How to Plan for Rising Health Care Costs

By: Fidelity Institutional Asset Management

Harvest Exchange

June 4, 2018

How to Plan for Rising Health Care Costs

Tab for health care post-age 65? Try $280,000 for the average couple.

Key Takeaways

It is estimated that the average couple will need $280,000 in today's dollars for medical expenses in retirement, excluding long-term care.

Health care continues to be one of the largest expenses in retirement.

To help fill a gap in saving for health care expenses, consider increasing contributions to your tax-advantaged accounts, especially HSAs (if you have one), which enable tax-free spending on health care in retirement.*

*HSA contributions, earnings, and distributions used to pay for qualified medical expenses are tax free for federal income tax purposes.

If you are like most Americans, health care is expected to be one of your largest expenses in retirement, after housing and transportation costs. But unlike your parents' generation, most of you won't have access to employer- or union-sponsored retiree health benefits. So, health care costs will likely consume a larger portion of your retirement budget—and you need to plan for that.

There are a number of drivers behind this mounting retirement health care cost challenge. In general, people are living longer, health care inflation continues to outpace the rate of general inflation, and the average retirement age is 62 for most Americans—that's 3 years before you are eligible to enroll in Medicare.

"Health care is creating a 'retirement cost gap' for many pre-retirees," says Steve Feinschreiber, senior vice president of the Financial Solutions Group at Fidelity. "Although many assume their savings will cover all of their expenses in retirement, health care costs are often higher than anticipated. Many people assume Medicare will cover everything, but it doesn't. The average 65+ year-old retiree today should expect to pay around $5,000¹ a year on health care premiums and out-of-pocket expenses. So, you should carefully weigh all options."

Health care: What's your price tag?

How much should you plan to pay in health care costs after you retire? According to the Fidelity Retiree Health Care Cost Estimate,² an average retired couple age 65 in 2018 may need approximately $280,000 saved (after tax) to cover health care expenses in retirement. Of course, the amount you'll need will depend on when and where you retire, how healthy you are, and how long you live. The amount you need will also depend on which accounts you use to pay for health care—e.g., 401(k), HSA, IRA, or taxable accounts; your tax rates in retirement; and potentially even your gross income.3

Tip: If you're still working and your employer offers an HSA-eligible health plan, you are eligible to contribute to a health savings account (HSA). An HSA offers a triple advantage.4 You can save pretax dollars (and possibly collect employer contributions), which have the potential to grow and be withdrawn tax free for federal tax purposes if used for qualified medical expenses—currently or in retirement.

Pre- and early retirees: Make the most of your time to prepare

As retirement nears, you will have several big decisions to make, including when to stop working, when to take Social Security, how to pay for health care, and how to generate cash flow from your retirement assets. These decisions are interconnected and could make a difference in your living costs and lifestyle in retirement—and when you can retire.

Some one third of "early retirees" who claim Social Security at age 625 do so to help pay for health care expenses until they are eligible for Medicare coverage at age 65. But if you can postpone retirement or save enough to cover health care costs until 65, then you may be able to defer your Social Security benefits. Generally speaking, the longer you can wait until age 70 to take Social Security benefits, the more you can collect, assuming you live a long life.

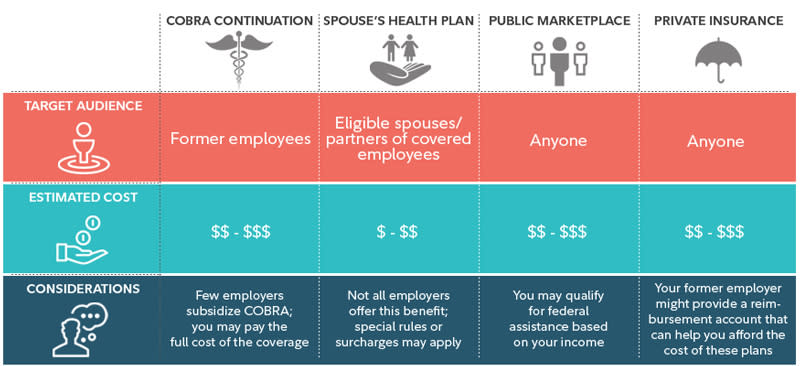

If you're like most people, you probably don't have access to employer-sponsored pre-65 retiree medical coverage. So if you retire prior to age 65, you'll need to find coverage until you are eligible for Medicare. Consider these options that may be available to you (see chart below).

Turning 65 and retiring: Consider Medicare and other options

When you get close to age 65, spend some time reviewing and considering all your Medicare options. When you do become eligible at age 65, you'll want to remember to sign up during your 7-month initial enrollment period that begins 3 months before the month you turn 65.

There's a lot to learn about the world of Medicare. You'll need to know about Medicare Parts A, B, and D, as well as Medicare Advantage and "Medigap" supplemental insurance plans.

In brief, Part A covers hospital costs after you meet a deductible. Part B is optional coverage for medical expenses and requires an annual premium. Part D is for prescription drug coverage. Medicare Advantage plans are all-in-one managed care plans that provide the services covered under Part A and Part B of Medicare and may also cover other services that are not covered under Parts A and B, including Part D prescription drug coverage. Supplemental policies, referred to as Medigap policies, are offered by private insurance companies to supplement expenses that Medicare Parts A and B do not typically cover.

"You need to consider the various factors to help make your decision. Look at the cost of annual premiums and co-pays at different levels of supplemental insurance. Compare these costs. Then factor in the number of visits and co-pay/coinsurance per visit that you anticipate for the next year. You may be better off paying a higher premium but not having to pay out-of-pocket at your office visits," Feinschreiber advises.

