Robinhood's new Gold Card, BaaS challenges and the tiny startup that caught Stripe's eye

Welcome to TechCrunch Fintech (formerly The Interchange)! This week, we’re looking at Robinhood’s new Gold Card, challenges in the BaaS space and how a tiny startup caught Stripe’s eye.

To get a roundup of TechCrunch’s biggest and most important fintech stories delivered to your inbox every Sunday at 7:30 a.m. PT, subscribe here.

The big story

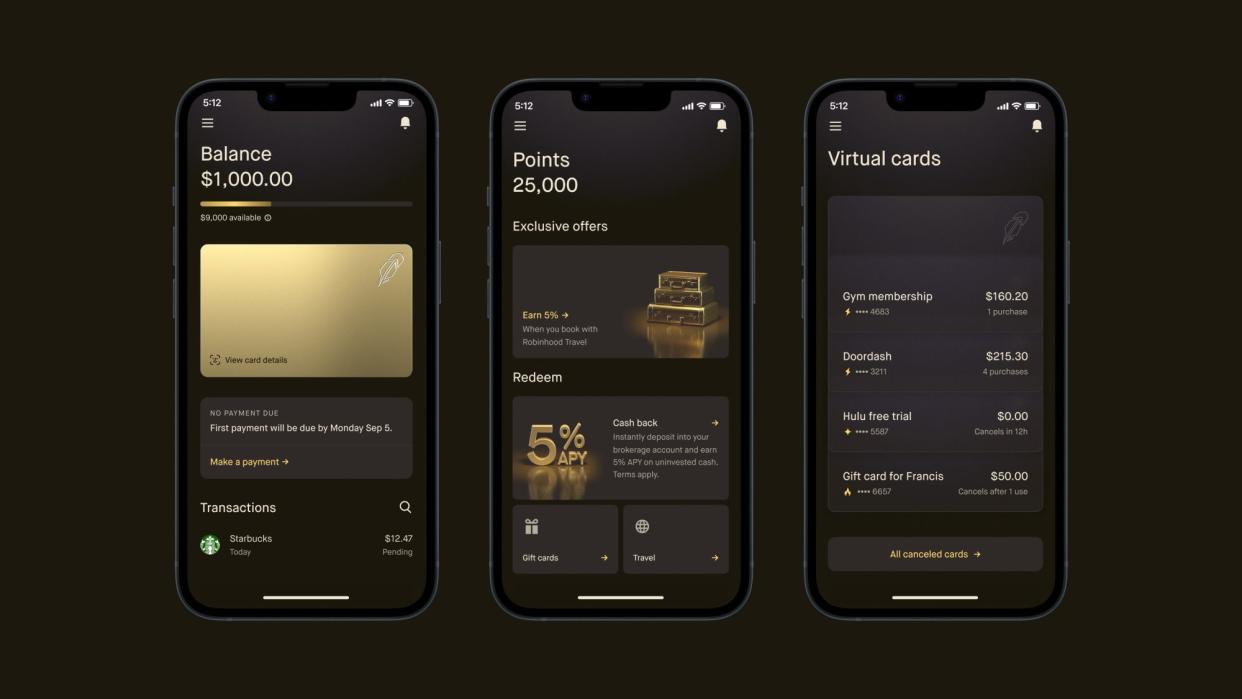

Robinhood took the wraps off its new Gold Card last week to much fanfare. It has a long list of impressive features, including 3% cash back and the ability to invest that cash back via the company’s brokerage account. A user can also put that cash back into Robinhood’s savings account, which offers 5% APY. We’re curious to see how this new card will impact the company’s bottom line. But also, we are fascinated by how Robinhood incorporated the technology it acquired when buying startup X1 last summer for $95 million and turned it into a potentially very lucrative new offering.

Analysis of the week

The banking-as-a-service (BaaS) space is facing challenges. BaaS startup Synctera recently conducted a restructuring that affects about 15% of employees. The startup is not the only VC-backed BaaS company to have resorted to layoffs to preserve cash over the past year. Treasury Prime, Synapse and Figure have as well. Meanwhile, according to American Banker, the FDIC announced consent orders against Sutton Bank and Piermont Bank, telling them “to keep a closer eye on their fintechs' compliance with the Bank Secrecy Act and money laundering rules.”

Dollars and cents

PayPal Ventures’ latest investment is in Qoala, an Indonesian startup that provides personal insurance products covering a variety of risks, including accidents and phone screen damage. MassMutual Ventures also participated in Qoala’s new $47 million round of funding.

New Retirement, a Mill Valley–based company building software to help people create financial retirement plans, has raised $20 million in a tranche of funding.

We last checked in on Zaver, a Swedish B2C buy-now-pay-later (BNPL) provider in Europe, when it raised a $5 million funding round in 2021. The company has now closed a $10 million extension to its Series A funding round, bringing its total Series A to $20 million.

What else we’re writing

Read all about how a tiny four-person startup, Supaglue, caught Stripe’s eye. Supaglue, formerly known as Supergrain, is an open source developer platform for user-facing integrations. The team is going to help Stripe on real-time analytics and reporting across its platform and third-party apps for its Revenue and Finance Automation suite.

Maju Kuruvilla is no longer CEO of one-click checkout company Bolt. He is replaced by Justin Grooms, Bolt’s global head of sales, who is now interim CEO. Kuruvilla, the former Amazon executive, took over as CEO in January 2022 after founder Ryan Breslow stepped down. The Information has more about Bolt’s woes here.

High-interest headlines

Inside Mercury’s stumble from fintech hero to target of the feds

RealPage and Plaid team to curb rental fraud

In HR software battle, Rippling makes up ground against Deel — at a cost

Is Chime ready for an IPO? It has more primary customers than Chase

Inside a CEO’s bold claims about her hot fintech startup, which TC previously covered here.

Cloverleaf raises $7.3M in Series A extension

Want to reach out with a tip? Email me at maryann@techcrunch.com or send me a message on Signal at 408.204.3036. You can also send a note to the whole TechCrunch crew at tips@techcrunch.com. For more secure communications, click here to contact us, which includes SecureDrop (instructions here) and links to encrypted messaging apps.