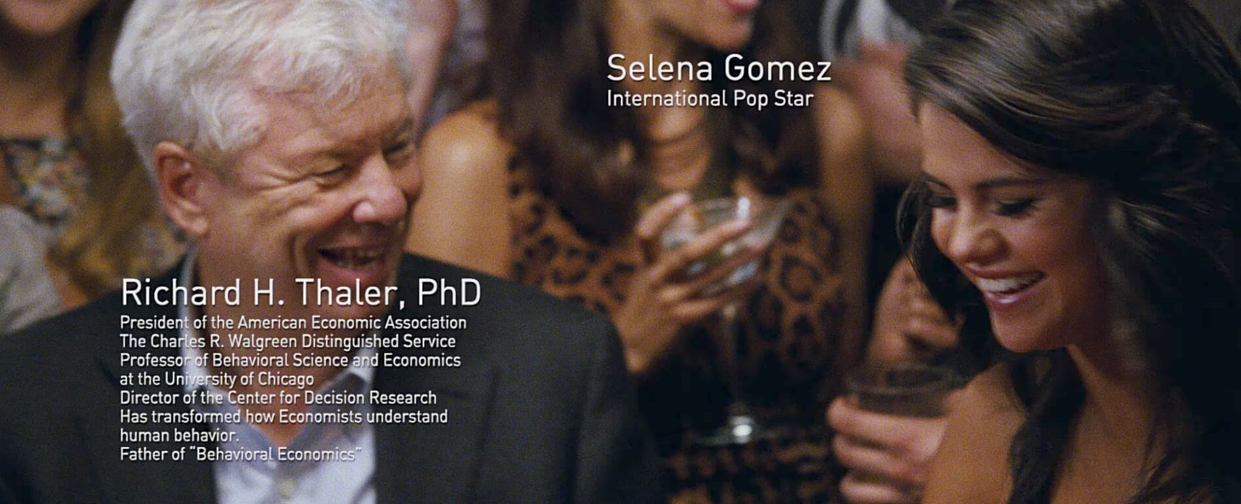

Nobel winner Richard Thaler explains the bizarre decision Americans make when gas prices plummet

On Monday, Richard Thaler was awarded the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel — better known as the Nobel Prize in Economics — for “contributions to behavioral economics.”

Thaler, a professor at the University of Chicago, is considered by many to be the godfather of behavioral economics, which is essentially the study of why people don’t behave the way economists often assume they do. People often act irrationally and yet the field of economics is mostly based on this not being true. Thaler’s work has explored why.

In his 2015 book “Misbehaving,” Thaler outlined a particularly elucidating example of how regular people make decisions that differ from what many in the economics field assume an “Econ” — that is, someone who always acts to maximize their economic potential — would behave.

And it requires us to simply look at the household budget.

Thaler highlights a study conducted by economists Justine Hastings and Jesse Shapiro, which, Thaler writes, “offers the most rigorous demonstration of the effects of mental budgeting to date.” Mental budgeting is the idea that we all have spending “buckets” which we treat as more or less immutable.

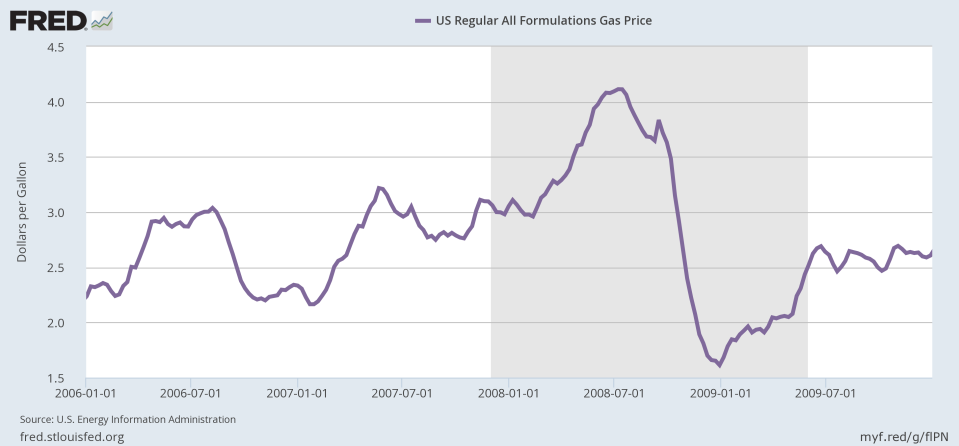

During the onset of the financial crisis in 2008, the price of gas went from about $4 a gallon to about $2. Using data from a grocery store chain that also sells gas, Hastings and Shapiro tracked where this money saved on gasoline went.

The answer: gasoline.

“The question Hastings and Shapiro investigated is what happens to the choice of regular versus premium gasoline when the price of gasoline changes,” Thaler writes. Economists would largely assume that this savings would be allocated to other areas of the household budget or saved for a rainy day.

Except this is not what happened.

“The shift toward higher grades of gasoline was fourteen times greater than would be expected in a world in which money is treated as fungible,” Thaler writes. “Further supporting the mental accounting interpretation of the results, the authors found that there was no tendency for families to upgrade the quality of two other items sold at the grocery stores, milk and orange juice.”

And so here Thaler illuminates a key idea that illustrates why this field has re-shaped the economics world and ultimately earned him a Nobel.

The idea that money is fungible is easy enough to understand in theory. Money, think euros or dollars, can basically be spent on anything. If you are given $1,000 to spend a month and the price of the items you are buying changes, then money’s fungibility allows you to alter the quantity of a given item you buy. So $200 a month spent on gas before the price of gas falls by 50% frees up $100 to be spent elsewhere.

Except that, as Thaler outlines, a lot of this $100 that had been “freed up” by a decline in gas prices was spent on more expensive gas. Meanwhile, other “buckets” of the household budget were unchanged. Namely, the grocery budget was not affected by the surpluses found in the gas bucket as the quality of milk and orange juice purchased during this period wasn’t changed.

And while many associated with economics today might not see the grand insight into consumers behaving irrationally as defined by the textbook, Thaler’s work was a leader in casting doubt on the “all else equal”–type assumptions that underwrote the entire economics profession at large.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: