Sally Beauty Stock Bounce Could Be Derailed

Shares of Sally Beauty Holdings, Inc. (NYSE:SBH) are down 1.2% at $16.20 this afternoon, reversing course after two-day climb up the charts, and a recent lift off their early September lows. Today's pullback may not be one-off, however, as data from Schaeffer's Senior Quantitative Analyst Rocky White, suggests a long-term bear signal may be flashing.

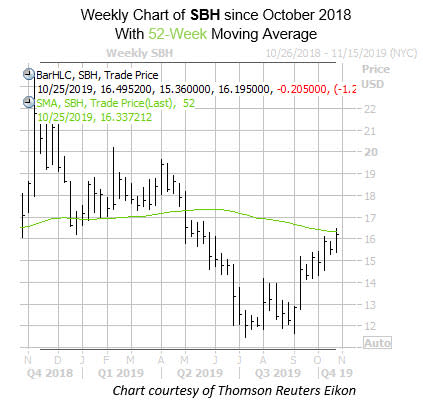

Specifically, per White, the security is trading within one standard deviation of its 52-week moving average, after spending significant time below this trendline. Similar tests of resistance at the 52-week trendline have occurred nine other times, resulting in an average three-month loss of 9.6% for the stock, with almost 70% of the returns negative. At SBH's current trading price, a similar drop would put equity back near $14.65 by early 2020.

Short sellers would certainly welcome more losses. Shorts currently control 27.58 million SBH shares, representing more than 23% of the stock's available float, or 12.8 times the average daily pace of trading.

Analysts have been skeptical, too. Specifically, all nine brokerage firms covering Sally Beauty both sport a "hold," "sell," or "strong sell" rating. Plus, the stock's average 12-month price target of $14.57 comes in 9.3% below current trading levels.

Lastly, Sally Beauty stock sports a Schaeffer's put/call open interest ratio (SOIR) of 7.48. This reading ranks in the 96th percentile of its annual range, showing such a preference for short-term puts over calls is rare. Further, peak put open interest sits at the December 12.50 put, where 7,500 contracts reside, and data from Trade-Alert points to mostly buy-to-open activity here.