Obama was great for the gun business — and Trump's been terrible

The Obama years were a great time for the gun business.

But since the election of Donald Trump as president and the resulting decline in fears over increased gun regulation, sales in the industry have plummeted.

On Thursday, shares of gunmaker Sturm, Ruger & Co. (RGR) were down as much as 9% after reporting results Wednesday afternoon that missed expectations. In the second quarter, sales for the company were down 22% against the same period last year while profits fell 53%.

In its earnings release, Sturm, Ruger cited, among other factors weighing on results, “Decreased overall consumer demand in 2017 due to stronger-than-normal demand during most of 2016, likely bolstered by the political campaigns for the November 2016 elections.”

Cabela’s (CAB), an outdoors retailer which sells guns, was also down about 1% on Thursday after it reported second quarter retail store sales declined 6.7%.

“Since the fall election, we have continued to see a slowdown in firearms and shooting related categories,” said Cabela’s CEO Tommy Millner.

Gunmakers celebrate when Democrats are in charge

Back in 2015, for instance, gunmaker Smith & Wesson said, “[W]e experienced strong consumer demand for our firearm products following a new administration taking office in Washington, D.C. in 2009.”

And as the gun control debate raged on in Washington, D.C., gun sales boomed in anticipation of a future in which it was more difficult to buy firearms. The Trump administration, however, has taken this political tailwind away from the industry as consumers no longer fear the government will come to take their guns. The National Rifle Association endorsed Trump for president.

In February 2016, Sturm, Ruger CEO Michael Fifer said, “I think we’ll see a step up in demand if a Democrat wins the election, particularly so if they win the Senate. Despite whether President Obama is successful in appointing a Supreme Court justice, it’s more than likely, based on age and health, that the next president will get several opportunities, and that could drive concerns about gun rights.”

At that point in the presidential campaign, you’ll recall, many expected Hillary Clinton would take the White House and that we’d see a continuation of the debate over gun control and potentially an expansion of government regulations over gun ownership.

And then Trump won the presidency

Of course, Trump’s election win has changed that behavior.

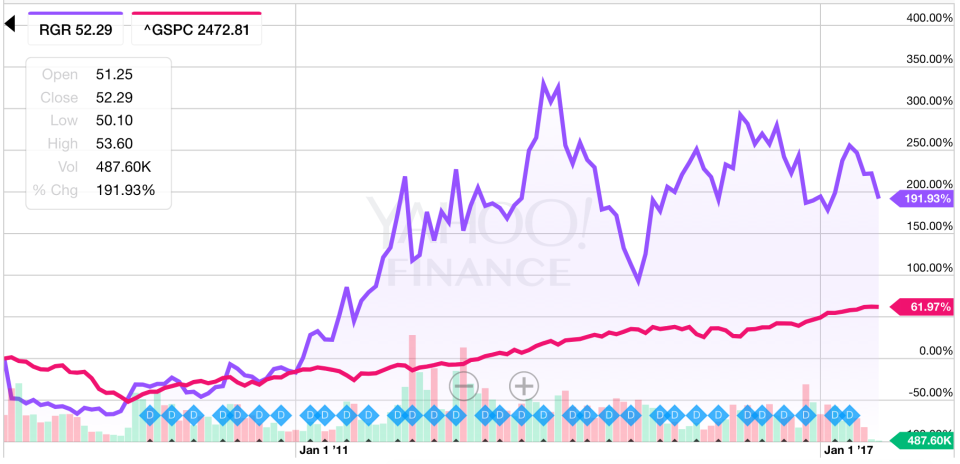

The market immediately took Trump’s win as a negative for Sturm, Ruger — as well as shares of American Outdoor Brands (AOBC), which owns Smith & Wesson — as we see in the chart below.

And with the gun industry’s political tailwind dissipating in the Trump era, Fifer took to Sturm, Ruger’s earnings call in February to argue that there’s never been a better time to be a gun owner.

“You’ve got more concealed carry in more states,” Fifer said.

“You’ve got more new shooters coming along […] All that stuff drives demand. And in some municipalities, you have the cops backing off. They’re being seen by the media too often as the enemy. And so, they’re backing off, and crime rates in those cities are soaring to the roof. Those people could care less who’s President. They want to defend themselves.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: