Pound dives against the dollar as interest rate hike hopes are dashed by inflation holding at 2.6pc

Retailing giant Next slipped towards the bottom of the FTSE 100 after Berenberg delivered a scathing critique of the clothing store’s recent share price rally, warning that its resistance to change could lead to a similar demise as US photo firm Kodak.

Shares tumbled 124p to £42.71, a 2.8pc dive, after the broker argued that, while the retailer had quickly recognised the online opportunity, it had failed to fully adapt to the new e-commerce environment.

It had instead short-sightedly remained steadfast to past profitability models, it added, likening Next’s possible trajectory to Kodak’s plunge into bankruptcy as its lack of exposure to the emerging digital camera market began to bite.

It told clients that Next’s 9.5pc rally following its weather-distorted earnings beat earlier this month had now made the stock a prime shorting target, with traders betting its shares will fall – the practice of borrowing shares to sell and rebuy later when they have fallen in price to pocket the difference.

“We believe Next is burdened by its overspaced store estate, which restricts its ability to invest in areas that matter most to the consumer – product and free home delivery, leading to market share erosion,” the broker said, downgrading the stock from “hold” to “sell”.

Elsewhere, German airline Air Berlin filing for insolvency propelled its rival easyJet to the top of the blue-chip leaderboard as hopes surfaced that the no-frills carrier can now bump up its market share.

The low-cost airline brushed off claims yesterday from French pilots that it is risking safety with its cluttered flight schedule to finish 57p higher at £13.22.

Analysts believe that fellow German operator Lufthansa is best positioned to snap up the debt-burdened company’s assets but London-listed operator TUI has also been sounded out as a possible buyer, lifting its shares 29p to £13.19. British Airways-owner IAG flew 18p higher to 631p from a read across while FTSE-250 carrier Wizz Air jumped 130p to £29.32, albeit on the paltry trading volumes typical of this time of summer.

On the wider index, the effects of investors returning to riskier assets started to wear but the pound’s 1pc plunge against the dollar lifted London’s exporters as the chances of an interest rate hike at the Bank of England subsided on yesterday’s weaker-than-expected inflation data. Buoyed by sterling’s slump, the FTSE 100 advanced 29.96 points to 7,383.85.

China-exposed mining stocks slumped as fresh data pointed to a slowdown in the Asian powerhouse’s housing market and therefore weaker demand for commodities. BHP Billiton and Rio Tinto slid 19p to £13.42 and 37.5p to £33.76, respectively, while Randgold Resources suffered most from gold and silver’s continued retreat, diving 235p to £72, a 3.2pc fall.

Markets wrap: Pound plunges against the dollar as inflation holds at 2.6pc

Dwindling hopes that the Bank of England will raise interest rates before the end of the year pushed the pound down to a one-month low against the dollar today.

The probability of a hike was slashed when inflation unexpectedly held at 2.6pc, reducing the need for the central bank to raise rates to curb inflation. All eyes will now be on wage growth data due tomorrow to determine whether the pressure on households might begin to ease.

City Index analyst Kathleen Brooks commented on the pound's performance:

"The BOE tried to convince the market that a rate rise will happen, however, the market is unconvinced and this is weighing on the pound. Weakening inflation pressure and a disappointing economic outlook keeps investors’ cool on the pound."

Aided by sterling's weakness, the FTSE 100 has had another strong day of trading with blue-chip airliners easyJet and IAG rising most on hopes that they can snap up more market share after Air Berlin filed for insolvency in Germany.

At the other end, precious metal prices' continued retreat pulled down Fresnillo and Randgold Resources while Next dropped 2.8pc on a scathing broker note from Berenberg.

Shire seeks European approval for dry-eye disease drops

A drop treatment for chronic dry eyes produced by FTSE 100 drug maker Shire has moved a step closer to launching in Europe.

The product, which is already available under the brand name Xiidra in the US, has been submitted for approval by European medicine regulators.

The drug lifitegrast is designed to treat dry eye disease, which causes symptoms including eye dryness, overall eye discomfort, stinging, burning, a gritty feeling and episodes of blurred vision.

It launched in the US last summer with an accompanying disease awareness campaign fronted by actress Jennifer Aniston, who suffers from the condition and said her eyes “were bothering me almost every day” before seeking treatment.

Read Iain Withers' full report here

Housing market speeds towards 'crisis point' as average price rises £10,000 in a year

House prices in the UK increased by £10,000 in the last year on average, according to official figures, with estate agents warning that affordability of houses is reaching "crisis point".

