Poorest UK households spend over £1 in every £4 repaying debts

One in six of Britain’s poorest households are falling behind with debt repayments – and one in ten are spending more than £1 out of every £4 on repayments.

A third of households have credit cards and loans that far outweigh any assets they do own, new analysis shows.

Around half of households in have some unsecured consumer debt, with 10% of households holding over £10,000 of such debt.

MORE: ‘Fat Cat Thursday’ sees UK’s top bosses pass average worker’s earnings by lunchtime

Almost half of this kind of debt is from formal loans (43%), with credit and store card debt (25%) and hire purchase debt (21%) the next most significant categories, figures from the Institute for Fiscal Studies show.

The majority of this debt could be paid off, the report said.

“More than 60% of unsecured debt is held by households with above-average incomes, and more than half of households with unsecured debts have more than enough financial assets to pay them off,” it said.

The real issue was, said the IFS, for households that were already behind on making debt repayments or that spent a large amount of their income on servicing debts.

“Debt looks like a real problem for a significant minority of those on low incomes, who are not keeping up with bills and, or, spending high fractions of their disposable income on debt repayment,” said the author of the IFS report, David Sturrock.

MORE: Five simple New Year’s resolutions to make you richer

The authors learned that more than one in five people on low incomes have problem debts, compared with just one in 20 people at the top of the income scale.

They found that on average the poorest fifth spend £457 a month paying towards their debts out of an average income of £1,012.

The IFS, which prepared the analysis for the Joseph Rowntree Foundation, also found:

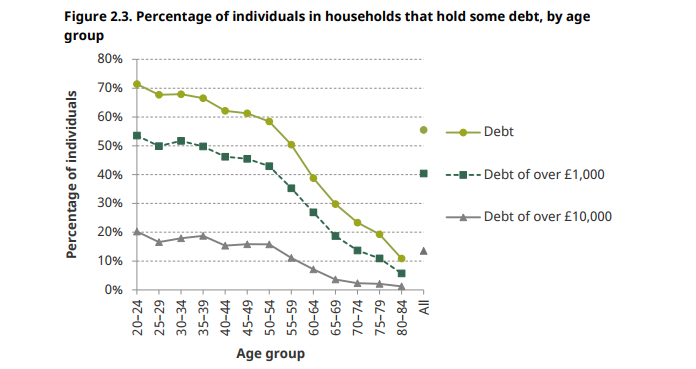

Young adults aged in their 20s were more likely to be in households with problem debt than older people

One in five people aged between 20 and 24 have debts, not including student loans, in excess of £10,000

Low-educated young adults were particularly likely to be struggling

Debt problems tended to be more persistent for low-income households

MORE: British workers’ pay will be ‘astonishingly’ bad for decades, experts warn

Helen Barnard, head of analysis at the JRF, said: “Low income household are facing a difficult 2018, with rising prices, frozen benefits and a wage squeeze all putting further pressure on household incomes.

“The government, regulators and lenders need to not only look at increasing access to affordable credit, but also at the financial pressures that can lead families to take on debt in order to get by.”

According to the Money Advice Service, there are now 8.3 million people in the UK with problem debts. Inflation during the past year has been edging upwards – now standing at 3% – with the cost of supermarket essentials and fuel also rising.

Coupled with that, wages have for the most part remained static, adding to the pressures many are facing.

Yahoo Finance

Yahoo Finance