Rising oil prices are both good and bad for the US economy

Oil prices (CL=F) have shot up following the drone attacks on Saudi Arabia’s oil production facilities over the weekend, which U.S. officials have blamed on Iran.

Higher oil prices have never been popular in the U.S. – they lead to higher prices for gas and plane tickets.

The consumer has been a “stalwart” of the latest expansion, as S&P Ratings's U.S. Chief Economist Beth Ann Bovino wrote in a recent note. Consumer spending and sentiment has driven the economy’s growth considerably – and higher energy prices could impede that momentum. As Bovino put it, "more money in the gas pump means less to spend for items at the mall."

All that extra cash people would have spent elsewhere does add up — and the economy misses it.

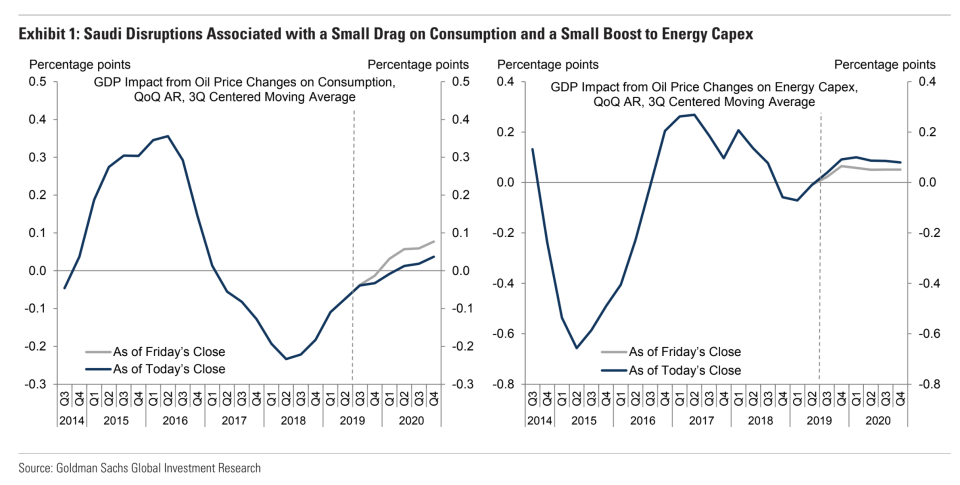

“Our general rule of thumb,” a Goldman Sachs analyst wrote this week, “is that a persistent $10/barrel increase in oil prices typically lowers the GDP contribution from consumption by 0.15% cumulatively.” So far, oil prices have gone up around $9 since the attacks on the Saudi infrastructure.

Another possible outcome from higher energy prices is how they might factor into the Federal Reserve’s interest rate decisions, as energy prices contribute to inflation.

There is another side of this, of course. Energy companies have been dreaming of higher oil prices for quite some time. Since oil companies are constantly evaluating what they can sell oil for versus what it costs to get it out of the ground, higher prices mean more operations can be profitable. Not surprisingly, higher oil prices beget higher capital expenditure.

According to Goldman Sachs, this increased spending by energy companies has a pronounced effect on the economy, to the tune of 0.12% of GDP. Energy-related capital spending had been subtracting 0.05 percentage points from GDP growth in the first half of the year. But with rising prices, Goldman expects it to actually add 0.1 percentage points of GDP growth. A $10-per-barrel price hike means an increase of 500,000 barrels of oil per day in production, according to Goldman Sachs analysts.

For frackers in particular, this comes as welcome news, as concerns about making money at lower prices have weighed on the industry. With higher prices, profitability is more within reach.

While airlines are being hit hard by rising oil prices, oil stocks like Hess (HES), Occidental Petroleum (OXY), Cimarex Energy (XEC) and Apache (APA), could see especially solid benefit from elevated prices.

"On net, the Saudi disruptions are likely to have a slightly negative impact on GDP growth as the drag on consumer spending slightly exceeds the boost to capex,” said Goldman.

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. He is reporting from Berlin on the Arthur F. Burns fellowship from the International Center for Journalists. Follow him on Twitter @ewolffmann.

Americans are trying to invest in Denmark’s negative mortgages

Tech companies are trying to disrupt banks, and banks are ready

‘Flight shame’: A potential headwind for airlines in Europe

Apple Card might finally get people to use Apple Pay

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.