President Luiz Inacio Lula da Silva Pays the Price as Brazil Inflation Slowdown Comes Up Short

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Brazil’s prolonged inflation slowdown is falling flat among disgruntled consumers who are increasingly blaming President Luiz Inacio Lula da Silva for a perceived decline in purchasing power.

Most Read from Bloomberg

Trump Vows ‘Day One’ Executive Order Targeting Offshore Wind

Macron Puts French Banks in Play With Plan to Transform Europe

Tesla Rehires Some Supercharger Workers Weeks After Musk’s Cuts

Five Under-the-Radar Billionaires Making Vast Fortunes in Modi's India

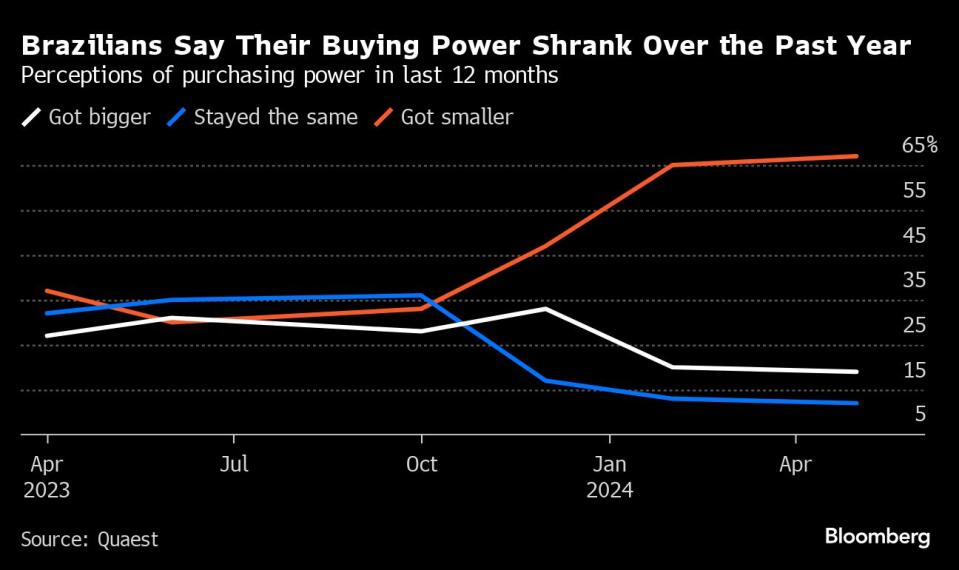

A whopping 67% of Brazilians said their buying capacity shrank over the past year, more than double the percentage recorded in October, according to a Quaest poll released last week. On the surface, that sentiment is hard to square with economic data, which shows inflation is cooling and wages are rising.

Average real incomes are near the highest since November 2020 and have increased over 4% since Lula started his term in January, 2023. Annual inflation slowed to 3.69% in April, government data showed on Friday, and the rate has fallen over 2 percentage points since the leftist leader returned to power.

Read more: Brazil Inflation Slows as Analysts Ponder Central Bank Plans

Yet those figures fail to fully capture simmering costs of food and services which jumped in recent months and carry significant weight in shaping public opinion. Things stand to get worse before they get better after floods ravaged a key agricultural region this month. In the eyes of many voters, the situation is hurting the standing of Lula, who returned to the nation’s top job on a promise to bring back prosperity and improve living standards.

“This is not pure math,” said Marcia Cavallari Nunes, the head of pollster Ipec. “Perceptions are formed on people’s own expectations of Lula and what they can actually afford to buy at the supermarket.”

Economists point out food and beverage costs surged in the first quarter — at about twice the pace of headline inflation — squeezed by seasonal factors and exacerbated by the El Nino weather pattern. That trend was repeated in April, when they rose 0.7%, nearly double the overall consumer price gain.

While other closely watched items such as airfares and fuel have also seen recent price jumps, the spike in food is far more damaging politically. Indeed, an Ipec poll from April found that 46% of respondents said government was doing a bad or terrible job at combating inflation.

“Food inflation is what gasoline prices are to US voters,” said Christopher Garman, managing director at political risk consultancy Eurasia Group.

No Meat

Rising prices are testing the patience of people like Rosiana Bertolazi, 51, an IT coordinator in Sao Paulo. “It’s been been hard enough stocking up on fruits and vegetables. Beef is simply left out of the shopping cart,” she said.

Growing frustration on the economy is part of the reason behind the 10 percentage point drop in Lula’s approval rating since August, according to Quaest. Disapproval has risen 12 points to 47% over the same span.

Like in other countries, political polarization affects voters’ outlooks. Polls show an overwhelmingly negative view of the economy among Brazilians who backed Lula’s right-wing predecessor, Jair Bolsonaro, in the 2022 presidential election.

In that context, Lula’s overall approval ratings near 50% are still far better than those of his counterparts in nations including Chile, Peru and Colombia.

Still, the pain from rising prices is compounded by an economy that’s now slowing after a stronger-than-expected year. A combination of bumper crops, fiscal stimulus and social spending sent real income soaring — and Lula’s approval along with it.

Read more: Lula Pulls Off Rare Trick Twice, Wooing Wall Street and the Poor

In coming weeks, his government will face intense scrutiny over its response to devastating floods in the southern state of Rio Grande do Sul, which have left over 110 dead and 330,000 displaced. The area is key to the production of staples like rice and beef, and economists warn the destruction has the potential to stoke food prices further.

Read more: Historic Floods Create ‘Katrina Moment’ for Lula Presidency

Analysts surveyed by the central bank are already revising up their inflation forecasts. They now expect consumer prices increases to hit 3.76% in December, above the 3% target, according to a poll published on Monday.

Absent another big economic boost, “you’re going see more decay in Lula’s numbers,” said Garman, from Eurasia Group. “We’re in an era of weaker governments and lower ceilings in presidential approval ratings.”

--With assistance from Beatriz Amat and Guilherme Bento.

(Updates with central bank survey in 15th paragraph)

Most Read from Bloomberg Businessweek

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

Cheap Prison Labor Is Keeping People Locked Up Longer, Suit Alleges

‘The Caitlin Clark Effect Is Real,’ and It’s Already Changing the WNBA

©2024 Bloomberg L.P.