Tip: Once you select a Medicare plan, it's not forever. You can switch Medicare plans as you age and as your situation changes. Generally, it makes sense to enroll in Medicare Parts A, B, and D when you are first eligible because the late enrollment penalty for doing so later is steep (see next section if you are continuing to work after age 65).

For illustrative purposes only. Source: Fidelity Benefits Consulting 2018

Turning 65 and still gainfully employed (or your spouse/partner is)

If you're still working when you're 65 and get health insurance through your employer or your spouse's employer, you'll have the opportunity to enroll in Medicare when you leave your employer plan through a Special Enrollment Period.

In addition to Medicare options to consider, if your spouse or partner continues to work, they may be able to cover you through their health plan. Talk to your HR department to help you evaluate all your options, costs, and any restrictions. The rules of Medicare are complicated, so to get started, consider the following questions:

Which plan offers you the best coverage for your health needs?

Your employer is required to offer you coverage, but is that your best option?

Is it more expensive to stay in your employer plan or join Medicare?

Can your spouse or partner remain in your employer's plan if you decide to leave?

Health care in retirement: Costs can come later

As you plan for health care expenses throughout your retirement—however long it may be—understand how paying for future health care expenses fits into your overall retirement income planning efforts because health care utilization tends to increase as we age.

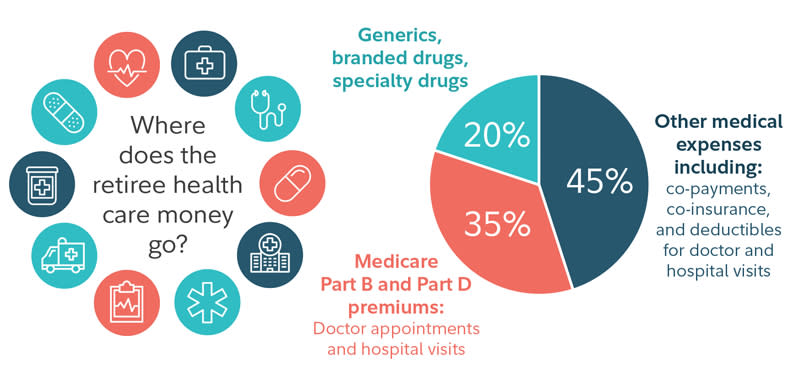

According to the Kaiser Family Foundation, the percentage of household budgets spent on health expenses is nearly 3 times as much for retirees on Medicare as for working households (14% versus 5%).6

"Although health care costs continue to rise, there are financial planning steps that you can take today to help prevent health care costs from eating into your retirement lifestyle," Feinschreiber advises. "For example, if you're age 50 or older, you may be able to make up for a savings shortfall with additional catch-up contributions to your 401(k) or IRA. In addition, if you are age 55 or older, you can make an additional $1,000 catch-up contribution annually to your health savings account."

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

The information provided herein is general in nature. It is not intended, nor should it be construed, as legal or tax advice. Because the administration of an HSA is a taxpayer responsibility, you are strongly encouraged to consult your tax advisor before opening an HSA. You are also encouraged to review information available from the Internal Revenue Service (IRS) for taxpayers, which can be found on the IRS website at IRS.gov. You can find IRS Publication 969, Health Savings Accounts and Other Tax-Favored Health Plans, and IRS Publication 502, Medical and Dental Expenses, online, or you can call the IRS to request a copy of each at 800.829.3676.

1. Fidelity Benefits Consulting estimate; 2018

2. Estimate based on a hypothetical couple retiring in 2018, 65 years old, with life expectancies that align with Society of Actuaries' RP-2014 Healthy Annuitant rates with Mortality Improvements Scale MP-2016. Actual expenses may be more or less depending on actual health status, area of residence, and longevity. Estimate is net of taxes. The Fidelity Retiree Health Care Costs Estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government's insurance program, Original Medicare. The calculation takes into account cost-sharing provisions (such as deductibles and coinsurance) associated with Medicare Part A and Part B (inpatient and outpatient medical insurance). It also considers Medicare Part D (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by Original Medicare. The estimate does not include other health-related expenses, such as over-the-counter medications, most dental services and long-term care.

3. For investors with MAGI above $170,000 in the calendar year 2 years before the current year, and filing taxes as married filing jointly, Medicare premiums for parts B and D are increased.

4. With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

5. Social Security Administration; https://www.ssa.gov/policy/docs/ssb/v76n4/v76n4p1.html

6. Kaiser Family Foundation, Health Care on a Budget: The Financial Burden of Health Spending by Medicare Households, 2014.

651511.6

RD_13569_29195

Unless otherwise disclosed to you, in providing this information, Fidelity is not undertaking to provide impartial investment advice, or to give advice in a fiduciary capacity, in connection with any investment or transaction described herein. Fiduciaries are solely responsible for exercising independent judgment in evaluating any transaction(s) and are assumed to be capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies. Fidelity has a financial interest in any transaction(s) that fiduciaries, and if applicable, their clients, may enter into involving Fidelity's products or services.

Registered investment products (including mutual funds and ETFs) and collective investment trusts managed by Fidelity Management Trust Company (FMTC), are offered by Fidelity Investments Institutional Services Company, Inc. (FIISC), a registered broker-dealer. Fidelity Institutional Asset Management (FIAM) investment management services and products are managed by the Fidelity Investments companies of FIAM LLC, a U.S. registered investment advisor, or Fidelity Institutional Asset Management Trust Company, a New Hampshire trust company. FIAM products and services may be presented by FIISC, a non-exclusive financial intermediary affiliated with FIAM and compensated for such services.

Before investing have your client consider the funds', variable investment products, or exchange traded products' investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or a summary prospectus, if available, containing this information. Have your client read it carefully.

Originally Published at: How to Plan for Rising Health Care Costs