Next Real Estate Hot Spots Revealed in Investor Survey

New York City? Fuhgeddaboudit! That’s because cities like Denver and Nashville are about to steal the real estate spotlight.

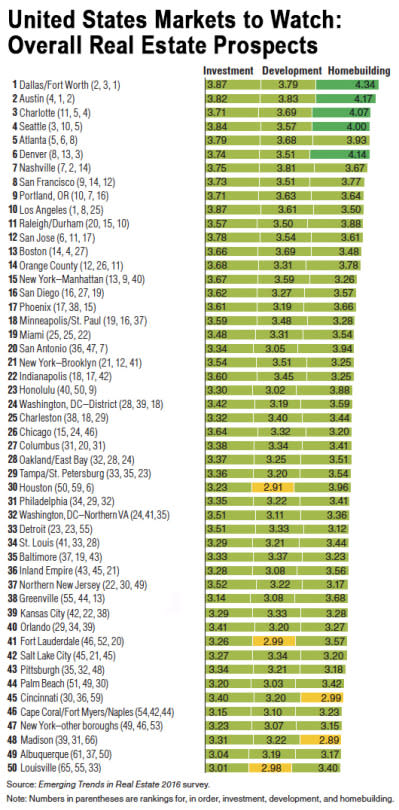

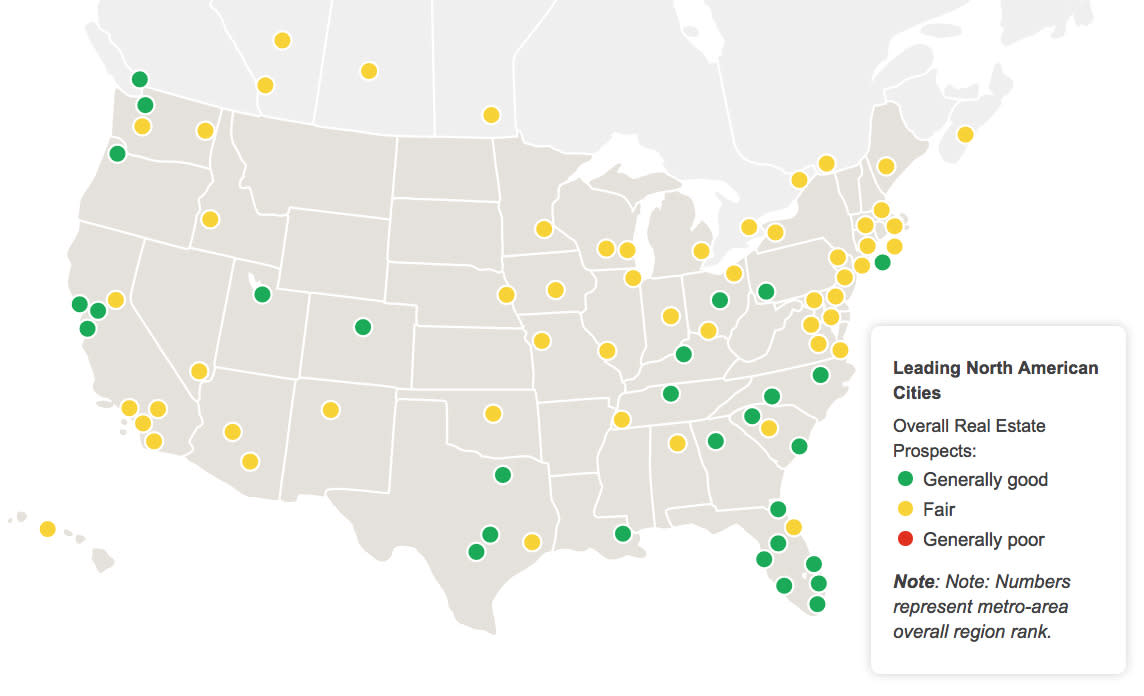

A new study shows investors are losing enthusiasm for large, trendy real estate markets in so-called gateway cities such as New York, Chicago, and Washington, D.C. Increasingly, they are turning their gaze toward secondary and tertiary cities like Austin, Charlotte, and Nashville. At the top of investors’ lists: Dallas/Fort Worth, according to a survey of nearly 1,500 real estate industry professionals by PwC (PricewaterhouseCoopers) and the Urban Land Institute.

The rankings were based on a combination of sentiment scores for investment, development, and homebuilding.

“It’s a job creation story,” said Mitchell Roschelle, the PwC real estate advisory leader who spearheaded the report. He cited Dallas, Austin, and Nashville as examples. “Jobs chase the people. As employment rises, more people come, more jobs come, so it’s really a good cycle.”

Employment growth, particularly from smaller companies, is what’s making secondary and tertiary cities more appealing than higher-cost, larger markets, he explained.

Still, there were some surprises. Houston, last year’s top market, came in at No. 30 this year while Nashville, which doesn’t have a reputation as a top-tier location for real estate investments, cracked the top 10.

The PwC/ULI survey also suggests a changing economy is having an effect on what types of real estate are popular.

Commercial real estate investors are shifting their gaze beyond industrial properties, for example. “Apartments remain hot and also what I refer to as derivative plays like student housing, senior housing, [and] medical office,” said Roschelle. “Those are going to be really interesting as they play out in 2016… Retail, not so hot. Full-service hotel[s] in sort of suburban areas, not so hot – but limited-service hotel[s], very, very hot.”

One thing that may be helping keep the apartment market buoyed is a shift from home ownership toward renting, a trend Roschelle expects will continue. He points out that U.S. Census data show home ownership down across all generations.

“Everyone’s blaming the Millennials who are living on their parents’ couch – [but] that’s really not the case,” he said. “The American Dream is certainly not dead but we’re in really a cycle, which could be more secular than cyclical, of renting as opposed to buying.”