Services and the Beige Book — What you need to know in markets on Wednesday

Tuesday started the holiday-shortened week with one of the year’s choppiest days for the stock market.

The blue chip Dow Jones Industrial Average lost more than 1%, falling 234 points, while the benchmark S&P 500 lost 18 points, or 0.8%, and the tech-heavy Nasdaq fell by 59 points, or 0.9%.

Treasury yields were also bid across the curve with the 10-year rallying to 2.06%, the 30-year Long Bond rallying to 2.68%, and the 2-year trading down to 1.29%. Gold continued its recent move higher, rising 1% on Tuesday to settle near $1,344.

On Wednesday, investors will get two pieces of economic data on activity in the services sector during August — services account for the vast majority of GDP — followed by the Federal Reserve’s latest Beige Book set for release in the afternoon.

At 9:45 a.m. ET, we’ll get the Markit U.S. services PMI, which is expected to register at 56.9. At 10:00 a.m. ET, we’ll get the ISM services index, which is expected to have climbed to 55.5. For both measures, anything above 50 signals growth.

The Beige Book, a collection of economic anecdotes from each of the Fed’s 12 regions, sets the tone for the discussion of the U.S. economy at the Fed’s next monetary policy meeting, which will kick off in just under two weeks.

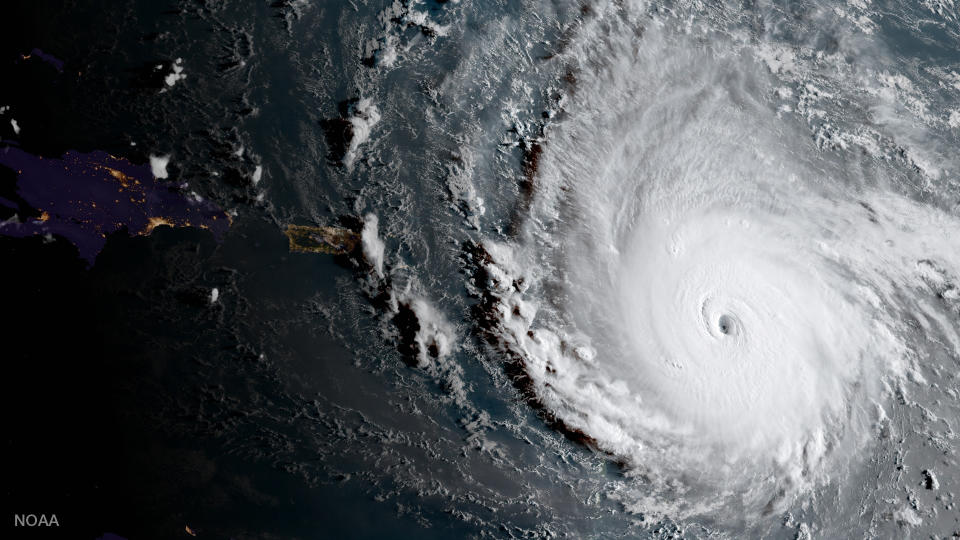

Markets started the week with lingering weekend concerns over tensions with North Korea while another hurricane, Irma, is now taking aim at Florida with a potential landfall set for sometime late Saturday or early Sunday.

Irma, which as of Tuesday evening was a Category 5 storm, appeared on track to impact the northern coast of Puerto Rico by Wednesday evening with a potential path towards the U.S. mainland currently in most forecasts.

In a note to clients on Tuesday, Jay Gelb, an insurance analyst at Barclays, said this storm could be the largest ever in terms of insured damage in the U.S., eclipsing Hurricane Katrina back in 2005. “In a worst case scenario, catastrophe modelers AIR Worldwide and Karen Clark and Co. have estimated a repeat of the 1926 Miami hurricane could result in $125-130bn of insured damage,” Gelb wrote.

On Tuesday, insurance stocks were market laggards, with Travelers (TRV) losing 3.7%, Allstate (ALL) losing 3.6%, American Financial Group (AFG) down 4.6%, and Reinsurance Group of America (RGA), losing 3.3%.

“From the insurance industry’s perspective, we would expect a substantial hurricane possibly impacting Florida as well as just after Hurricane Harvey to possibly halt further reinsurance price declines for the first time in many years,” Gelb wrote.

Additionally, the reinsurance companies — or companies that effectively insure insurers — are likely at more of a risk from Irma, in Gelb’s view. And while quite a bit in forecasts can change from day-to-day, what seems likely is that a major hurricane is likely to in some form or fashion impact parts of at least one Florida coast.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: