Questor: Hold NMC for an eye-catching record and its clean bill of health

The battle over Saudi Aramco illustrates just how far London is prepared to go to secure the biggest share listings from all over the world. By proposing a new category within its premium listing regime for state-controlled enterprises that would make it easier for the Gulf oil giant to comply, the Financial Conduct Authority has aroused the concerns of the Treasury Select Committee, the Institute of Directors and City investors. Diluting the Square Mile’s reputation for good governance for short-term gain is in no one’s interests.

But the last decade has seen all manner of international firms sell shares here, each with their own interpretation of best practice. In truth, governance is only part of the picture. Shareholders focused on performance can be sold a growth story from a far-flung territory but only really discover what they have bought over time.

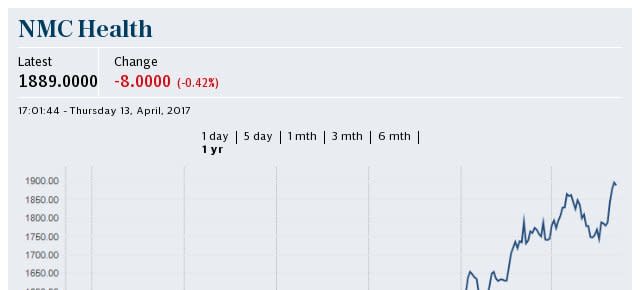

Take the case of NMC Health, a hospitals operator and the first Abu Dhabi-based company to list in London. Anyone buying the shares in 2012 when NMC – which stands for National Medical Centre – floated to raise £117m did not realise at the time they were jumping on board one of the issues of the decade. Priced at 210p, the stock has been hotter than the United Arab Emirates’ desolate Rub’ al Khali desert, multiplying in value more than 13 times.

This week the company takes its place as a member of the FTSE 100. Its sharp appreciation gives NMC a market capitalisation of £5.7bn, putting it higher up the list of Britain’s biggest public companies than famous names such as Rentokil Initial, water supplier Severn Trent and Marks & Spencer.

That is some performance given NMC’s humble beginnings. Founder Bavaguthu Raghuram Shetty arrived in the oil-rich UAE from India in 1973 with $8 in his pocket and the debt from his sister’s wedding to pay off. Having qualified in pharmacy, he set up as a drugs salesman, selling stock to doctors, door-to-door. Inspired by a proclamation from Sheikh Zayed bin Sultan Al Nahyan, the UAE’s first president, for affordable healthcare for all, he opened a pharmacy shop and clinic employing his wife, Chandrakumari, as the sole practitioner. The operation was so basic that in the early days he even used to carry patients in on his shoulders in lieu of an ambulance.

NMC grew through supporting the oil industry, such as by installing onshore decompression chambers for divers who got into difficulty, as well as the region’s first CT scanner so patients no longer had to go abroad for diagnosis. Today it has eight hospitals, two day care patient centres, nine medical centres and 15 pharmacies, plus fertility clinics in Europe and beyond that it is looking to expand.

NMC treated close to 4.3m patients in 2016. The company has done what it said it would on listing: added bed capacity in the UAE, expanded across the region including into Saudi Arabia and Oman, and focused on higher margin treatments such as IVF.

Healthcare revenues rose 44pc in the first half, which analysts at Investec think suggests a 13pc organic growth rate.

There is also a distribution arm which accounts for 30pc of sales. It delivers medical supplies and groceries to more than 10,000 retailers across the UAE including petrol stations.

JP Morgan Cazenove points out the division’s relative importance to the overall group continues to diminish even though the top line is growing at 15pc and the margin is strengthening.

Shetty retired as chief executive in March and now serves as joint non-executive chairman.

As well as his opposite number, there is an executive vice-chairman, making for a unique board structure. Prasanth Manghat, the new chief executive, has been with the company for 12 years.

The Shetty family retain a 24pc stake. Together with other large shareholders, the free float is only 40pc. NMC Health shares are trading on a heady 28 times next year’s forecast earnings. So high are expectations, it would not take much disappointment to put them in the sick bay.

However, growth shows no sign of waning with earnings per share on track to increase by 20pc per annum for several years to come. Much of the upside appears to have been captured, but FTSE membership could win NMC new fans including tracker funds. Worth holding.