Pfizer vs Moderna vaccines: What we know, and what we don't

Two vaccine candidates using similar technology are winning the COVID-19 vaccine race in the U.S., and in the process validating the mRNA platform — which is yet untested on the market — as well as setting the path for vaccine makers to follow in order to block the virus.

Pfizer (PFE) and BioNTech (BNTX) have the highest efficacy rating at 95% — much higher than the 60% bar set by the U.S. Food and Drug Administration and surpassing the minimum number of infections required in order to conclude the trial.

Moderna (MRNA), on the other hand, is not far behind at a 94.5% efficacy rating. But Moderna has a leg up with its cold-chain needs, which are significantly less arduous than the ultra-cold chain required for Pfizer’s vaccine.

Moderna also said that zero severe COVID-19 cases were reported in the vaccinated group, which gives the company an even bigger boost.

“Moderna has basically told us its 100% (efficacious). No one is saying it out loud, but that’s huge. If that were to hold up across the population, we could get back to normal life,” said Dr. Howard Forman, health policy expert and Yale University professor.

While Pfizer, a pharmaceutical giant and one of the leading vaccine makers in the world, has the experience and infrastructure to scale up more quickly, both it and Lonza, Moderna’s Swiss manufacturing partner, have had to retrofit their plants to produce the necessary doses.

Pfizer’s vice president of distribution, Tanya Alcorn, recently told Yahoo Finance that the move, along with the purchase of hundreds of ultra-cold freezers to hold the vaccines as it ramps up production, is more of a short-term effort — with little known about the potential of the technology.

“We haven’t thought about what’s next ... if we overbought on freezers, we overbought,” Alcorn said.

This, even as Pfizer has said it is pursuing a powder version of the vaccine which would reduce the ultra-cold storage burden for shipping and storage.

For Moderna, the story is very different. The company’s existence is based on the mRNA platform — which has now been validated and sets the template for future vaccines and treatments. The company had been private for eight years before going public in 2018.

“2021 is going to be an inflection year for the company. We now know that Moderna can make effective vaccines. This was proven today,” CEO Stéphane Bancel told Yahoo Finance Monday.

Pfizer has opted to directly ship its vaccine to points of use, while Moderna will rely on the federal government’s contract with McKesson (MCK). Operation Warp Speed officials recently said the vaccines will be distributed within 24 hours of an emergency use authorization, with a weekly shipment expected after.

Pfizer’s CEO has been keen to highlight the company’s independence from federal funding, though it is a part of Operation Warp Speed as it relates to the government purchasing the vaccines, as well as supplying vials and other supplemental equipment. Moderna, on the other hand, has been very reliant on federal funding — receiving nearly $2 billion, which is the same amount Pfizer says it has spent — to develop the vaccine as well as for the purchase order for the U.S.

For now, we know that both companies have some data on the vaccine’s efficacy within different age and ethnic groups, and are hoping that their vaccines will prove best for the elderly and for children — two sensitive groups for vaccines that remain in question. Trials for younger recipients are ongoing with Pfizer; Moderna plans to begin those trials soon.

Pfizer also revealed its vaccine, at a low 30 micrograms, proved especially efficacious with the 65-and-older population, which makes it the prime candidate for nursing homes.

What we don’t know

Among the things we don’t know yet is how long the vaccines will protect recipients. That requires actually studying participants in trials for an extended period of time. So even though the vaccine will be used under emergency use authorization, participants will still need to be monitored.

Which brings up another question — can placebo group patients be inoculated once the vaccine is approved? Some ethicists believe it is the correct thing to do, but there is a need to maintain a control arm as the vaccine’s durability is tested. That is another decision that is likely to come form the FDA.

Who will receive the vaccine first is also a question, since the data will reveal which age groups and ethnicities best respond to the vaccine of each company. The elderly and children require the most attention as vaccine doses can affect them more dramatically than healthy adults, which is something the U.S. Centers for Disease Control and Prevention (CDC) is still wrestling with.

Scaling up the production of the vaccines that do make it to the finish line is also a concern. Especially since not all are using the mRNA platform. That means that manufacturing partners are going to have to stick to one company, and if that company’s vaccine doesn’t make it, they will be hard-pressed to pivot and retrofit to adopt to another platform if a similar one isn’t available to partner with.

It’s why Operation Warp Speed has focused on the production of supplemental products like vials and syringes, rather than the vaccines themselves.