The average property price in June was £223,257, compared to £214,000 in June 2016, the Office for National Statistics said.

On a month-by-month basis, house prices were up nearly £2,000 on average.

Although the speed of growth has marginally slowed, with house prices increasing by 4.9pc in the year to June compared to 5pc in the year to May, the ONS said growth had remained flat in 2017 at around 5pc.

Read Sam Dean's full report here

Dow Jones jumps back over 22,000 but equity markets start slowly in the US

Markets have awoken in the US and the Dow Jones index has eked past 22,000 once again but it still remains around 100 points short of its position just before the North Korea sell-off.

It's been a bit of a limp start to trading over in the US with the three major indices stuck in flat-ish territory. Financials are continuing their strong run, however, with American Express and Goldman Sachs leading the index early on.

FTSE 100 update: Sector-specific factors driving movements

A couple of sector-specific developments have moved shares in London today with the wider FTSE 100 coming off its lunchtime highs but still heading towards a positive finish.

Air Berlin filing for insolvency has lifted easyJet to the top of the blue-chip leaderboard on hopes that the no-frills airline can increase its market share as a result.

At the other end, mining stocks have been hit on two fronts. The global base metal miners have retreated on fears of a slowdown in the Chinese housing market following fresh data released overnight while precious metal miners have slipped as gold and silver continue to fall on waning appetite for safer assets.

European carrier Air Berlin lands in administration after backer Etihad balks at giving it more cash

European airline Air Berlin has filed for administration after its largest shareholder Etihad refused to plough more cash into the ailing business.

The Gulf-based company said the development was “extremely disappointing” especially as it had provided extensive support to Air Berlin over the last six years, notably with a €250m (£227m) cash injection in April this year.

Air Berlin’s troubles come as it, like rival Alitalia which also filed for administration this year and is also part-owned by Etihad, has struggled to fight off competition from low-cost operators such as easyJet and Ryanair.

EasyJet shares have jumped 3.2pc in reaction to the news.

Read Bradley Gerrard's full report here

Economics reaction round-up: German GDP solid; US retail sales show dollar weakness overplayed

Now the reaction to the UK inflation data has quietened down a little, we can have a quick look at today's important data coming out of Germany and the US.

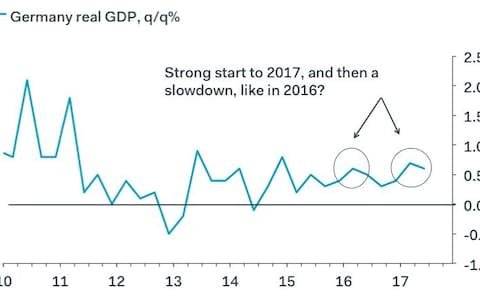

Germany's GDP growth slowed to 0.6pc in the second quarter ahead of the country's key federal elections next month. The figure was still "solid" but quarter-on-quarter growth will slow in the second half of the year, argued Pantheon Macro eurozone economist Claus Vistesen.

Good morning from #Germany where econ seems to have reached growth limit. Grew 0.6% in Q2 below forecast of 0.7% as imports outpaced exports pic.twitter.com/CyJ93xJkLH

— Holger Zschaepitz (@Schuldensuehner) August 15, 2017

Over in the US this afternoon, retail sales data for July beat expectations, rising 0.6pc after two months of consecutive decline.

Ranko Berich, head of market analysis at Monex Europe, believes that the figures show that the negativity over the dollar may have been overplayed:

"July’s firm retail sales figures from the US are in line with the generally optimistic tone of consumer survey data we’ve seen recently. The upbeat consumer is in contrast to price action on the US dollar, which was overwhelmingly pessimistic for most of July - and only reversed with the release of the month’s jobs report, which was also better than expected.

"The solid state of consumer spending suggests pessimism about USD and the path of interest rates in the United States may be overplayed."

The pound really did not enjoy that beat after a tough morning of trading and has slipped 0.9pc against the dollar today.

US Retail Sales: a rather solid beat ex Autos and Gas, which were revised from -0.1 to +0.3 for June and saw +0.5% more in Jul. $USDX forex

— John J. Hardy (@johnjhardy) August 15, 2017

Hargreaves looks to woo savers from funds sector as profits jump

Investment shop Hargreaves Lansdown is on the lookout for opportunities in the funds sector after striking a deal with BlackRock last month that saw it scoop up 4,300 clients.

Chief executive Chris Hill, who has been in the top job for six months after former boss Ian Gorham quit, said the company was preparing to snap up books of investment trusts from asset managers following a deal with BlackRock last month and Legg Mason last year.

"The key thing is to position ourselves so we can take advantage of those opportunities as and when they arrive," he said, himself a former client of Hargreaves. "[We're] on the lookout for any other opportunities - it works for the asset managers and it works for the client."

Read Lucy Burton and Sam Dean's full report here

US retail sales jump by 0.6pc, beats expectations

Stronger US retail sales and revisions #Fed#USDpic.twitter.com/XUQAzXapcx

— Sigma Squawk (@SigmaSquawk) August 15, 2017

US retail sales jumped by 0.6pc in July compared to the previous month, beating expectations of 0.4pc growth and rebounding from two consecutive months of falls.

The pound has nudged down a little further against the dollar following the fresh figures, trading 0.95pc lower for the session.

US Retail Sales kills it! Long USD/JPY as another Fed Hike looks more possible in 2017. �� https://t.co/csPyW75Rtr

— Andrea Marcia-Jones (@amjwealthgroup) August 15, 2017

Pound hits one-month low against the dollar

The pound has hit a one-month low against the dollar as expectations of a rate hike at the Bank of England recede.

The markets have put a 22.7pc chance of a rate rise before the end of the year in the UK following the weaker-than-expected inflation figures compared with a 42pc chance of one in the US, a complete role reversal to the odds from just over a month ago when Mark Carney was sounding a little hawkish and inflation was flirting with the 3pc mark.

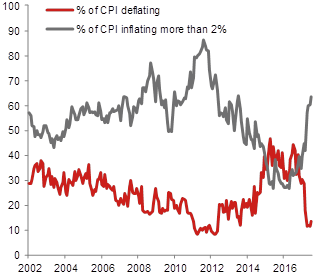

Nomura analyst George Buckley has commented, however, that today's CPI figure does "not change the underlying inflation picture".

He added:

"Domestic pressures remain weak, therefore, but are expected to trend upwards going forward. In terms of the “breadth” of inflation, 63% of the CPI basket is now inflating at a rate at or above the 2% target – the largest proportion since mid-2013.

"At the same time just 14% of the basket is deflating, close to its all-time lows. These moves are in large part due to the impact of sterling’s past declines."

#Pound falls to five-week lows after #CPI data as investors re-draw their expectations on the timing of the next UK rate rise.#inflation

— ِِِAhmed Al-Zeini (@alzeini) August 15, 2017

Amec Foster Wheeler's £2.2bn merger with Wood Group set to avoid watchdog probe

Wood Group’s £2.2bn takeover of Amec Foster Wheeler is set to escape an in-depth investigation by the competitions watchdog after the companies offered to sell off major North Sea assets.

The Competitions and Markets Authority said the disposals “might be acceptable” as the two companies look to avoid the merger being referred for an in-depth investigation.

The CMA is considering the proposal after an earlier investigation found that the tie-up could “significantly reduce customers’ ability to obtain competitive bids, which could lead to increased prices and affect the competitiveness of the oil and gas industry in the UK”.

Pound falls close to seven-year low against the euro

The pound is closing in on its lowest level against the euro in over seven years. It reached an intraday low of €1.0939 last October and is currently trading at €1.0953 following today's inflation figures.

Lunchtime update: Weaker-than-expected inflation pulls the pound down to near seven-year low against the euro

Inflation unexpectedly holding at 2.6pc in July has lampooned the pound's performance today as the probability of an interest rate rise before the end of the year diminishes.

Against the dollar it has dived 0.8pc, trading at $1.2875, while against the euro it has plummeted to near its lowest point in over seven years.

The pound's fall and increasing risk appetite in the markets has helped the FTSE 100 tick along nicely today, however, the index rising 0.4pc.

A broad-based rally on the blue-chip index has helped to offset mining stocks falling on new data pointing to a slowdown in the Chinese housing market and retailer Next tumbling 4.4pc on a scathing broker note from Berenberg.

Here's the current state of play in Europe:

FTSE 100: +0.44pc

DAX: +0.33pc

CAC 40: +0.45pc

IBEX: +0.09pc

Nightclub owner Deltic looks to gatecrash Stonegate bid for Revolution Bars

Nightclub owner Deltic has gone public with its desire to merge with Revolution Bars as it looks to sink a rival bid by Slug and Lettuce owner Stonegate.

Deltic, which owns 57 clubs under brands including PRYZM and Fiction, called Stonegate’s bid for Revolution “opportunistic” and claimed its 200p per share offer would be a “disappointing outcome” for Revolution investors given it matches the value of the company when it listed on the stock market in 2015.

But Revolution has told Deltic it does not wish to discuss its alternative proposal, which would see the two companies merge but remain listed under the Revolution name. Under this plan, Deltic's owners would hold an as yet undisclosed number of shares in the enlarged entity.

Read Bradley Gerrard's full report here

Planning for Brexit: Financial giants trigger their contingency plans

As Britain enters a key week in the Brexit negotiations, the country’s financial sector is losing interest in the Cabinet quarrels that have dominated talks this summer.

Stepping back from the chaos and pushing on with its assumption that the talks will end in a worst-case scenario - no trade deal, or a so-called hard Brexit - the City is getting tired of the political to-ing and fro-ing that could see it stung once Britain leaves the bloc.

Read Lucy Burton's full article here

Inflation snap reaction: CPI still on its way to 3pc in 2017

UK inflation remains stable at 2.6pc in July, but well ahead of 2pc target and other major western economies. pic.twitter.com/hcJnCDE3Ns

— Andrew Sentance (@asentance) August 15, 2017

The probability of an interest rate hike has nudged down since the inflation release this morning with the markets now pricing in a 23.4pc chance of a rise in 2017. Today's figures undoubtedly ease the pressure ratcheting up on the Bank of England to raise rates.

Although some have commented this morning that inflation could have hit its peak already, Capital Economics still believes that the CPI figure will inch up slightly before the end of the year.

It added:

"We still think that inflation will climb to about 3% or so by October, as the effects of sterling’s slide continue to work their way through the supply chain. However, we think that should be the point at which inflation peaks."

Tej Parikh, senior economist at the Institute of Directors said following today's inflation figures that it is time for the government to provide some political certainty to boost confidence:

"Subdued wage growth is likely to weigh down consumer demand, while an uncertain investment environment—owing to a lack of clarity surrounding the UK’s future relationship with the European Union—continues.

"The Bank is using many of the tools at its disposal to provide as much economic certainty as possible, but it cannot provide political certainty. This must come from the Government as it returns from its summer recess."

Relief for drivers as falling petrol prices stop inflation rising

Falling petrol prices bailed out British households in July as inflation stayed flat at 2.6pc, defying expectations that prices would resume their accelerating trend.

Economists had predicted inflation of 2.7pc in the 12 months to July, climbing towards more than 3pc by the end of the year as the effect of the weak pound hits shoppers on the high street.

But a surprise dip in inflation in June was maintained into July, as rises in the cost of clothing, food and energy were offset by falling motor fuel costs, the Office for National Statistics (ONS) said.

Read Tim Wallace's full report here

FTSE 100 rises as pound takes a tumble

With the pound tumbling this morning to lift the big exporters in London and investors continuing to pile back into riskier assets as they return to risk-on mode, the FTSE 100 is pushing back towards the 7400 mark as we approach lunchtime.

Pharma firm Shire has been lifted 2pc by its submission of an eye-drops drug for approval in Europe while at the other end mining stocks have been hit by figures showing a slowdown in the Chinese housing market.

With seemingly half of the City on a sun lounger in Tuscany, trading volumes are a fraction of what they were earlier in the summer and the lack of newsflow is meaning that a lot of the risers and fallers on the index today are moving on analyst notes.

Elsewhere, social housing company Mears Group has fallen much as 11pc in intraday trading on the mid-cap FTSE 250 index after it issued a profit warning. The firm said that work orders have been delayed by the impact of the Grenfell Tower fire with Mears now 8.5pc down for the session.

Inflation snap reaction: Borrowers and consumers the winners from today's figures

U.K. inflation unchanged at 2.6% in July. Pound falls to intraday low of $1.2910 after ONS data. pic.twitter.com/zvxxXXExxo

— Carla Mozee (@MWMozee) August 15, 2017

Borrowers and consumers are today's big winners, according to senior economist at Hargreaves Lansdown Ben Brettell:

"All this is good news for the consumer, as it helps alleviate the continuing squeeze on household finances, though pay is still shrinking in real terms for now. Tomorrow’s labour market update is expected to show wage growth remained at 1.8% for the three months to July.

