QuantVR wants to turn stock market data into immersive virtual reality experiences

This article, QuantVR wants to turn stock market data into immersive virtual reality experiences, originally appeared on TechRepublic.com.

Image: QuantVR

Visualizing data is becoming an increasingly important tool for understanding data. Charts and graphs are tried and true, but they have their limits -- limits partly dictated by the way they're presented.

For Eric Greenbaum and business partner, one of the key components missing from data presentation was immersiveness.

So they started a company called QuantVR, a set of virtual reality applications that take stock market-related data, and bring it into VR.

The interest in virtual reality started with the 1992 movie The Lawnmower Man, which tends to come up when VR and pop culture cross paths in conversation.

"I left the theater being really depressed. I thought it was amazing, I knew that the tech was coming, but also knew that at that point, it was totally fictional," Greenbaum said.

SEE: Why virtual reality could finally mend its broken promise

Still, the idea of VR was something that's stuck with him through his life.

In grad school, Greenbaum got to use a 3D application that allowed users to manipulate protein structures in 3D and alter them to make them fit data. It wasn't exactly VR. It was also very expensive. Coming in at around $20-30,000, a technology that allowed for data visualization and manipulation was well out of reach of average consumers.

Then a few years back he read a book about virtual reality, a "VR for laymen" type thing.

"I'm a patent attorney, I still have a patent practice, but when the Rift Kickstarter was announced, I started to focus a lot of energy on VR and learning about VR, and getting immersed and involved in the community," he said.

He founded the New York Virtual Reality meetup group, and there met his partner. His partner is anonymous for now, but is a C-level executive at a high-frequency trading firm, who designs algorithms for trading, and runs a hedge fund, Greenbaum said.

So far, they have developed about five applications.

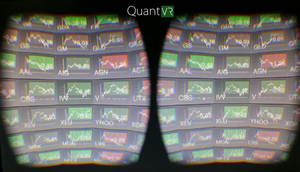

QuantVR's Ticker Tube application

Image: QuantVR

Ticker Tube shows real-time stock price plots. It takes a shot at the old problem of how many screens can one have, realistically. It features 300 or 400 stocks and their live feeds. Users can rearrange however, and dig into further info about the stocks.

Then there's Visual Order Book. Greenbaum talked about the high percentage (70%) of trades that are done with algorithms, and they occur in a fraction of a second.

"3D graphs that represent stock price over a day or over a few hours, they fundamentally fail in their ability to represent what's actually happening in the market," he said.

The idea behind Visual Order Book is to allow for representation of those split second timescales. "It's really the first time that you can actually see the stock market from the point of view of an algorithm," he said

There's also Stockscape. It does two things: Lets users set up multiple screens, and also creates a large, navigable graphic that looks like a city where the 2,000 most highly-traded stocks on the US exchanges are divided by industry sector, subdivided into industry groups, and further subdivided into high performing, mutually performing, and poorly performing stocks. The height of individual stock blocks represent different metrics like market cap, volatility, and price.

Alpha Canvas allows users to enter a trading strategy in the form of a graphical element. Greenbaum said that for traders who want to design an algorithm, but don't know how to code, they can draw a filter that will function like an algorithm.

"If you like the way that algorithm performs, you can set the system to trade automatically based on that algorithm or give you an alert that a stock or group of stocks is performing in accordance with an algorithm," Greenbaum said.

The fifth is underwraps, he said, as they're still filing patent paperwork.

Both Stockscape and Ticker Tube were available as demos recently at the Silicon Valley Virtual Reality Conference and Expo in May in San Jose, California.

When they show QuantVR to people on Wall Street, Greenbaum said they get a bifurcated response. Either they're quickly onboard, or they're skeptical that VR could offer something their Bloomberg terminal can't.

"To an extent, I think that tracks along with people that get VR and are VR believers and drink the VR kool aid," he said. Although, a good explanation and a demo can help win folks over.

It's early days for QuantVR. They're figuring out the best way to go about raising funds, and they're also working on bringing those five applications together in one platform. They're also planning on more extensive user testing.

They're hoping the ability to be immersed in data and to manipulate it will lead to better insights and better engagement with the information.

"It's a little bit of an untested hypothesis at this point, but we think there's a very good and logical argument that by using and exploring stock market data in virtual reality, it's going to really allow people to make better decisions," he said.