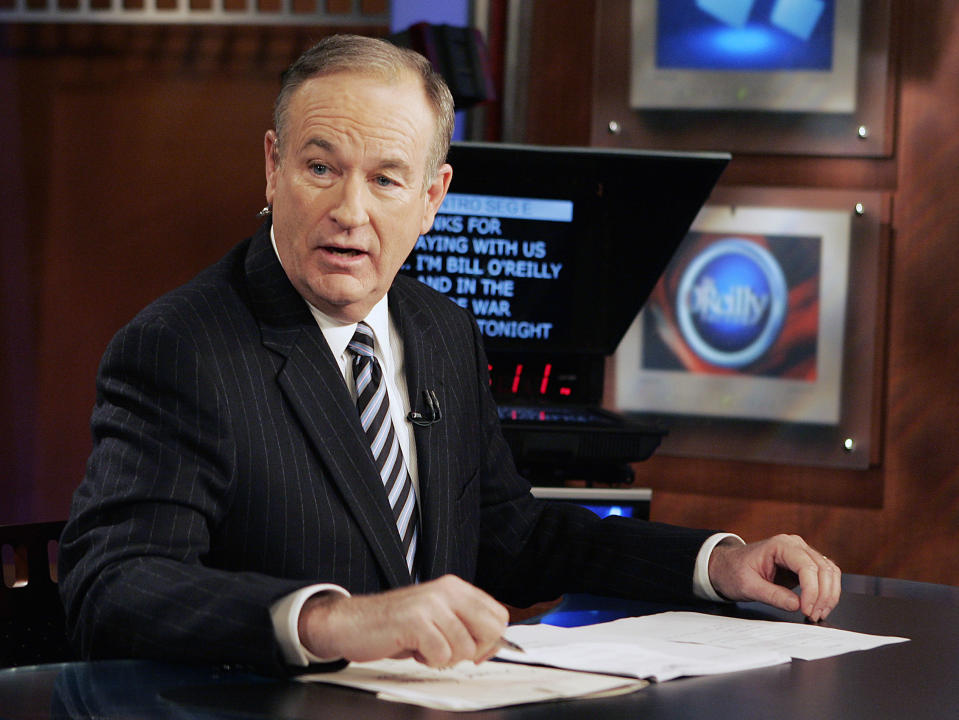

Why O’Reilly’s firing hasn’t hit Fox stock

Following Wednesday’s confirmation of Bill O’Reilly’s ouster, the impact of losing the long-running No. 1 cable news show on Fox News has been debated widely.

The show, which drew in nearly four million average nightly viewers, was seen as the flagship show for the conservative cable station, drawing in close to $200 million in advertising revenue.

However, the stock of Fox News’ parent company hardly budged, seemingly yawning off the news. 21st Century Fox (FOXA) closed down 0.88% on the day the news of O’Reilly’s exit hit, only slightly under-performing the broader market. And Thursday, the stock rose over 2%, bringing its year-to-date performance to over 10%, outperforming the S&P (^GSPC) and media peers, including CBS (CBS) and Time Warner (TWX).

So what gives?

21st Century Fox is a big company

While Fox News has dominated headlines of late, it makes up just 25% of the parent company’s cable division.

The cable division, which includes domestic and international stations beyond Fox News, generates about 75% of the company’s earnings.

21st Century Fox also gets 15% of earnings from filmed entertainment and 11% from broadcast television, both growth areas.

In film, Disney (DIS) is the dominant force in the space. But Fox has a solid slate ahead, including Deadpool 2, Kingsman 2, X-Men (Logan) and Avatar sequels expected within the next couple of years, to name a few.

Broadcast also continues to benefit from successful series like Empire along with Brooklyn Nine-Nine, New Girl and The Simpsons. (Unscripted series include Hell’s Kitchen and Master Chef.)

Overall, 21st Century Fox’s focused growth assets—including cable, film and broadcast—have benefited from Rupert Murdoch’s 2013 split of News Corp (the company he originally founded in 1979) into two. The company spun off its higher-growth film and TV business (21st Century Fox) from News Corp (NWSA), which is dominated by print assets, including Dow Jones (and the Wall Street Journal), The New York Post, The Sun, and HarperCollins Publishers.