"It’s also good news for borrowers – moderating inflation means less pressure on the Bank of England to consider raising interest rates, and will allow the MPC to remove the sticking plaster of ultra-low interest rates very slowly indeed. With only two of the eight members voting for higher rates earlier this month, it seems even a return to 0.5% is some way off for now."

Tomorrow's wage growth data is now the focus for the markets, argues forex research director at OFX Jake Trask:

"The market will now be watching tomorrow’s wage growth data closely, to see if the spread of incomes and inflation will narrow to ease pressure on UK consumers.

"But even if the spread closes, it seems unlikely we will see an interest rate hike anytime soon, as ongoing concerns over the UK’s Brexit negotiating position compounded by a slowing domestic economy weigh on both business and consumer confidence."

A quick sitrep on the pound. It has stabilised at 0.45pc down against the dollar and 0.16pc down against the euro, trading at $1.2923 and €1.0989.

Can the pound really be heading towards parity against the euro? Your trip to Malaga for some winter sun is starting to look a little pricey.

Falling fuel prices the main thing keeping inflation from rising further this month pic.twitter.com/fEUsYAaotz

— Ed Conway (@EdConwaySky) August 15, 2017

Inflation snap reaction: CPI is close to topping out

on UK CPI: At the margin the lower than expected number is good news but its importance can only be truly recognised once the context of

— World First (@World_First) August 15, 2017

I'm relieved and surprised that CPI has not risen from 2.6%. Keeps a bit of pressure off family budgets. Also pushes back next interest rise

— Rodney Hobson (@RodneyHobson) August 15, 2017

Here's a round-up of the snap reaction from today's surprise inflation figures. Were predictions of 3pc inflation by the end of the year premature?

Royal London Asset Management economist Ian Kernohan believes CPI might be close to its peak:

"While there is still some residual impact of sterling devaluation to feed through, with underlying inflationary pressures low, we think that CPI is close to topping out for the immediate future.

"In their latest Inflation Report, the Bank of England forecast inflation to peak at 3% in the autumn, and will be happy to keep interest rates on hold as a result."

Chief market analyst at Think Markets Naeem Aslam believes energy prices could lift CPI in the future:

"The inflation data overshooting the bank’s target continues to be blamed on the sterling weakness. Going forward, the growth picture still looks subdued and this does not appear to be changing in 2018 as well.

"More notably, one can not disregard the influence of higher energy prices from Big six energy suppliers making its way to the CPI basket."

Rail fares will rise as RPI unexpectedly hits 3.6pc

RPI at 3.6% - will mean biggest train price hikes since 2012 pic.twitter.com/oJncu96Hm4

— Lee Boyce (@lee_boyce) August 15, 2017

Although the consumer price index held at 2.6pc indicating that the squeeze on households is beginning to ease, the retail price index rose to 3.6pc. As train fares are still linked to RPI, the unexpected rise will result in higher rail fares despite RPI being regarded as an outdated measure of inflation.

Tomorrow's employment figures will also provide a fuller picture on whether the strain on households from the gap between high inflation and sluggish wage growth is starting to ease.

Inflation key takeaways

Inflation unexpectedly holds at 2.6pc, below expectations of 2.7pc.

The pound has fallen 0.4pc against the dollar, trading at $1.2924, and has now touched into negative territory against the euro for the session.

The price of fuel continuing to fall provided the largest downward contribution to the figure.

The Office for National Statistics said that this was offset by smaller rises in prices of clothing, household goods, gas and electricity and food and non-alcoholic beverages.

Inflation in July held at 2.6pc; pound dives in reaction

Inflation in July held at 2.6pc, below expectations of 2.7pc. The pound has dived in reaction. More to follow...

Inflation preview: Carney's smoke and mirrors act can't convince the markets anymore

The recent hint from Mark Carney and the Bank of England that the markets are under-pricing the prospect of a rate rise is failing to convince traders as the central bank has turned ambiguity on monetary policy into an art form, according to CMC Markets analyst Michael Hewson.

Mr Carney and his colleagues at the BoE have been teasing traders all summer with both hawkish and dovish hints but at the press conference on 'Super Thursday' earlier this month the currency markets largely ignored the central bank governor's hawkish comments.