That the two frontrunners require two shots to provide adequate protection is also a hurdle, and what happens if individuals forget to get the booster shot, or what happens when they get a different company’s booster than the original shot, are all still unknowns.

And finally, we don’t know what the out-of-pocket cost to the general public will be. Even with pledges of free product, administration of the vaccine at some sites might result in charges.

Moody’s analysts said in a note that they expect insurers will take on the costs— which falls in line with mandates for testing coverage earlier in the pandemic.

“We expect the costs of a vaccine, which we believe is unlikely to be widely available until mid-2021, would be borne by health insurers, but those costs would be offset by lower coronavirus treatment costs and hospitalizations. Therefore a vaccine would not likely have a significant effect on health insurers' earnings,” the note said.

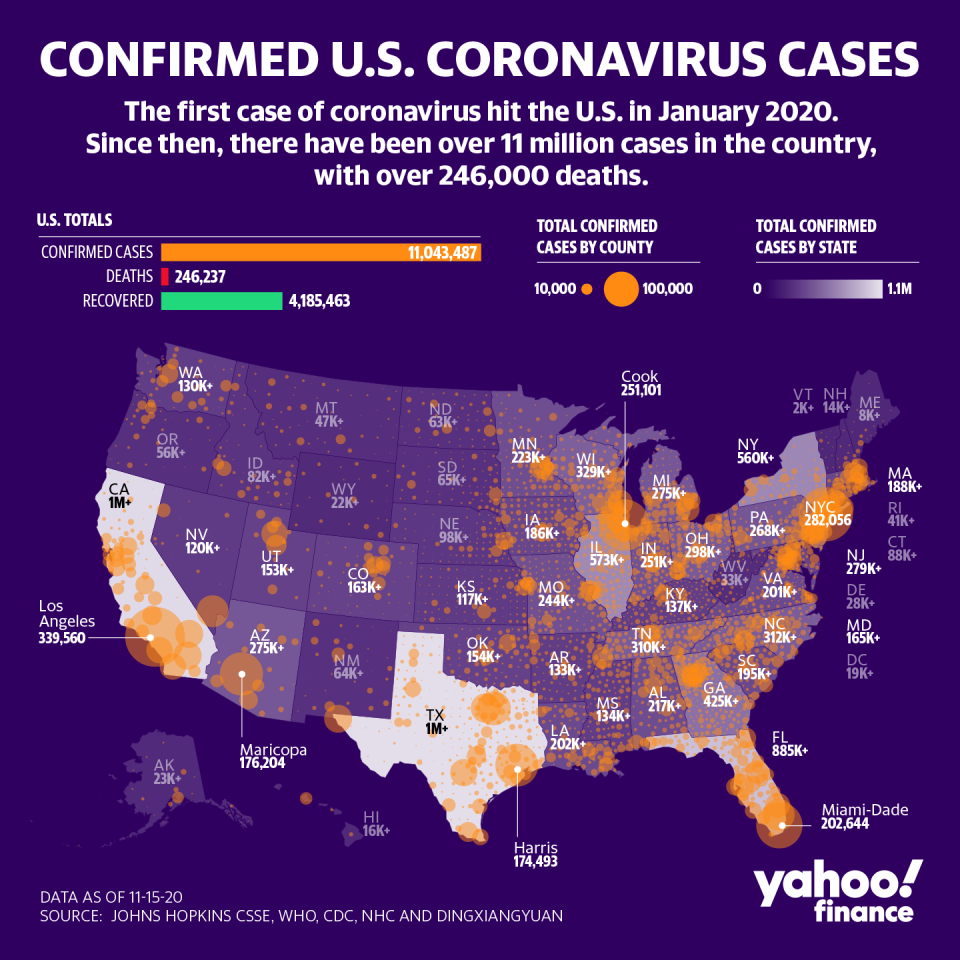

Some answers will come sooner than others. Meanwhile, the U.S. is in its darkest phase of the pandemic with daily cases at more than 100,000 per day and more than 11 million cases in total reported. Positivity rates are rising, leading to more restrictions on outdoor activities and social gatherings in various states.

More from Anjalee:

Fauci: Vaccines will only prevent symptoms, not block the virus

A Biden win could lead to a mask mandate, more testing: Expert

Trump admin rules for health insurer price transparency has potential to curb costs

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube.