Pound slides as interest rate cut looks increasingly likely

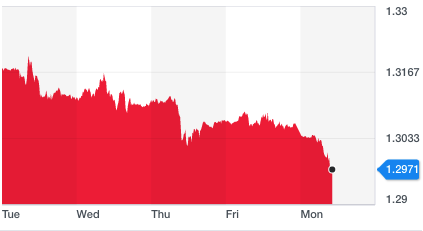

The pound fell against the euro and dollar on Monday, as expectations of a Bank of England interest rate cut rose.

Sterling fell below $1.30 for the first time in over two weeks, after a member of the Bank of England’s interest rate setting committee said he could favour a rate cut.

Gertjan Vlieghe, a member of the central bank’s Monetary Policy Committee, told the Financial Times over the weekend he would back a cut later this month if UK economic data does not improve. He described the decision as a “close call”.

The pound was already under pressure after Vlieghe’s comments and worse-than-expected data, released Monday morning, pushed sterling lower. New data showed the UK economy shrank by 0.3% in November. Economists had been forecasting 0% growth.

The pound fell 0.6% against the dollar to $1.2979 (GBPUSD=X) and 0.5% against the euro to €1.1671 (GBPEUR=X). The prospect of lower interest rates make currencies less attractive to international investors looking for yield.

“Today’s release might well tip the balance of one or two members ahead of the meeting on 30 January, where the market probability assigned to a 25 bps cut has risen to 50% versus 5% at the start of last week,” said Peter Dixon, an economist at Commerzbank.

Vlieghe’s comments echo the sentiments of two of his colleagues on the Monetary Policy Committee.

Silvana Tenreyro, who also sits on the committee, said at a conference on Friday she would back a rate cut “in the near term” if the economy does not pick up. And the pound slipped last week after Bank of England governor Mark Carney said the central bank was weighing up the merits of a “near-term stimulus” to revive the economy.

Vlieghe, Tenreyro, and Carney have historically not supported cutting rates and a change in their positions would be enough to swing the committee. Nine people sit on the Monetary Policy Committee and they voted 7-2 to maintain interest rates unchanged at the last meeting. The dissenting voters both backed a rate cut.

Any decrease in interest rates would be the first cut since 2016, when the Bank of England briefly lowered the borrowing rate to 0.5%. The UK interest rate currently stands at 0.75%, a level it has been at for the majority of the post-financial crisis era.

The next interest rates decision from the Bank of England’s Monetary Policy Committee is due on 30 January.

“Key data points set to fall over the next fortnight will be crucial to the Bank of England's January rate decision,” said Bethel Loh, a macro strategist at ThinkMarkets. “This includes CPI [inflation], retail sales, jobs, and arguably the most important, UK PMIs on 24 January.”