What Can We Make Of Photronics' (NASDAQ:PLAB) CEO Compensation?

This article will reflect on the compensation paid to Peter Kirlin who has served as CEO of Photronics, Inc. (NASDAQ:PLAB) since 2015. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Photronics.

See our latest analysis for Photronics

How Does Total Compensation For Peter Kirlin Compare With Other Companies In The Industry?

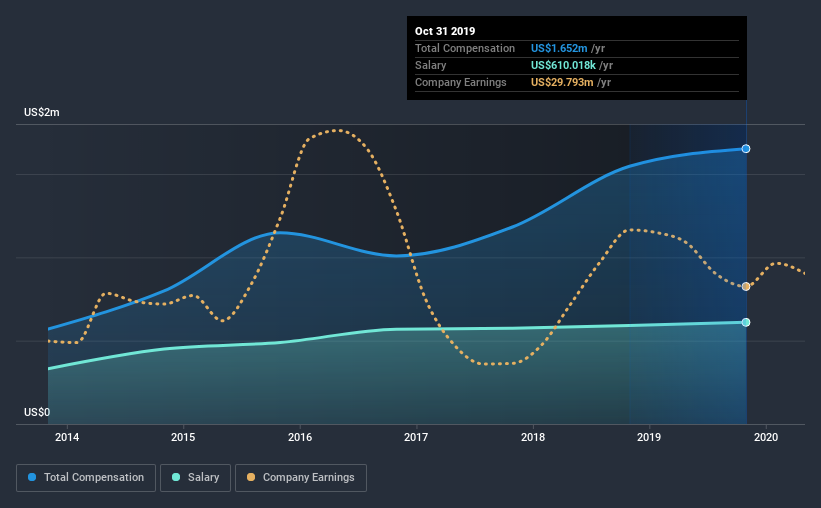

At the time of writing, our data shows that Photronics, Inc. has a market capitalization of US$755m, and reported total annual CEO compensation of US$1.7m for the year to October 2019. That's just a smallish increase of 6.8% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$610k.

For comparison, other companies in the same industry with market capitalizations ranging between US$400m and US$1.6b had a median total CEO compensation of US$2.5m. Accordingly, Photronics pays its CEO under the industry median. Furthermore, Peter Kirlin directly owns US$4.0m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$610k | US$591k | 37% |

Other | US$1.0m | US$955k | 63% |

Total Compensation | US$1.7m | US$1.5m | 100% |

Talking in terms of the industry, salary represented approximately 14% of total compensation out of all the companies we analyzed, while other remuneration made up 86% of the pie. It's interesting to note that Photronics pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Photronics, Inc.'s Growth Numbers

Photronics, Inc.'s earnings per share (EPS) grew 26% per year over the last three years. In the last year, its revenue is up 11%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Photronics, Inc. Been A Good Investment?

Boasting a total shareholder return of 46% over three years, Photronics, Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we touched on above, Photronics, Inc. is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Considering robust earnings growth, we believe Peter to be modestly paid. And given most shareholders are probably very happy with recent shareholder returns, they might even think Peter deserves a raise!

So you may want to check if insiders are buying Photronics shares with their own money (free access).

Switching gears from Photronics, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.