By one key measure, Amazon is the most underestimated company in the S&P 500

Few companies are as closely watched as Amazon (AMZN). Not only has the disruptive retail force been blamed for toppling iconic retail brands, but in the process, it has also turned its founder and CEO Jeff Bezos into the wealthiest person in the world.

All of this has come with a lot of hype and no shortage of speculation that the company, which is worth about $900 billion, may be overvalued.

But is it possible that the company is actually being underestimated?

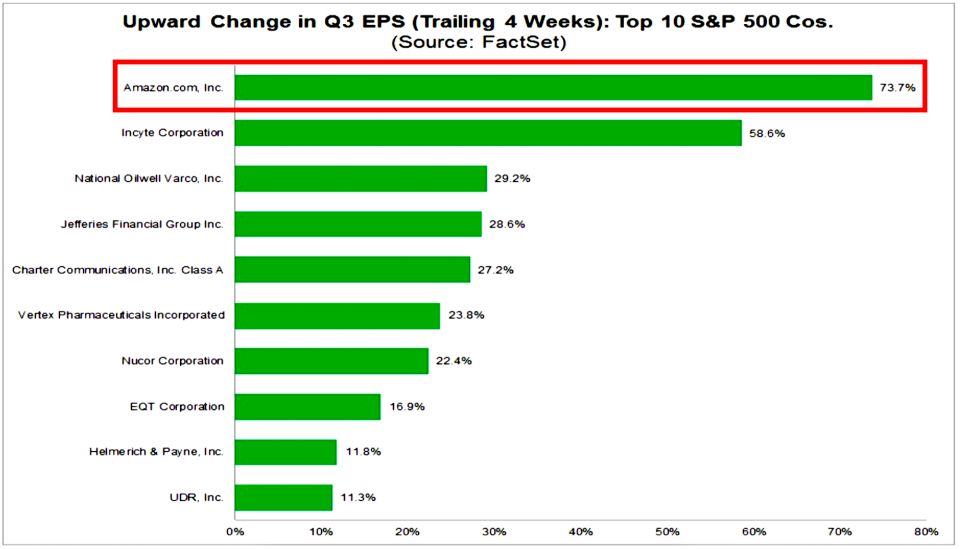

According to data compiled by FactSet, in the past four weeks analysts have revised their Q3 earnings estimates for the company by a whopping 73.7%. That’s the largest upward revision among S&P 500 (^GSPC) companies covered by analysts.

This follows Amazon’s Q2 earnings announcement where the company smashed expectations by reporting earnings of $2.5 billion or $5.07 per share, which itself was one of the biggest surprises of the recent earnings season.

“The Consumer Discretionary (+10.4%) sector is reporting the largest upside aggregate differences between actual earnings and estimated earnings,” FactSet’s Johns Butters said on Friday. “In this sector, Lennar ($0.94 vs. $0.43) and Amazon.com ($5.07 vs. $2.48) have reported the largest upside differences between actual EPS and estimated EPS.”

Earnings are incredibly difficult to forecast on a quarterly basis. But it’s certainly notable that Amazon of all companies is seeing the largest upward revisions to what professional analysts had forecast. Perhaps Amazon actually is underestimated.

–

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @bySamRo

Read more:

Robert Shiller: The stock market today is similar to the stock market in 1928

Janet Yellen nails how investors should think about valuations

The stock market has been in a new price regime for 20 years

Warren Buffett: One metric tells me the most about the future

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn