Options Bears Gear Up for Kohl's Earnings Report

Ahead of Kohl's Corporation's (NYSE:KSS) third-quarter report, due out before the open next Tuesday, Nov. 19, things have been especially bearish in the options pits. During the last 10 days, 10,511 puts have been bought to open on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), compared to just 6,230 calls. And in fact, KSS' 10-day put/call volume ratio of 1.69 sits higher than 78% of all other readings from the past year, suggesting this rate of put buying is unusual.

Kohl's Schaeffer's put/call open interest ratio (SOIR) of 1.57 tells a similar story. The ratio ranks in the 88th percentile of its annual range, suggesting short-term options players have rarely been more put-biased during the past year. In fact, the December 57.50 put is home to peak open interest of 8,079 contracts in the soon-to-be front-month series.

Most of yesterday's activity centered around this contract, with positions being purchased. The 11/22 53.50-strike put saw some action yesterday, too, with buy-to-open activity detected here. Currently, KSS is trading at $57.93 -- and puts are outpacing calls by a 2-to-1 ratio in intraday action -- which means these traders are expecting more downside following the retailer's turn in the earnings confessional.

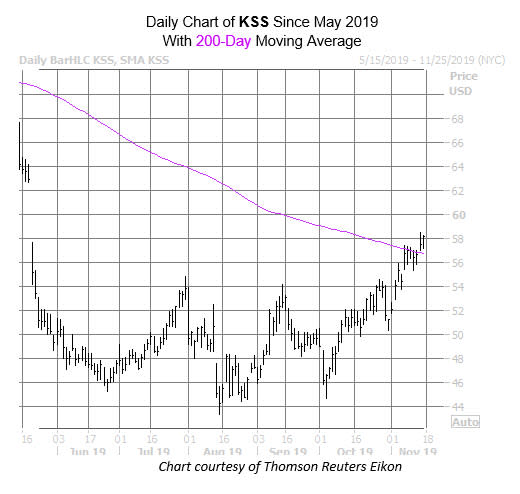

On the charts, KSS just found its footing atop the 200-day moving average, after toppling the trendline earlier this week. Now, the equity is contending with pressure in the $58 region -- near its late-May post-bear gap highs. And while Kohl's is still eyeing a 12.9% year-to-date deficit, the stock has managed to tack on almost 34% since its two-year lows in mid-August.

Taking a look at its past eight post-earnings moves, Kohl's tends to finish lower. As we previously indicated, the equity suffered a 12.3% next-day drop last May, and a 9.2% plunge this time last year. This time around, the options market is pricing in a 10.8% swing in Tuesday's trading, which eclipses KSS' average next-day move of 6.4%.