Mr Hewson added on his approach ahead of today's inflation release:

"This “smoke and mirrors” approach to monetary policy may well have worked a few years ago when markets were still coming to terms with the new approach of the Bank of England’s then new governor Mark Carney, this so called “rock star” of central banking beguiled investors by introducing the concept of forward guidance.

"While effective at the time the concept now appears to be looking a little tired, and the enthusiasm that greeted his arrival has also diminished, with the Bank of England governor being likened to an “unreliable boyfriend” for his ability to appear to switch from dovish to hawkish and then back again on an almost week to week basis."

Here's who's predicting what UK inflation will be at the end of this year. pic.twitter.com/T3uaFKQ7oU

— Rupert Seggins (@Rupert_Seggins) August 15, 2017

German GDP for the second quarter misses expectations

A quick note on the Germany GDP figures which have dropped this morning. GDP growth came in at 0.6pc in the second quarter, slightly below expectations of 0.7pc. We'll provide a bit more analysis on that once all of the inflation excitement has passed.

Inflation preview: Solid data could bring the hawks back into the game

Ahead of today's inflation data, the markets are currently pricing in a 24.9pc probability that the Bank of England will hike interest rates by the end of the year to curb inflation.

Last month's surprise drop in inflation to 2.6pc appeared to have scuppered the chances of an early rise but the central bank's governor Mark Carney said at the BoE's 'Super Thursday' earlier this month that the markets had underestimated the prospect of a rate rise. The markets remained unconvinced, however, and the pound continued to fall as he spoke.

Is a 2017 hike now out of the question? Not according to London Capital Group analyst Ipek Ozkardeskaya:

"Solid data could bring some Bank of England hawks back in game, yet the upside potential in the pound markets shall remain limited given the BoE’s decidedly dovish tone regarding the foreseeable future of its monetary policy under the Brexit circumstances.

"On the other hand, a second month of softening in the UK’s inflationary pressures would confirm the Bank of England Governor Mark Carney’s expectation that lower wages would translate into softer price inflation."

Pound pulled in different directions by euro and dollar as Brexit plans fail to convince currency markets

News this morning that the UK will attempt to retain a temporary customs union with the EU during a two-year transitional period hasn't proved particularly alluring for traders on the currency markets.

The pound edged up against the euro early on but is descending towards flat territory. It's currently trading at €1.1016, close to its recent 10-month low.

Sterling has deteriorated against the dollar as we approach today's UK inflation figures. Hawkish comments from FOMC member William Dudley in the US last night has shifted the momentum in the dollar's favour with the pound trading at $1.2931 against the greenback.

Mr Dudley, who is the US Federal Reserve's vice-chair, said that he favoured one more interest rate hike this month and also hinted that the central bank will reveal its balance sheet reduction plans in September. The chances of a 2017 hike seemed to have been torpedoed by soft inflation but his latest comments have helped to lift the dollar overnight.

Agenda: Key UK inflation data in focus for investors

Welcome to our live markets coverage.

The pound has been pushed back by the dollar ahead of today's key UK inflation data due at 9.30am with hawkish hints from FOMC member William Dudley that the US Federal Reserve will hike once more in 2017 helping to lift the greenback. Sterling is trading at $1.2948 against the dollar this morning.

UK Inflation is expected to rebound to 2.7pc from June's surprise drop to 2.6pc but any rise is not expected to be persuasive enough to overturn the dovish consensus at the Bank of England to leave interest rates at 0.25pc.

$Silver and $gold are feeling the pain as the risk off trade ease off pic.twitter.com/4OdSKo6JT6

— Naeem Aslam (@NaeemAslam23) August 15, 2017

US and Asian stock markets pushed on from where their European peers left off and made further dents into last week's North Korea-related losses.

This morning, the FTSE 100 continued to rally, the UK's blue-chip index edging up 0.2pc early on. The corporate calendar is looking very bare again today with the headline figures from Hargreaves Lansdown's full-year results already having been released earlier this month.

Interim results: Jackpotjoy, Telecom Egypt, H&T Group

Full-year results: Hargreaves Lansdown

AGM: Falcon Acquisitions, Acorn Income Fund

Economics: CPI y/y (UK), PPI m/m (UK), RPI (UK), House price index y/y (UK), CB leading index m/m (UK), Import prices m/m (US), Retail sales m/m (US), NAHB housing market index (US), Business inventories m/m (US), ZEW economic sentiment (EU), Preliminary GDP q/q (GER),