What you need to know in markets this week

In a holiday-shortened week, a lot went on.

President Donald Trump pulled the U.S. from the Paris climate accord, prompting CEOs including Disney’s (DIS) Bob Iger and Tesla’s (TSLA) Elon Musk to remove themselves from Trump’s advisory panel, formally known as the President’s Strategic and Policy Forum. This action also prompted the first-ever tweet from Goldman Sachs (GS) CEO Lloyd Blankfein.

Meanwhile, in U.S. economic data, the labor market continued to look strong. ADP reported that private payrolls grew in May by 253,000. The government’s official payrolls figure, meanwhile, showed that 138,000 jobs were added to the economy in May while the unemployment rate fell to 4.3%.

This report also showed that folks newly entering the workforce are getting jobs quickly, indicating that there remains considerable demand for labor. This data also echoed comments we heard this week from business leaders across the country, which pointed to quality labor being the top problem for business.

Meanwhile, the U.S. stock market powered to a record high, the U.S. 10-year Treasury yield fell back to near where it was just after election day, and financial markets continue to take the seeming chaos in Washington, D.C. in stride.

In the coming week, the economic calendar is pretty empty, with Tuesday’s job openings and labor turnover survey (JOLTS) report serving as the highlight, while markets will turn their attention to the June 13-14 Federal Reserve meeting, at which the Fed is expected to raise rates for the third time since December.

Economic calendar

Monday: Markit US services PMI, May (54 previously); ISM non-manufacturing PMI, May (57.1 expected; 57.5 previously); Factory orders, April (-0.2% expected; +0.2% previously); Labor market conditions index, May (3.0 expected; 3.5 previously)

Tuesday: JOLTS, April (5.74 million jobs open expected; 5.74 million previously)

Wednesday: Consumer credit, April (+$15 billion expected; +16.4 billion previously)

Thursday: Initial jobless claims (240,000 expected; 248,000 previously)

Friday: No major economic data released

Millennials vs. Avocado Toast, again

Is it cool to buy a house anymore, asks Bank of America Merrill Lynch in a note to clients published Friday.

And the answer is: depends what cool is.

If the last few years of economic discussion have been preoccupied with one thing, it is what millennials will be like as they grow up. Right now, the most populous ages in America are 26, 25, 27, 24, and 28, in that order. Which means that the world’s favorite generation to pick on — for killing napkins and retail stores and golf, among other things — is growing into their prime earnings years and their prime home-buying, family-starting ages.

Economists have argued that as the housing market goes, so goes the U.S. economy. Millennials paying up to buy houses, then, is an important piece of the economic puzzle going forward.

So what Bank of America really wants to know is not whether millennials think buying a house is cool, per se, but whether they can afford to buy homes.

And the answer is mixed.

“The first question to ask is whether the younger generation can afford to buy a home,” writes Bank of America Merrill Lynch economist Michelle Meyer.

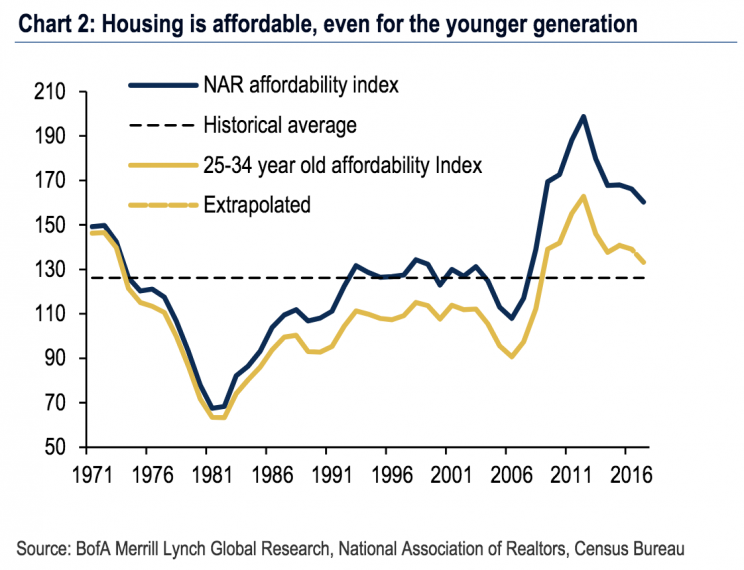

“We find that housing is still affordable for young adults, although not to the extent it is for the overall population. The gap in affordability between the overall population and young adults has widened over the years. That said, the affordability index for young adults is still above the historical average for the aggregate, implying that housing is generally affordable.”

