The Government Shutdown Shines a Light on Americans' Poor Savings Habits, Research Shows

450,000 federal employees are working without pay during the longest-ever government shutdown in U.S. history.

Many federal employees who live paycheck-to-paycheck are struggling to make ends meet.

Research shows Americans need to prepare their finances for the shutdown to last indefinitely.

The federal government has been shut down since Dec. 22, 2018, and there is no end in sight. The shutdown is poised to continue into its fifth week and has already become one of the most expensive shutdowns in history.

The main sticking point in the government shutdown is funding for Trump’s border wall with Mexico. Considering Democrats won’t give Trump funding for the wall and Republicans won’t reopen the government without it, the shutdown seems like it will go on indefinitely. Currently, 450,000 federal employees are working without pay and that number could go up as Trump recalls IRS employees to handle tax returns, reports ABC News.

During this shutdown, one important thing has been clear: Many federal employees don’t have the savings needed to pay for their housing, cars and more.

Many Americans Don’t Have the Savings Needed to Survive the Government Shutdown

What is the most practical lesson Americans should take away from the shutdown? That it’s absolutely necessary to have an emergency fund.

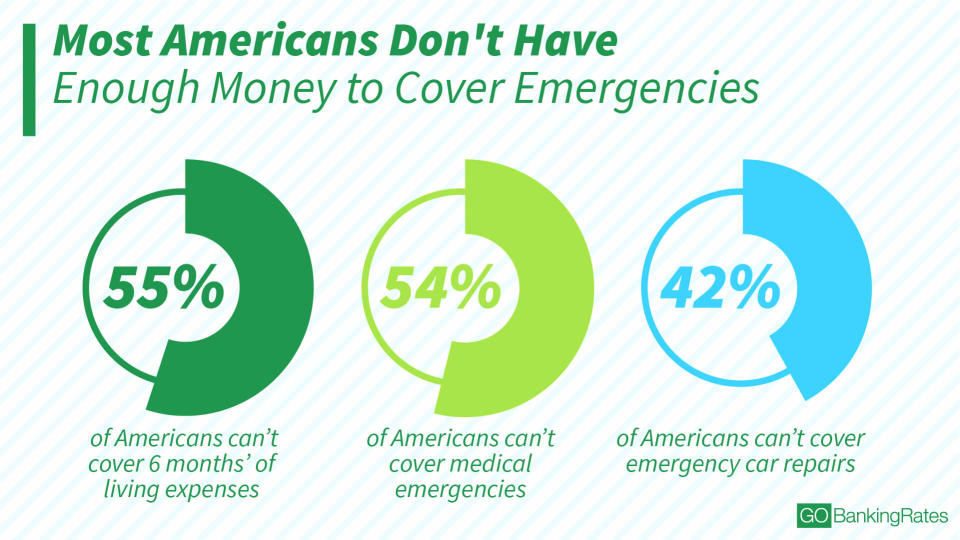

Building a buffer that can cover six months of living expenses is a fundamental practice for good personal finance. Unfortunately, most Americans lack savings for emergencies, according to a 2018 GOBankingRates survey. The survey found that more than half of Americans can’t cover six months of living expenses or medical emergencies. And, more than 40 percent said they don’t have the savings needed to cover emergency car repairs.

A more recent survey of 5,000 Americans also found that 32 percent have $0 in a savings account, and 26 percent have less than $1,000 in savings.

How Much Americans Have in a Savings Account | Response Rate (%) |

$0 | 32% |

Less than $1,000 | 26% |

$1,000-$4,999 | 15% |

$5,000-$9,999 | 7% |

10,000-$19,999 | 5% |

$20,000-$49,999 | 6% |

$50,000 or more | 10% |

An emergency fund is essential for covering expenses associated with disasters or unforeseen events. In regards to the government shutdown specifically, there are several reasons having an emergency fund is especially critical.

Impact of Shutdown on Government Employees

First, if you’re a federal government employee, the need for an emergency fund is pretty straightforward. You might get back-pay eventually, but for the time being, there’s no take-home money to spend. You’ll need a secure buffer underneath your feet as you spend cash and credit. Indeed, federal employees are already saying they’re feeling the impact on their finances.

Click to Read: As the Shutdown Drags On, One Federal Employee Reveals His Real-Life Money Woes

Impact of Shutdown on the Stock Market

With its implications of uncertainty and discord, a government shutdown can disturb the stock market. If the deadlock underlying the shutdown continues with little hope of an agreement in sight, then market worries could turn into real actions like panic selling, leading to losses on the stock market. Even if you’re not directly involved in trading, your pension or retirement account often is, which is why the shutdown’s effects on the market can ultimately hit you in your wallet.

Don’t Miss: 10 Recession Warning Signs You Need to Know

Impact of Shutdown on Tax Season

Disruption of tax season is a big potential issue. In past government shutdowns, the Internal Revenue Service’s interpretation of the Antideficiency Act did not allow IRS employees to work while the federal government was shut down.

Fortunately for Americans, the IRS said that tax season would begin as scheduled on Jan. 28, 2019. As such, tax refunds will be processed as scheduled. Find out other ways the government shutdown is affecting you taxes and refund this tax season.

More on Saving Money

Here’s Exactly How Much You Should Have Saved in an Emergency Fund

Here’s Why the Government Shutdown Is Bad News for Your Tax Refund

We make money easy. Get weekly email updates, including expert advice to help you Live Richer™.

This article originally appeared on GOBankingRates.com: The No. 1 Lesson All Americans Can Learn From the Government Shutdown