Here's why the retail sector keeps bleeding jobs

Underneath the headline numbers of what was a solid U.S. jobs report for September is a retail sector that’s relentlessly shed jobs, with no end in sight.

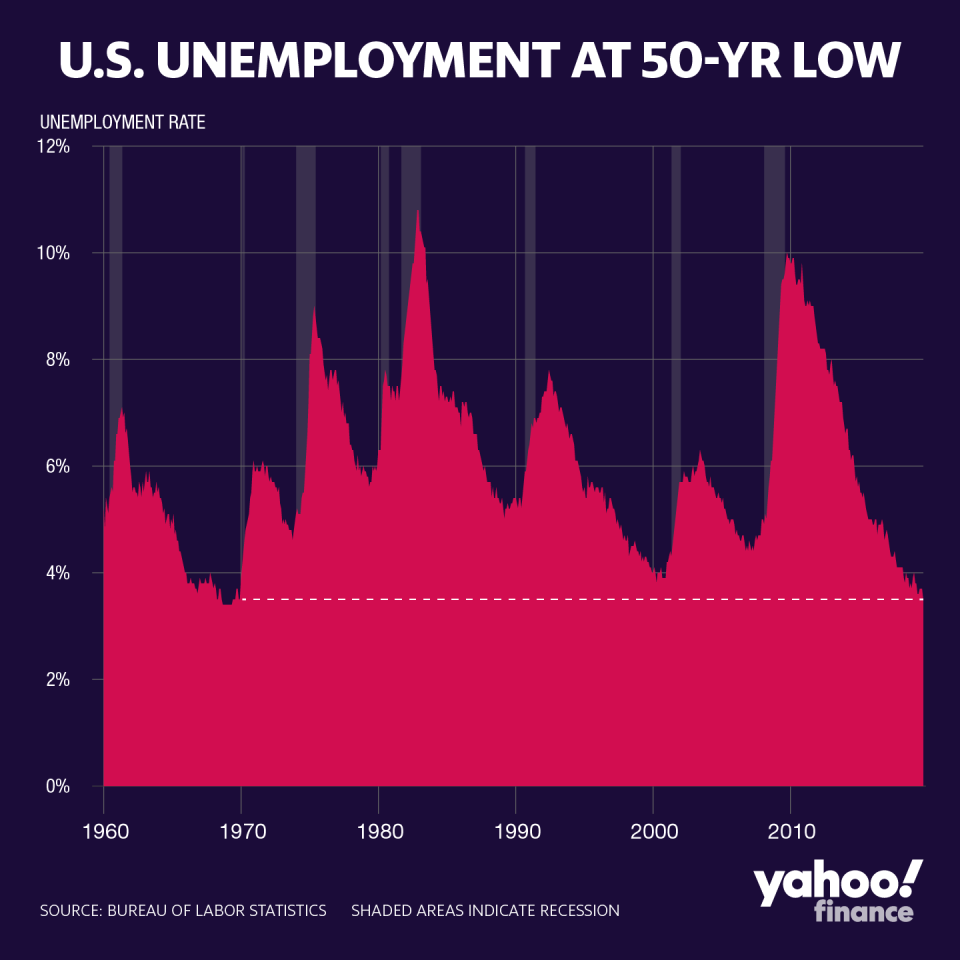

Last month, the U.S. economy added 136,000 jobs, with the unemployment falling from 3.7% to 3.5%— its lowest level since December 1969. But the embattled retail industry saw job losses that nearly doubled in September from August, reflecting a sector beset by bankruptcies, restructuring and headwinds from the U.S. trade war.

In a note to clients, Capital Economics chief U.S economist Paul Ashworth noted that the decline in retail employment "reflects structural change rather than cyclical weakness."

All told, the retail trade shed 11,400 jobs in September, with most of that concentrated from the clothing and accessories business. The Labor Department showed much of that concentrated in clothing (down 14,000), which was partly offset by a 9,000 job gain in food and beverages.

But “since reaching a peak in January 2017, retail trade has lost 197,000 jobs," the BLS stated.

To be certain, retail is a sector undergoing deep and wrenching change. Amid a widespread shift to buying on the web, malls and physical retailers have shuttered, and big retail chains — under fierce pressure from online retail giant Amazon (AMZN) — are consolidating.

“You continue to see this move to online shopping,” Bank of America’s chief U.S. economist Michelle Meyer told Yahoo Finance’s “The First Trade” on Friday, underscoring why retail’s been shedding workers for some time.

The competitive environment is “changing the workforces and showing up in the statistics,” she added. People “are just spending differently and retailers are trying to accommodate that.”

It suggests the payroll data’s weakness is more about the brick-and-mortar getting displaced by the rise of e-commerce than economic weakness.

A key takeaway is along the lines of what investment bank UBS said in a note to clients in April.

At the time, UBS predicted that roughly 75,000 retail stores that sell clothing, electronics, and furniture would close by 2026, as e-commerce continues to gain share. The bank noted around 16% of retail sales are currently online — and that number is expected to grow to 25% of all retail sales in 2026.

Breaking the forecasted 75,000 number further, UBS expects 21,000 apparel stores to close their doors, along with 8,000 furniture stores and 10,000 consumer electronics locations.

Even still, consumers are certainly not slowing down. The National Retail Federation said it expects holiday retail sales to surpass 2018, with a forecasted increase between 3.8% and 4.2% to total between $727.9 billion and $730.7 billion.

“The U.S. economy is continuing to grow and consumer spending is still the primary engine behind that growth,” NRF CEO Matthew Shay said in a statement.

“Nonetheless, there has clearly been a slowdown brought on by considerable uncertainty around issues including trade, interest rates, global risk factors and political rhetoric. Consumers are in good financial shape and retailers expect a strong holiday season. However, confidence could be eroded by continued deterioration of these and other variables.”

Despite the uncertainty surrounding the trade war and the tight labor market, the NRF expects retailers will staff up more than ever the holiday season. The NRF believes retailers will need 530,000 and 590,000 temporary workers this year versus the 554,000 brought on last year.

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.