But while overall housing affordability — as measured by the National Association of Realtors and BAML — remains reasonable for millennials, any homebuyers know that the biggest hurdle to buying a home is literally getting in the door, or, in other words, putting down a down payment.

“The NAR measure assumes a 20% down payment, which is a high hurdle for young adults– remember that the bulk of the current 25-34 year old cohort started their careers during the financial crisis and early stages of the recovery, when the economy and labor market were fragile,” Meyer writes.

“Plugging in a lower down payment of 10% and the situation looks worse due to increased principal and interest payments. With a 10% down payment, the index would be at 125.2 in 2015, which is 11% lower than the standard 25-34 year old index and 25% lower than the broad NAR index.”

Whether millennials have student loans hanging over their heads or not — and a lot of them do — the question then becomes do millennials want to buy a home. On this, BAML’s analysis is more mixed.

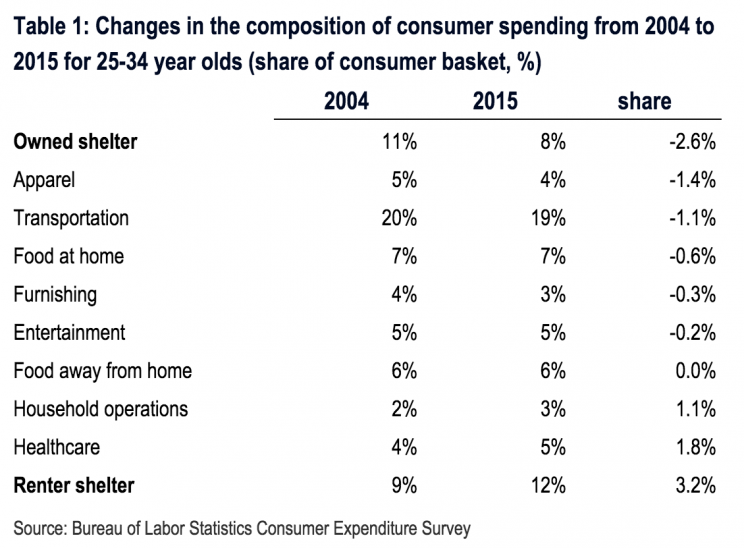

Recall that earlier this month there were headlines about one real estate developer scolding millennials for spending money on brunch rather than homes. And there is a grain of truth to this if we allow “brunch” to mean “discretionary services, experiences, rent, and other lifestyle choices not necessarily conducive to saving for a large down payment on a home.”

BAML posits that millennials remaining unmarried longer, living in expensive cities, and shopping not for stuff but services, all impacts how money will, or will not, eventually shift towards the housing sector.

Home prices across the country are back near pre-crisis highs and this lack of supply, particularly in less expensive homes, is squeezing potential first-time buyers out of the market. And many have argued that for the homeownership rate — which has been on the decline for years — to stabilize or tick higher, more homes will need to be built.

But if low inventory and high prices persist, no matter how affordability is measured, the marginal new buyer who needs 20% to put down on a home will continue to be squeezed. So while millennials are making choices about their spending habits that are different from earlier generations, they are still facing an uphill battle when it comes to homeownership.

And if these patterns persist, there is likely to be a more structural re-alignment in the U.S. housing market, which has seen the homeownership rate decline in recent years. Many have argued that not only will this rate come up, but that for this rate to rise so too will new homes need to be built.

“Addressing whether Millennials can afford to buy is only one part of the story,” Meyer writes.

“We need to understand if they actually want to buy. The homeownership rate has tumbled at a faster rate for 25-34 year olds than for other generations which we do not think can be explained by affordability metrics. We think it also owes to lifestyle changes. Maybe there is something to the stories about Millennials preferring to spend money on avocado toast instead of their home?”

And so all this begs the question of whether it is housing market supply, or millennial buyer demand, that keeps us from seeing an acceleration in how many people are owning homes in America.

To this question, of course, there is no easy answer. Unless you blame the avocado toast.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: