Only 3 Days Left To Cash In On TFS Financial Corp (TFSL) Dividend, Should Investors Buy?

Investors who want to cash in on TFS Financial Corp’s (NASDAQ:TFSL) upcoming dividend of $0.17 per share have only 3 days left to buy the shares before its ex-dividend date, 27 November 2017, in time for dividends payable on the 12 December 2017. Is this future income stream a compelling catalyst for dividend investors to think about TFSL as an investment today? Let’s take a look at TFSL’s most recent financial data to examine its dividend characteristics in more detail. View our latest analysis for TFS Financial

5 checks you should use to assess a dividend stock

When researching a dividend stock, I always follow the following screening criteria:

Does it pay an annual yield higher than 75% of dividend payers?

Has it consistently paid a stable dividend without missing a payment or drastically cutting payout?

Has it increased its dividend per share amount over the past?

Does earnings amply cover its dividend payments?

Based on future earnings growth, will it be able to continue to payout dividend at the current rate?

Does TFS Financial pass our checks?

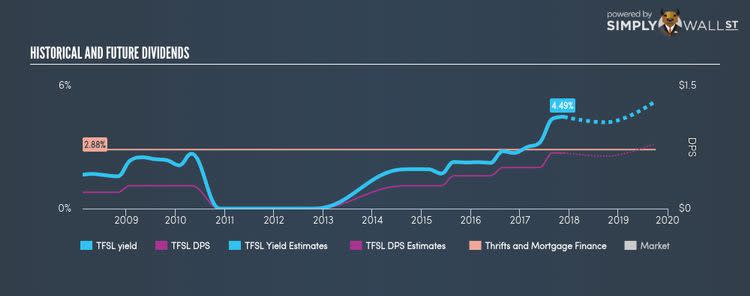

The current payout ratio for TFSL is 169.99%, which means that the dividend is not well-covered by its earnings. Furthermore, analysts are forecasting the payout ratio to exceed earnings going forward, leading to a future of uncertainty around the stability of TFSL’s dividend income. If there is one thing that you want to be reliable in your life, it’s dividend stocks and their constant income stream. Whilst its per-share payments have increased during the past 10 years, there has been some hiccups. Investors have seen reductions in the dividend per share in the past, although, it has picked up again. Compared to its peers, TFSL generates a yield of 4.47%, which is high for thrifts and mortgage finance stocks.

What this means for you:

Are you a shareholder? If TFSL is in your portfolio for cash-generating reasons, there may be better alternatives out there. It may be valuable exploring other dividend stocks as alternatives to TFSL or even look at high-growth stocks to complement your steady income stocks. I encourage you to continue your research by taking a look at my interactive free list of dividend rockstars as well as high-growth stocks to potentially add to your holdings.

Are you a potential investor? Taking all the above into account, TFS Financial is a complicated pick for dividend investors given that there are a couple of positive things about it as well as negative. However, if you are not strictly just a dividend investor, TFSL could still offer some interesting investment opportunities. I also recommend taking sufficient time to understand its core business and determine whether the company and its investment properties suit your overall goals. Dig deeping in our latest free fundmental analysis to explore other aspects of TFSL.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.