPGY), were driven by a significant reduction in marketing budgets at packaged goods companies like Procter & Gamble (PG) and Unilever (UL).

And these cutbacks reflect, above all else, rising skepticism about the effectiveness of digital ad spending that comes amid rising pressures to reign in costs.

“Concerns about fraud, waste and unsuitable context”

Companies selling consumer staples have expressed less confidence in the effectiveness of digital marketing spend, according to analysts.

An investigation by a US trade association last year eroded trust that agencies are acting in the best interest of brands when purchasing ads on their behalf. And the revelation at the end of last year that Facebook inflated its metrics for video ads added fuel to the fire.

“Certainly an early refrain from the corporates was that they were getting much better bang for their buck as digital allowed them to target marketing communication more accurately and effectively,” according to Credit Suisse’s Charlie Mills. “However, more recently this has given way to concerns about fraud, waste and unsuitable context associated with digital advertising.”

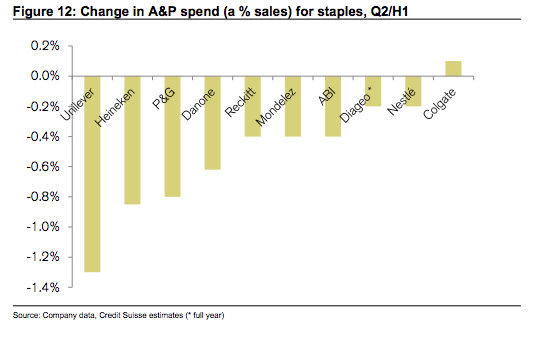

Advertising and promotion (A&P) spending has been significantly cut this year, as shown in the chart below, just as digital advertising surpassed TV for the first time.

In fact, P&G cut $100 million in media placement spending last year because it did not have the assurances it wanted, according to a spokesperson at the company. The company still hit its 2% sales growth target last year, validating the decision to cut back, the company added.

In a January speech, P&G’s chief brand officer Marc Pritchard said the company, which is the world’s largest advertiser, needed more clarity on the impact of digital spend.

“We make decisions involving billions of dollars on where to invest our media money. These are big bets,” Pritchard said. “The times of giving digital a pass are over.”

Pritchard added in January that P&G would be scaling back from its initial enthusiasm for digital until there is more clarity on effectiveness.

“P&G believed the myth… that we could be the first mover on all the latest shiny objects despite the lack of standards and measurements and verification…We accepted multiple viewability metrics: publishers’ self-reporting with no verification, outdated agency contracts and fraud threats with somewhat delusional thought that digital is different…We’ve come to our senses. We realize there is no sustainable advantage in a complicated, non-transparent, inefficient and fraudulent media supply chain,” Pritchard said.

He added that despite marketers spending $200 billion on advertising in the US alone, the growth rates of the collective industries is anemic.

And while major consumer brands have aimed to boost profits amid tepid growth and increased pressure from activist investors, questions about the long-term impact of cuts at big brands have risen.

“The headlong rush to cut costs is understandable in such a low growth environment, but cutting in to advertising budgets risks the very franchises these businesses have been built on,” Mills said.

This could be particularly concerning for big brands, given that smaller consumer names—like Chobani, KIND, Dollar Shave Club, and Blue Buffalo—are quickly gaining traction.

—

Nicole Sinclair is markets correspondent at Yahoo Finance

Please also see:

Why Home Depot is leaving Lowe’s in the dust quarter after quarter

Walmart’s sales numbers make Amazon look small

Summers: Trump Cabinet resignations could unfold like ‘a dam breaking’

Howard Schultz: ‘I come to you with profound, profound concern’

HomeGoods is the most impressive retail story in America

Why Nordstrom is beating all of its department store competitors