Sen. Warren says the total tax revenue from corporations is too low and needs to be higher

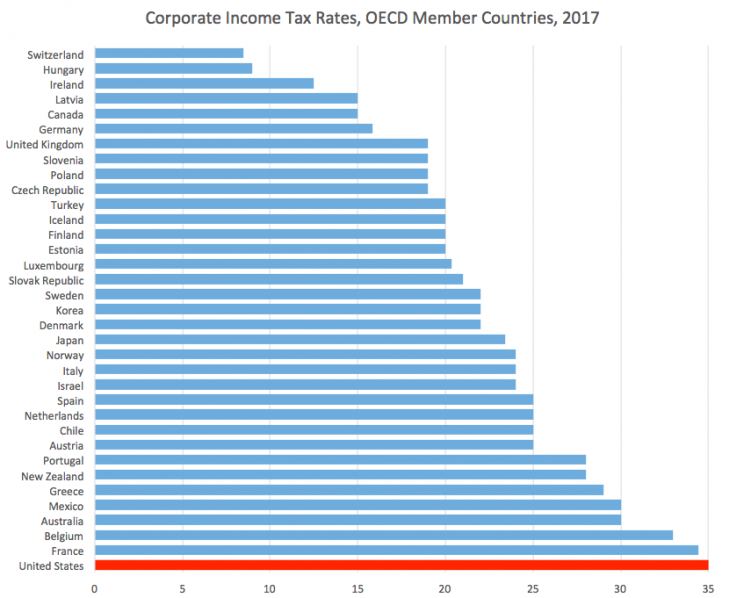

President Trump’s tax blueprint released last month by Treasury Secretary Steven Mnuchin and White House chief economic adviser Gary Cohn includes a significant cut in the corporate tax rate to 15% from 35%, which is the highest rate among the Organization for Economic Cooperation and Development (OECD) countries.

But Senator Elizabeth Warren (D-Mass.) says the total tax revenue from corporations is too low and needs to be higher.

There have been long-standing efforts from both sides of the aisle to reduce corporate taxes, including from President Barack Obama, particularly since the US has not shifted its tax system in 30 years while countries around the world have. But Warren said it’s about corporations paying their fair share.

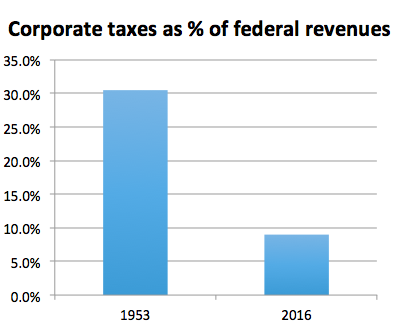

“Somebody’s going to have to pay the bills to keep the government running,” Warren said. “A generation ago, corporations paid 30% of what it costs to run the federal government. Today, corporations pay less than 10%.”

“That means it falls on everyone else. All of those expenses then fall on working families,” Warren said. “The way I see it, taxes and the whole debate around taxes is ultimately going to be about who pays a fair share to keep this government running and that’s the question we need to look at on the corporate side and on the individual side.”

The Republicans, along with many economists, however, have pointed to disadvantages in competitiveness and disincentives to hold cash domestically. The 35% rate is the highest among OECD countries.

Cohn said the US has not kept up with the rest of the world in tax policy, hurting competitiveness. In the 30 years since the last major tax reform in the US (the Reform Act of 1986), other countries have responded to dramatic world economy changes, including globalization and digitization. But the US tax system has largely remained unchanged.

“The US tax system has become a significant competitiveness problem given dramatic changes abroad and inaction at home,” Michael Porter wrote in a recent Harvard Business School report, highlighting, in particular, the US statutory rate standing 10 percentage points higher than the average OECD rate.

“The forces of globalization have amplified the inefficiencies and complexities of the current tax system and demand that reform make the US less of an outlier in key tax policy areas—particularly corporate tax policy,” Porter added.

That said, a decrease to the 15% level sets up a face-off with House Speaker Paul Ryan (R-Wisc.), a deficit hawk who has called for the tax plan to pay for itself.

The Ryan-backed House GOP plan, released in June, called for replacing the 35% corporate tax rate with 20%. Ryan’s plan also adds a border-adjustment tax (BAT) proposal, which the Trump plan does not include.

The plan also includes a shift to a territorial system of taxation (taxation of income within one’s borders) that countries around the world have embraced and a move away from the worldwide system (taxation of income no matter where it’s earned) currently used by the US.

This has caused US multinational companies to hold large sums of cash abroad. These companies have used tax inversions and cross-border M&A that favor foreign acquirers, and corporations have actively shifted income around the world to avoid high tax rates.

NOTE: An earlier version of this story had the headline “Senator Warren: The corporate tax rate is not too high.” It has been changed to “Sen. Warren says the total tax revenue from corporations is too low and needs to be higher.”

—

Nicole Sinclair is markets correspondent at Yahoo Finance.

Please also see:

Elizabeth Warren finds it ironic that Jamie Dimon and Lloyd Blankfein complain about regulation

Senator Warren: Republicans have locked us out of healthcare reform talks

White House unveils Trump’s tax reform plan

Citigroup CEO on Trump’s policies: ‘It’s a matter of when and not if’