Options Bulls in Overdrive as GE Stock Hits New High

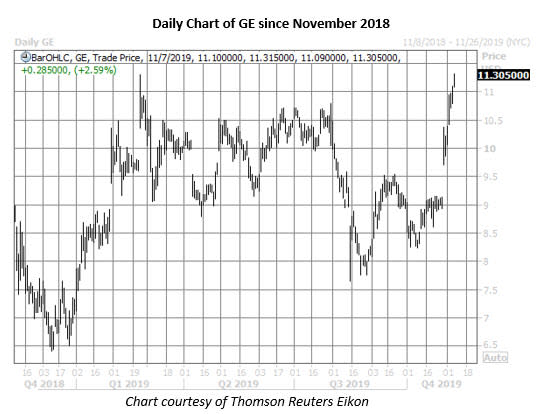

General Electric Company (NYSE:GE) surged into double-digit territory in late October, as Wall Street cheered the industrial conglomerate's impressive earnings report. GE stock has yet to look back, and is up 2.6% today at $11.30, earlier hitting a new annual high of $11.31, on positive U.S.-China trade headlines, and pacing toward its fifth straight weekly win.

Options traders have reacted to today's upside by targeting calls at an accelerated clip. More than 158,000 GE calls have traded today, two times what's typically seen at this point, and triple the number of puts on the tape. The November and December 11 calls are most active, and it looks like speculators may be selling to close their now in-the-money positions.

Elsewhere, the November 11.50 call is in high rotation, and data suggests traders are buying to open the options for a volume-weighted average price of $0.09. If this the case, breakeven for the call buyers at the close next Friday, Nov. 15, is $11.59 (strike plus premium paid). For reference, GE stock hasn't closed above $11.59 on a weekly basis since Oct. 19, 2018.

And in the wake of GE's late-October earnings report, implied volatility (IV) has imploded. The stock's Schaeffer's Volatility Index (SVI) of 30% registers in the 10th percentile of its annual range, meaning short-term General Electric options are pricing in relatively low volatility expectations at the moment -- a key to maximizing the benefit of leverage.