Small business and the Fed — What you need to know in markets on Tuesday

Tech stocks sold off for a second day on Monday, with the Nasdaq losing 0.5%, more than the broader market.

But on Tuesday, the market’s attention will slowly begin turning to Washington, D.C. where it is not the Trump administration but the Federal Reserve that will be in focus. On Tuesday, the Fed will begin its two-day policy meeting, which will culminate in Wednesday afternoon’s announcement of its latest monetary policy statement.

Also on Tuesday morning, investors will get the latest report on small business optimism from the National Federation of Independent Business. The NFIB’s report has been one of the strongest readings since President Donald Trump was elected.

The corporate calendar this week remains fairly quiet, with most of the focus likely to remain on Uber, as the ride-hailing service is set to release an internal report on its corporate culture prepared by the law firm of former Attorney General Eric Holder to its staff.

Uber and everything else

There are two major technology stories playing out right now.

The first is that big, publicly-traded tech companies have seen their stock prices slide in the last two trading days. This decline follows a huge run-up this year in the stock price of stalwarts including Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), Alphabet (GOOGL), Microsoft (MSFT), and Nvidia (NVDA).

On Friday, a report from analysts at Goldman Sachs, who published a note wondering if the big tech stocks powering the market were creating a mispricing in the market. Perhaps most concerning to investors was Goldman’s reference to the “Nifty Fifty” stocks of the 1960s and 70s and the performance of major tech companies in 1999-2000, two periods for stock returns that preceded brutal bear markets.

And as Bloomberg reported on Monday, most of the drop we’ve seen in tech stocks comes from just five of the aforementioned stocks: Facebook, Apple, Microsoft, Google, and Amazon.

As we’ve noted several times, however, research indicates that the stock market’s returns are only ever powered by a few high-flying stocks. So while the ascent of a few stocks may make some investors feel as though the market-at-large is in a perilous state, it is how things have proceeded through time.

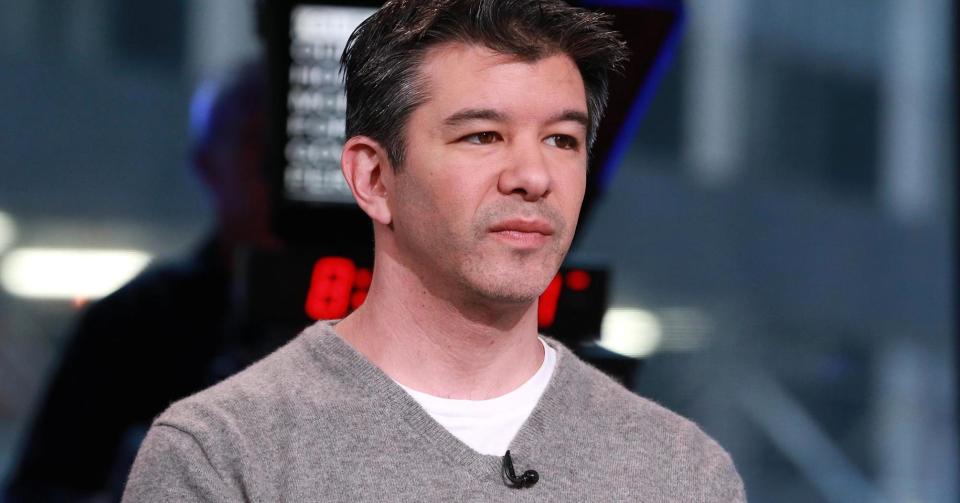

But the drama playing out at Uber, which is on a business-level unrelated to the goings-on at major public tech companies, has also garnered headlines in the last week. The latest report from Reuters indicates that CEO Travis Kalanick will likely take a leave of absence from the company, which has been embroiled in sexual harassment scandals.

And with Uber, the biggest unicorn of them all with a private market valuation approaching $70 billion, fraying around the edges, broad sentiment towards the tech sector has surely tempered some.

Because at the core of investments in Uber and Amazon and Facebook is a view that the future of the economy, and by extension our modern lives, will be shaped by the goods and services these companies deliver. And when the ability of one of these companies to execute on that vision appears less certain, a re-jiggering of investor expectations about the sector-at-large ought not to be a total surprise.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: