Red Springs company’s request for $1.1m in state funds “would not survive an audit”

The Emerging Technology Institute operates out of a former mill that is now a town-owned building in Red Springs. (Photo: Lisa Sorg)

No payroll. No receipts. No bills or invoices.

Lacking any supporting documentation, James Freeman, president of the Emerging Technology Institute, nonetheless asked the Town of Red Springs to reimburse him $1.1 million in state taxpayer funds for “service, salaries and goods” related to his military training center and STEM education venture, public records show.

But the Office of State Budget and Management, which must approve the town’s reimbursement to ETI, told the Red Springs attorney that officials “should not disburse any funds [to ETI] based on the document provided.”

Newsline reported in March that ETI received $2 million in the state budget, in grant funds passed through by the Town of Red Springs. Public records showed that Freeman planned to use some of the money for kids’ STEM educational materials, but allocated a significant portion for “cameras, gates, fences and sensors,” for military training, as well as unspecified uses.

In a video produced by N.C. State University, Freeman called ETI “an integration hub for the Department of Defense.” ETI operates out of a one-story, town-owned building and former mill on more than 40 acres at 16824 N.C. Route 211. As of 2022, the company had a two-year lease with the town and an option to purchase the property, according to an ETI presentation.

Sen. Danny Britt (R-Hoke, Robeson, Scotland) and Rep. Jarrod Lowery (R-Robeson) were behind the earmark, according to a 2023 article in the Robesonian. Neither Britt nor Lowery responded to questions from Newsline.

Freeman, who has a doctorate in business administration and management from the for-profit Capella University, did not respond to inquiries from Newsline about the expenditures and the lack of paperwork. Nor did Mayor Ed Henderson, a supporter of ETI and its projects.

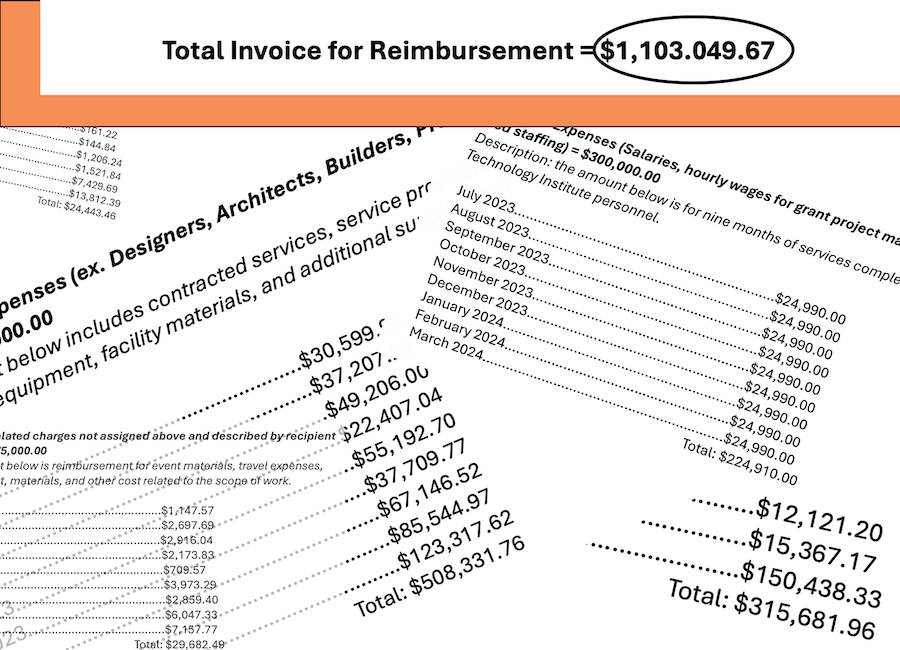

Public records obtained from OSBM show that Freeman submitted undated paperwork to Red Springs officials asking for reimbursement to cover nine months’ of expenses, from July 1, 2023, to March 31, 2024.

The Town of Red Springs then submitted the paperwork to OSBM for approval to reimburse Freeman – with a caveat. Emails dated May 3 between OSBM and the Red Springs town attorney, Antoine Marshall, show Marshall felt uneasy about the reimbursements because of a lack of documentation.

“This was the information provided to us by ETI when we requested an invoice,” Marshall wrote. “I advised the town manager that the information is not detailed enough for the town to survive an audit.”

The $1.1 million was broken down into several categories:

Employee salaries: $24,990 per month, total $224,910.

This represents nearly 80% of ETI’s payroll budget through the end of the grant period.Administration, such as utilities, telephone, data and lease-related expenses, totaled $24,443.

ETI’s budget and scope of work submitted to the state allocated $25,000 for this purpose. With nine months left in the grant period, ETI has nearly exhausted its administrative budget.More than $315,000 in goods, including “equipment purchased, technology and facility materials and additional supplies.”

Monthly expenditures ranged from $5,555 in September to $150,438 in March. The total spent so far is about a third of the original allocation.Contract and services expenses for “designers, architects, builders” totaled more than a half million dollars, with monthly expenses ranging from $22,000 to $123,000.

ETI has spent nearly three-quarters of its budget on this line item.And “other expenses” for events, travel and technology development, totaled $29,682 — about 40% of the total budget.

Freeman withheld expenditure details because he “expressed a desire for some secrecy concerning protecting trade secrets,” Marshall wrote to OSBM, “and fears if favorable deals from subcontractors were made public that he would no longer receive such discounts.”

However, Freeman did not explain to the town why he omitted payroll, travel, utilities and other non-proprietary information. Even private personal data and proprietary information must still be included in a report to OSBM, which redacts it before being made public.

Marshall wrote that he advised Freeman his office needed supporting documentation to provide reimbursement. “We do not wish to be difficult or withhold any duly owed money, but to be good stewards of taxpayer dollars,” he wrote to OSBM.

The Town of Red Springs is required to obtain and provide all documentation from Freeman and ETI, according to state law. ETI’s financial records can also be audited by the state. Since the company received more than $500,000 in state funds, it must comply with General Accounting Government Auditing Standards,

Jordan Cole, grants manager for OSBM, agreed with Marshall’s concerns. “You are correct that the request for reimbursement document … is not sufficient by any means and does not adhere to the reporting requirements for recipients of state funds.”

The post Red Springs company’s request for $1.1m in state funds “would not survive an audit” appeared first on NC Newsline.