This move toward more focused businesses reflected a theme in the industry, including Viacom (VIAB) splitting off CBS (CBS) in 2006 and Time Warner (TWX) spinning off Time Inc (TIME) in 2014.

Insulating the television business from the newspaper industry also helped 21st Century Fox distance itself from the hacking scandal that surrounded the News of the World, the British newspaper that News Corp shut down in 2011.

21st Century Fox has been focused on growth, investing organically and also pursuing outside opportunities (though its 2014 bid to acquire Time Warner for $80 billion was rejected).

Fox News is just one part of 21st Century Fox’s cable biz

While Fox News, at 25% of cable earnings, is an important business component, the cable segment boasts strong channels in both its domestic and international markets.

The domestic division’s strong channels include FX (with popular shows including Fargo, American Horror Story, and The Americans), FXX (known for Always Sunny in Philadelphia, Man Seeking Woman, and The League), Fox Sports, National Geographic, and Regional Sports Networks (RSNs).

Meanwhile, a ratings hit (or brand image concerns) could impact advertising revenue for Fox News. But the majority of revenue (about 65% for the news channels) comes from more stable affiliate fees, as shown in the figure above. Affiliate fees are basically the portion of subscription fee users pay to cable or satellite operators that is then shared back to the content owner like Fox and are not dependent on ratings.

Overall, the cable business has seen consistent growth, and analysts only see a slight slowing in growth rate due to cord cutting. Plus, Fox’s 30% stake in Hulu and incorporation in skinny bundles will help offset any acceleration in cord cutting, according to analysts.

And international revenue in cable networks—including STAR in India—remain a key growth driver for the company, especially because of significant subscriber growth, especially when compared to the US. Analysts estimate that STAR will double earnings from $200 million in 2016 to $1 billion in 2020.

The company is also pursuing a bid for the 61% of British pay television giant Sky PLC (SKYAY), which some analysts view as an additional growth driver.

Fox News stability: Viewer loyalty in a politically-charged era

Even when zeroing in on Fox News, worries seem muted.

There are, frankly, meager alternatives to Fox for conservative television viewers. And the loyalty to the station and its messaging supersedes its talent, according to Needham’s Laura Martin. “There might be an initial downdraft, but then it will come back, because the people who watch Fox News don’t have an alternative,” she said.

Despite concerns about a viewership drop for the 9 p.m. slot after Megyn Kelly’s departure from the network, Tucker Carson has actually brought in more viewers during that time.

Plus, the highly-politicized nature of the Trump era has kept viewers coming in droves. In the first quarter of this year, Fox News had its largest audience in history.

These results followed the January departure of Megyn Kelly along with Greta van Susteren’s exit from the network last September—not to mention the July 2016 resignation of Fox News chief Roger Ailes following sexual harassment lawsuits.

Plus, even though ratings were high for O’Reilly, many advertisers were reluctant to advertise, even before the controversy erupted, Martin explained.

Over 50 advertisers left the O’Reilly Factor, pressured by grassroots efforts, following the April 1 New York Times article that revealed the settlement of five sexual harassment lawsuits for $13 million. But Martin said there was some advertising hesitancy before this date as well, despite high ratings.

“The advertisement base was limited, even before the controversy, because advertisers don’t want to place their brands alongside very politicized content” Martin said. “We expect a ratings decline because of the departure of O’Reilly, but we think the economic downdraft will be more muted.”

While 21st Century Fox has underperformed peers, including Disney and Comcast (CMCSA) over the last five years, analysts say some of this is because of higher investments in programming.

“The Murdochs tend to take a ten-year view,” Jefferies’ John Janedis said, referring in particular to cable show investments. “Manypeers take more of a one- to three-year view. Different timelines mean different outcomes.”

Nicole Sinclair is markets correspondent at Yahoo Finance.

Please also see:

America’s regional banks address the bank lending slowdown

Two US states have contracting economies

Citigroup CEO on Trump’s policy changes: ‘It’s a matter of when and not if’