Russian Oil Flows Edge Lower With Moscow Readying Sanctions Test

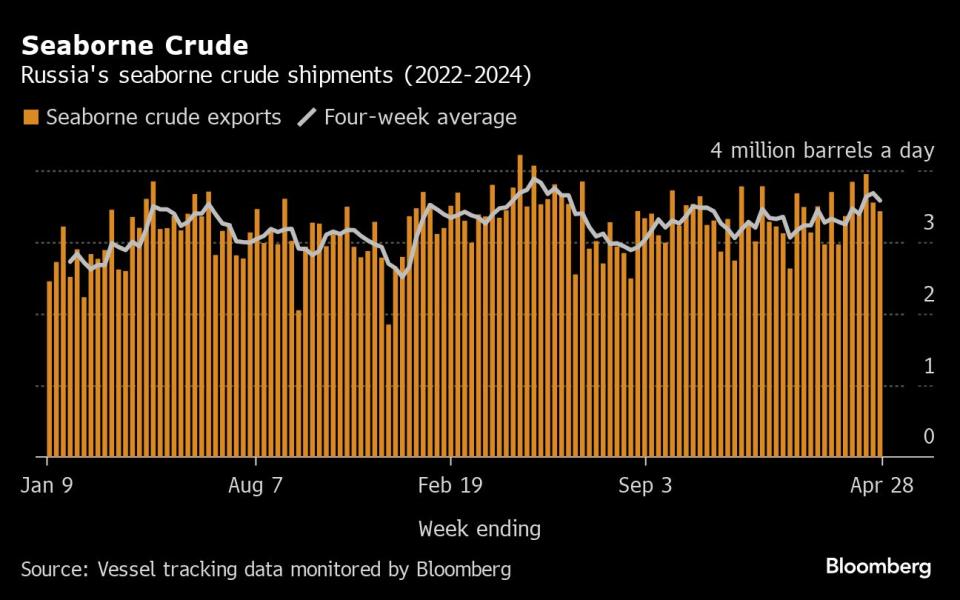

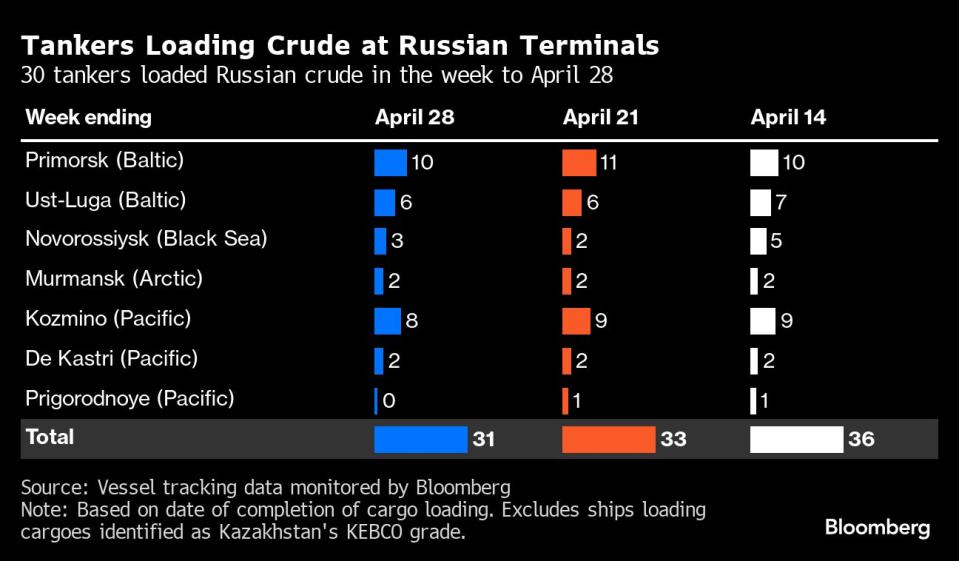

(Bloomberg) -- Russia’s crude flows fell for a second week in the seven days to April 28, with fewer vessels leaving the key ports of Primorsk on the Baltic and Kozmino on the Pacific. The four-week average was also down.

Most Read from Bloomberg

NYPD Arrests Over 300 Protesters in Crackdown on College Campuses

The Ozempic Effect: How a Weight Loss Wonder Drug Gobbled Up an Entire Economy

Lilly Soars as Forecast Boost Shows Weight-Loss Drugs’ Power

Despite the declines, crude shipments remain above their average for the year so far, with domestic oil processing still under pressure as refineries that have barely recovered from Ukrainian drone attacks enter seasonal maintenance.

Russia is stepping up efforts to undermine US-led sanctions on its tanker fleet. India looks like it may again accept cargoes delivered on vessels belonging to state-controlled shipper Sovcomflot PJSC, which the Asian nation’s refiners had shunned previously. The first Sovcomflot tanker of Urals crude in several months is headed to the Indian port of Paradip, following a fuel oil cargo delivered to the port of Sikka last week.

