Roche (RHHBY) Presents Encouraging Data on MS Drug Ocrevus

Roche Holding AG RHHBY announced encouraging data on multiple sclerosis (“MS”) drug Ocrevus at the 70th American Academy of Neurology (“AAN”) Annual Meeting, held from Apr 21-27 in Los Angeles, CA. The data revealed the efficacy of Ocrevus in relapsing multiple sclerosis (“RMS”) through several measures of underlying disease activity and disability progression, including magnetic resonance imaging (“MRI”), cognitive function, and spinal fluid biomarkers of inflammation and neurodegeneration.

The data showed that four years of continuous treatment with Ocrevus showed a sustained reduction in underlying disease activity in RMS from the open-label extension period.

Patients who continued with Ocrevus maintained low numbers of T1 gadolinium-enhancing (T1Gd+) lesions (0.017 pre-OLE to 0.17 T1Gd+ lesions per scan at year four [year two of the OLE phase]) and new/enlarging T2 (N/ET2) lesions [0.052 pre-OLE to 0.080 N/ET2 lesions per scan] through year two of the OLE phase.

The safety data was consistent with the drug’s favorable benefit-risk profile in both relapsing and primary progressive multiple sclerosis.

Additonally, a second four-year analysis presented in a poster at AAN also revealed that patients who stayed on Ocrevus through year two of the OLE period sustained low annualized relapse rates and 24-week confirmed disability progression.

Those who switched from interferon beta-1a to Ocrevus experienced a significant decline in ARR by year one that was maintained through year two. Further, Ocrevus reduced the risk of 12- and 24-week confirmed cognitive decline (as defined by confirmed worsening on the Symbol Digit Modalities Test of at least four points) by 38 and 39% (p≤0.001 and p=0.002, respectively) during the 96-week period in people with RMS, compared to interferon beta-1a.

Pooled data from phase III studies, OPERA I and OPERA II data, showed that patients with RMS at increased risk of progressive disease (as determined by baseline Expanded Disability Status Scale and pyramidal Kurtzke Functional Systems scores of at least four and two points, respectively) and treated with Ocrevus experienced a significant improvement in cognitive function compared with those taking interferon beta-1a through 96 weeks.

In March 2017, the FDA approved Ocrevus to treat adults with relapsing forms of MS and primary progressive multiple sclerosis. However, there were uncertainties over Ocrevus being a new innovation or a reformulation of Roche’s older drug Rituxan. The drug sales aren’t that impressive yet either.

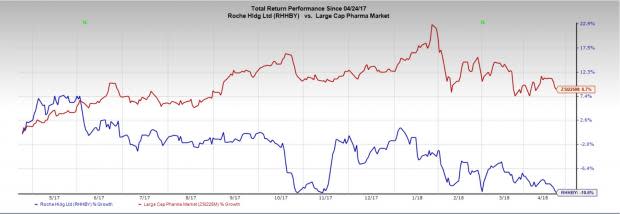

Roche’s stock has lost 10.6% over a year, as against the industry's gain of 8.7%.

Last week, Novartis NVS also announced encouraging data from the phase III study, EXPAND, on oral, once-daily siponimod (BAF312) in patients with secondary progressive multiple sclerosis (“SPMS”).

Given the complexity of the market, MS drugs have a long history of serious side effects, making it a risky therapeutic area. An autoimmune inflammatory disease of the centrol nervous system, MS disrupts the normal functioning of the brain, optic nerves and spinal cord through inflammation and tissue loss. There are three types of MS widely known to affect adults — relapsing-remitting MS, SPMS and primary progressive MS.

Competition is also stiff in the market. Biogen BIIB is a dominant player in the MS market with drugs like Avonex, Tysabri, Tecfidera, Plegridy and Zinbryta. The FDA recently issued Refusal to File letter to Celgene’s CELG New Drug Application for ozanimod, which is in development for the treatment of patients with relapsing forms of multiple sclerosis.

Zacks Rank

Roche currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Novartis AG (NVS) : Free Stock Analysis Report

Celgene Corporation (CELG) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

To read this article on Zacks.com click here.