Palo Alto Networks' Call Volume Picks Up

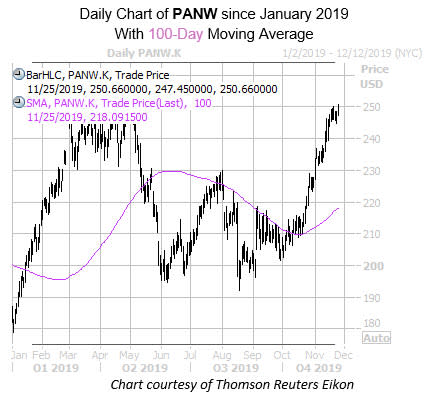

Cybersecurity name Palo Alto Networks Inc (NYSE:PANW) is up 1.2% at $249.87 this afternoon. Options traders look to be gearing up for the company's fiscal first-quarter earnings, which is slated for after the close today. On the charts, PANW has resumed its climb higher, with help from the 100-day moving average a few weeks back. Longer term, the equity has added 50% over the last 12 months.

As far as PANW's earnings history goes, the security has closed higher the day after reporting in all but three of the past eight quarters. During this time frame, the cybersecurity name has moved an average of 4% regardless of direction. This time around, the options market is pricing in an almost double, post-earnings swing of 7.9%.

In the options pits it looks like traders are expecting PANW to make a post-report swing to the upside. Not only is total options volume running at four times the expected rate, but calls are a hot commodity, with 8,700 traded so far.

Today's excess in call buying is a change from what we've seen recently, as during the past 10 days puts have been favored at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). In fact, PANW's 10-day put/call volume ratio of 1.01 ranks in the 88th percentile of its annual range.

Echoing this, near-term open interest looks unusually put-heavy on Palo Alto Networks stock. This is according to the Schaeffer's put/call open interest ratio (SOIR) of 1.71, which ranks just 2 percentage points from an annual high.