Options Trader Bets on Monster Micron Move

Micron Technology, Inc. (NASDAQ:MU) is slated to report earnings in mid-December, and the chip stock has a history of making big post-earnings moves -- averaging a next-day swing of 7.2% over the last two years. One options trader on Friday wagered on another volatile earnings reaction for Micron, initiating a long straddle in the front-month series.

Looking closer, one speculator bought to open 10,000 December 55 calls and 10,000 December 55 puts for an initial cash outlay of $7.94 million (10,000 spreads * $7.94 premium paid * 100 shares per contract). By doing so, the trader expects MU to surge above $62.94 (strike plus net debit) or sink below $47.06 (strike less net debit) by the close on Friday, Dec. 20, when the options expire. However, if the stock lands right at $55 when the options expire, the spread strategist will forfeit the entire premium paid.

More broadly speaking, options traders have struck a bullish tone toward Micron. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity's 10-day call/put volume ratio of 1.35 registers in the 75th annual percentile, meaning calls have been bought to open over puts at a quicker-than-usual clip.

It's certainly an attractive time to purchase premium on MU options. The stock's Schaeffer's Volatility Index (SVI) of 42% arrives in the 19th percentile of its 12-month range, meaning short-term contracts are pricing in relatively low volatility expectations at the moment -- ideal for long straddles, which require buying double premium.

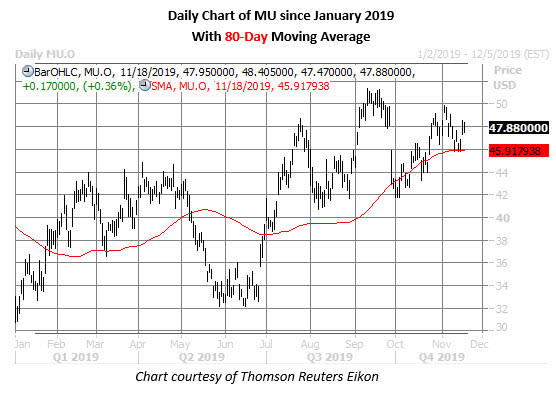

On the charts, Micron shares have been gaining ground since bouncing from familiar support in the $42 region in early October -- home to their pre-bear gap levels from July. More recently, last week's slip was quickly contained by MU's 80-day moving average, and today, the equity is up 0.4% at $47.88, bringing its year-to-date gain to 50.9%.