The country is also beginning to put tankers individually sanctioned by the US Treasury Department back to work. The SCF Primorye, cited by the US in October for breaching a Group of Seven price cap, loaded Urals at Novorossiysk on the Black Sea last week, and is sailing toward the Suez Canal. It’s the first sanctioned vessel to load Russian barrels after being listed and could pave the way for others.

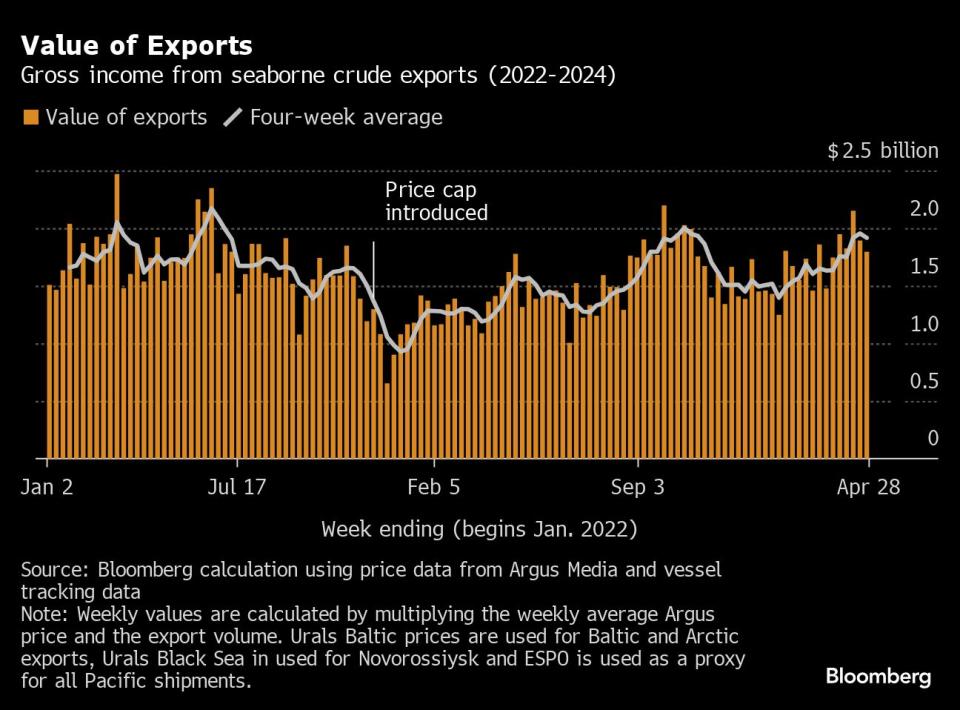

The moves come as an organization at the heart of the global insurance industry said the cap on the price of Russian oil is becoming increasingly unenforceable, offering one of the most direct criticisms yet of measures that were meant to deprive the Kremlin of petrodollars. The gross value of Russia’s crude exports in the four weeks to April 28 was down by about $38 million to $1.92 billion a week from the period to April 21.

The backlog of Russia’s Sokol crude that built up after being turned away by Indian refiners has now almost disappeared. About 9.1 million barrels, half of the total, have been delivered to refineries in China. Another 7 million barrels eventually found their way back to India. Two cargoes have been delivered to Pakistan.

That leaves just 1.4 million barrels still to be delivered. Half of those are heading back to India after being discharged onto a smaller vessel from the tanker that had been storing them since January. The rest are still on a vessel anchored in the Strait of Malacca, suggesting they could also eventually end up in India.

Crude Shipments

A total of 31 tankers loaded 24 million barrels of Russian crude in the week to April 28, vessel-tracking data and port agent reports show. That was down by about 840,000 barrels, from the revised figure for the previous week.

Russia’s seaborne crude flows in the week to April 28 fell by 120,000 barrels a day to 3.43 million from a revised 3.55 million for the week to April 21. The less volatile four-week average was down by 100,000 barrels a day at 3.58 million.

The drop was driven by fewer shipments from Primorsk and two of the Pacific ports, partly offset by higher shipments through the port of Novorossiysk on the Black Sea.

Weekly shipments were about 30,000 barrels a day below Russia’s April target, which is part of the OPEC+ alliance’s broader effort to curb supplies and support prices. The four-week average was about 120,000 barrels a day above the target.

Russia said it would cut crude exports during April by 121,000 barrels a day from their average May-June level as part of the wider OPEC+ initiative, as Moscow shifts more of the burden onto production targets, which are preferred by other members of the group. Seaborne shipments in the first three months of the year exceeded Russia’s target level for that period by just 16,000 barrels a day.

No cargoes of Kazakhstan’s KEBCO were loaded at Ust-Luga or Novorossiysk during the week.

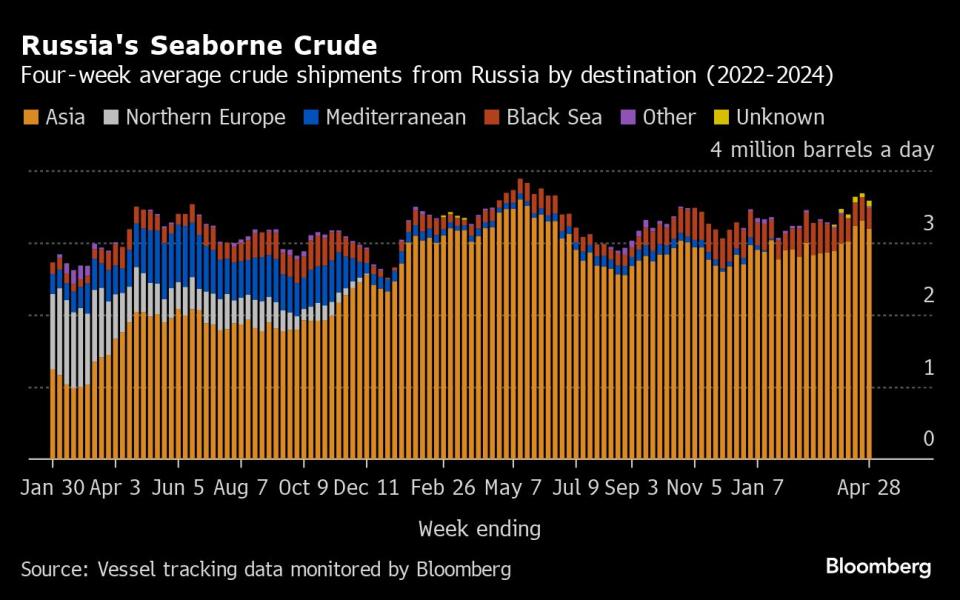

Flows by Destination

Asia

Most Read from Bloomberg

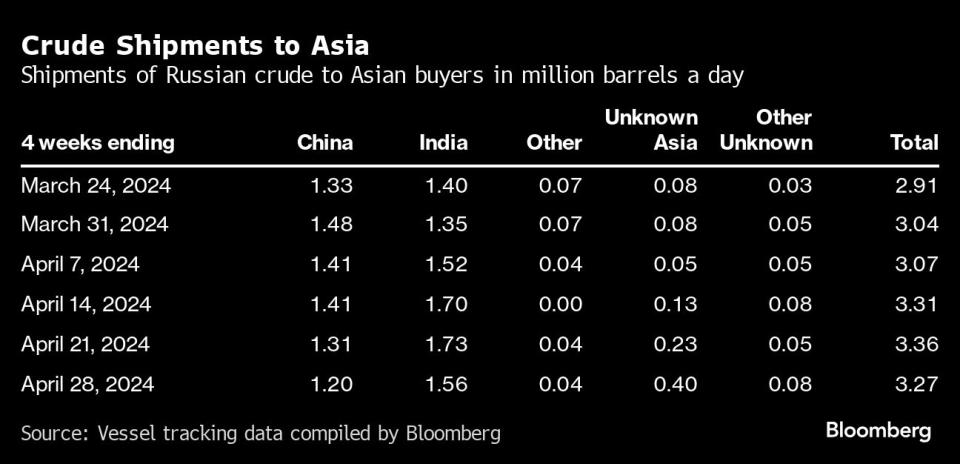

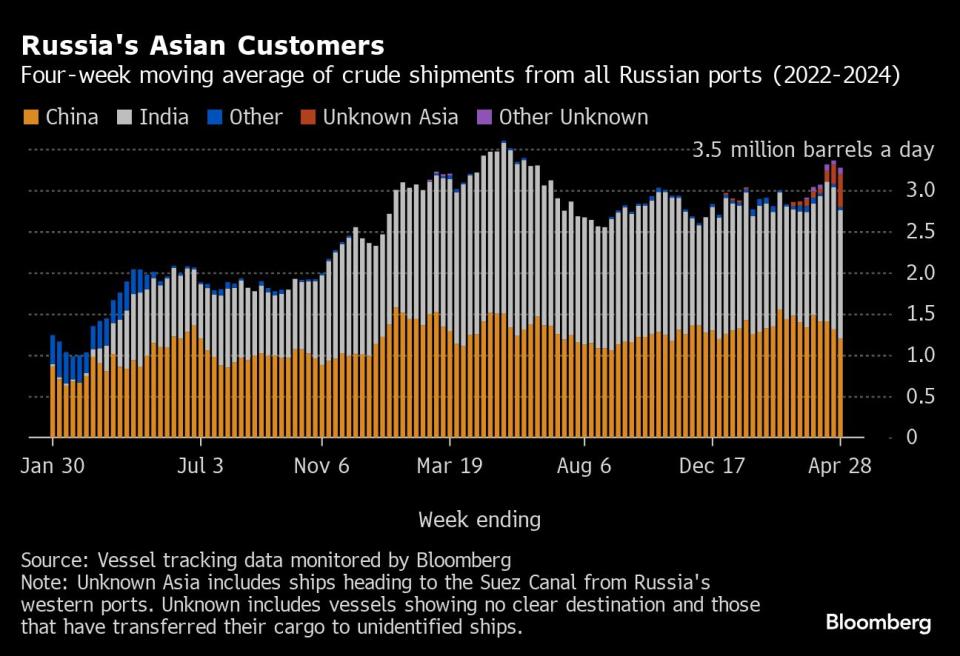

Observed shipments to Russia’s Asian customers, including those showing no final destination, edged lower to 3.27 million barrels a day in the four weeks to April 28, from a revised 3.36 million in the previous four-week period.

About 1.2 million barrels a day of crude was loaded onto tankers heading to China. The Asian nation’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 1.56 million barrels a day.

Both the Chinese and Indian figures are likely to rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 400,000 barrels a day was on vessels signaling Port Said or Suez in Egypt. Those voyages typically end at ports in India or China and show up as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 80,000 barrels a day in the four weeks to April 28, are those on tankers showing no clear destination. Most originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others may be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, or more recently off Sohar in Oman.

Europe and Turkey

Most Read from Bloomberg

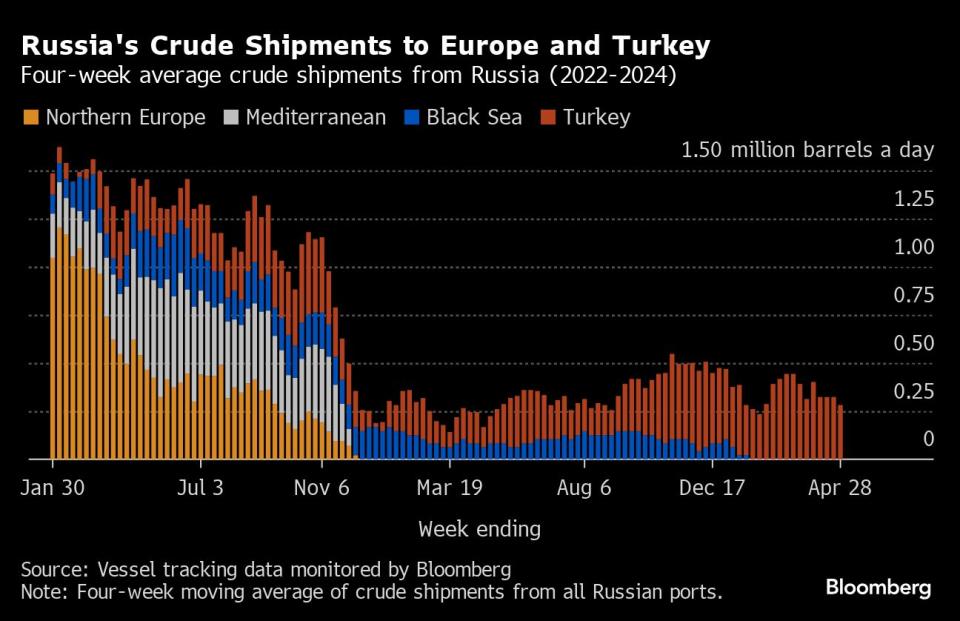

Russia’s seaborne crude exports to European countries have ceased, with flows to Bulgaria halted at the end of last year.

Turkey is now the only short-haul market for shipments from Russia’s western ports, with flows in the four weeks to April 28 slipping to a 12-week low of about 280,000 barrels a day.

Export Value

The gross value of Russia’s crude exports fell back to $1.8 billion in the seven days to April 28 from a revised $1.89 billion in the period to April 21. Four-week average income was also down, falling by about $38 million to $1.92 billion a week, aided by higher oil prices. The four-week average is still below its peak of $2.17 billion a week, reached in the period to June 19, 2022.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

NOTES

This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the gross value of those flows. The next update will be on Tuesday, May 7.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and Ust-Luga and are not subject to European Union sanctions or a price cap. The Kazakh barrels are blended with crude of Russian origin to create a uniform export stream. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

If you are reading this story on the Bloomberg terminal, click here or a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

Modi Is $20 Trillion Short on His Grand Plan for India’s Economy

AI Is Helping Automate One of the World’s Most Gruesome Jobs

©2024 Bloomberg L.P.