Snap is hurting itself by neglecting most of the world

Snap (SNAP) reported its first-ever quarterly report after the bell on Wednesday. And it disappointed big time. Shares were down more than 24% on underwhelming daily active user growth and a miss on revenue.

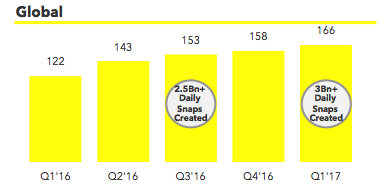

Snap had 166 million users in Q1, which represents a 5% growth rate, falling short of analysts’ estimates of 168 million. It brought in $149.6 million in revenue, compared to the $158.6 million the Street was expecting. While its growth in the US is lackluster, it’s even worse in one major region: what Snapchat calls “rest of world,” every continent except North America and Europe.

SNAP’S PLAN (OR LACK THEREOF) IN ‘REST OF WORLD’

“By definition, Snap is nearing capacity with millennial population user growth. Where are they going to find other millennials around the world? [CEO] Evan [Spiegel] needs to come out with a vision, a specific strategy regarding what their international plan will look like,” said Eric Kim, managing partner at venture capital firm Goodwater Capital.

Last month, Spiegel came under fire (and shares took a tumble) on a report from a former employee that Spiegel said the app is for rich folks, not for “poor” countries like Spain and India. The report sparked a movement called #UninstallSnapchat.

“This supposed comment created huge backlash not just outside of the userbase but actual users. This millennial population is really conscious of doing good, of being mission-oriented, and when you see companies like Snap making these comments, it does have an impact,” Kim said.

Even though Spiegel has denied this allegation, it illuminates a glaring problem for Snap: it’s not flourishing abroad. Investors were hoping for an explanation or a potential strategy for developing countries or markets outside of its core audience during the conference call.

But analysts were left without any answers.

‘CONNECTIVITY ISSUE’

During the company’s first-ever conference call, Spiegel did little to dispel the notion that it’s neglecting emerging markets. His comments suggested Snap remains laser-focused on North America and Europe.

“I think the connectivity issue is a real problem in the developing world. In certain developing world markets, people tend to use their WiFi at home or in an internet cafe…What that means is you can’t use Snap to communicate in the moment, really. That turns Snap into much more of a broadcast, lean back kind of service. …The way that our service works is by empowering this visual communication, and that’s just really tough if you don’t have cell service wherever you go,” he said.

Rather than coming up with a solution to penetrate these markets, he repeatedly blamed the company’s failure to reach consumers in developing countries on a lack of connectivity.

“We focused on markets where affordable broadband cell service is available…where we can deliver our products that way. As connectivity grows, more people will continue to use our products,” he reiterated.

Quarterly average revenue per user (ARPU) is a key metric that Snapchat has touted. And while the global ARPU this quarter was $0.90, it’s clear Spiegel wants to focus on North America, which raked in $1.81 per user (compared to $0.19 in the Rest of World).

Citing Snow, Asia’s answer to Snapchat that’s currently being used by 100 million users, Kim points out that Spiegel is failing to pay attention to plenty of incumbents already in markets outside of North America and Europe that Spiegel.

“Anyone with a long-term view has to understand the importance of international,” he said.

Snap chief strategy officer Imran Khan said the company was really doubling down on advertisers in Germany and the Nordic regions but made no mention of Asia, South America or Africa.

FOCUS REMAINS ON NORTH AMERICA & EUROPE

“We’re going to continue to focus on North America and Europe and longer term we believe that Snapchat is for everyone. It’s just early days, but we’re focused on North America and Europe,” Spiegel reiterated.

Facebook (FB) already has a model to address this lack of connectivity in most of the world. Its initiative Internet.org, which is a collaboration with nonprofits and local communities to connect the 4.5 billion people that don’t have internet access. Of course, it has a self-serving vision in the process — to ultimately get people on Facebook, but it’s developed a strategy to penetrate other markets, particularly with its acquisition of Whatsapp, when Indonesia was its fastest growing market.

One thing is for sure: Spiegel is not proactively trying to connect with users outside of its core demographics. Though Snapchat has been successful in increasing engagement among its current userbase, with users spending over 30 minutes per day on the app, it won’t be enough.

Melody Hahm is a writer at Yahoo Finance, covering entrepreneurship, technology and real estate. Follow her on Twitter @melodyhahm.

Read more: