Pound sterling slumps after inflation in June comes in below expectations

Inflation in June came in well below market expectations prompting a steep drop in the pound.

The Office for National Statistics reported that consumer price inflation was steady at 2.4 per cent in the month.

City of London analysts had mostly expected it to pick up to 2.6 per cent.

Subdued price pressures are deemed to make an interest rate hike in August from the Bank of England less likely.

The Bank of England's Monetary Policy Committee has been flagging underlying inflationary pressures in the economy, signalling that it will increase the cost of borrowing later this year.

Financial markets had been pricing in a roughly 70 per cent chance of the next rate hike - to 0.75 per cent- coming on 2 August, at the MPC's next meeting.

Steady price pressure

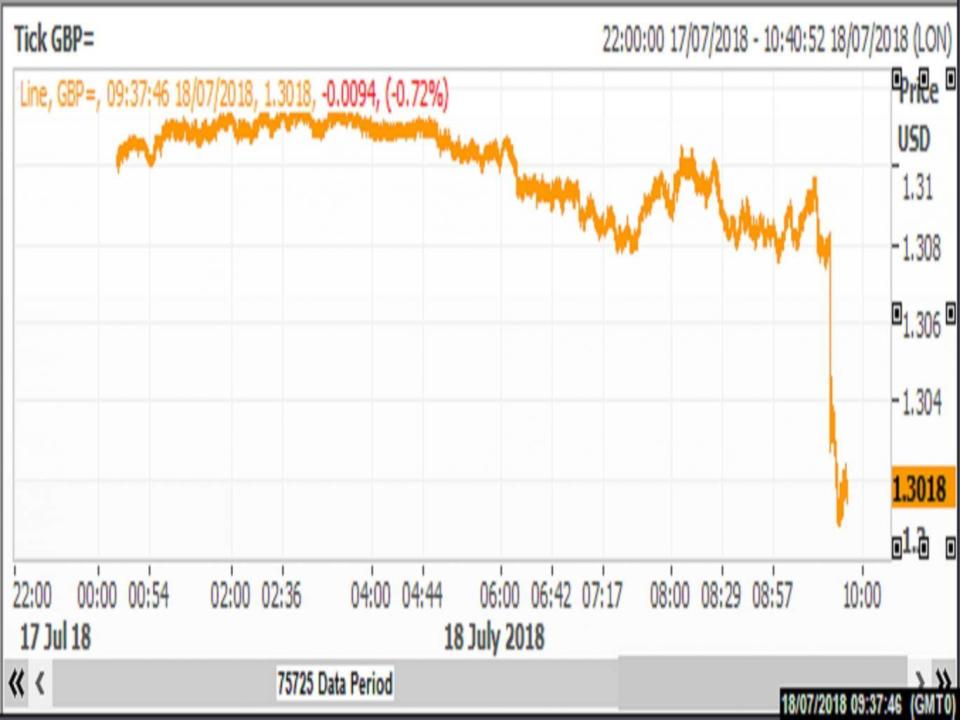

The pound fell to $1.3014 in the wake of the data on Wednesday, down 0.72 per cent on the day and its lowest level against the dollar in 10 months.

Ten month low

“June’s unchanged inflation rate is a huge surprise," said Tom Stevenson of Fidelity International.

"Faster rising prices would have given the Bank of England cover for an interest rate hike next month. Now it looks odds-on that the MPC will hold fire yet again. That’s particularly the case after yesterday’s wage growth data emerged weaker than expected at 2.5 per cent including bonuses."

More follows…