Morning Brief: Trump pledges to help China’s ZTE get back in business

Monday, May 14, 2018

What to watch today

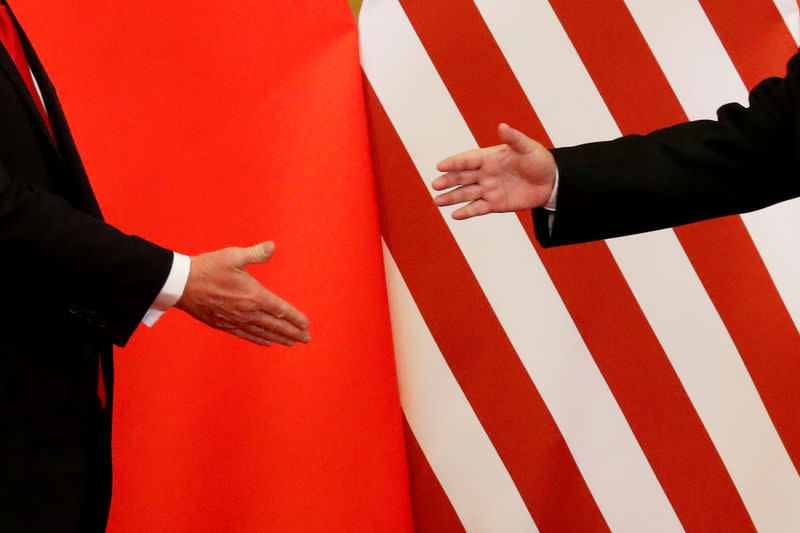

U.S. stock market futures are higher as investors and traders continue to watch for developments in global trade policy. On Sunday, President Donald Trump tweeted that he’d help China’s ZTE “get back into business, fast.” The U.S. Commerce Department had recently banned American companies from selling the tech giant’s products after it violated U.S. sanctions on Iran.

This week will be busy with Fed speakers, who will be expected to address recent report reflecting slowing job creation and cooling inflation. Speakers include Cleveland Fed’s Loretta Mester, Dallas Fed’s Robert Kaplan, incoming New York Fed President John Williams, Atlanta Fed’s Raphael Bostic, Minneapolis Fed’s Neel Kashkari, and Fed Governor Lael Brainard.

On Monday, St. Louis Fed President James Bullard will speak at the Consensus Blockchain Technology Summit in New York. On Tuesday, Fed nominees Richard Clarida (Vice chairman) and Michelle Bowman (Governor) will appear before the Senate Banking Committee for their confirmation hearings.

Top news

Tesla’s churn is making it tougher for Musk to ‘burn’ short sellers: Elon Musk has said the “short burn of the century” is coming soon to investors betting against Tesla (TSLA). He’s rapidly losing top deputies to help him deliver on that prediction. Tesla’s management churn is among the reasons some investors say they’re wagering against shares of the company, which is valued similar to General Motors Co. (GM) despite selling a fraction as many vehicles and burning through billions in cash. [Bloomberg]

Xerox says it is ending Fujifilm deal: Xerox Corp (XRX) said on Sunday it was ending a planned $6.1 billion deal with Fujifilm Holdings Corp. and had reached a settlement with activist investors Carl Icahn and Darwin Deason. The company said Chief Executive Officer Jeff Jacobson had resigned and that John Visentin was expected to be the new CEO. [Reuters]

Gas is headed for $3. What that means for the US economy: Economic growth has boosted demand for oil. If that growth continues, most consumers should be able to afford to pay more to fill up their tanks. But conflicts in oil-producing regions could mean even higher gas prices, posing a threat to U.S. growth as the cost of fuel and gasoline weighs on drivers, airlines, delivery companies and other big consumers. [The Wall Street Journal]

JPMorgan applies to set up majority-owned securities business in China: The unit, in which JPMorgan Chase & Co. (JPM) would own 51%, would allow the firm’s corporate and investment banking divisions to seek more Chinese clients on the mainland in an effort to expand and grow their businesses, JPMorgan said. The U.S. bank also said it is looking to double its research coverage of China-listed companies across all sectors. [Reuters]

Apple CEO Tim Cook brings up data privacy at Duke: While addressing Duke University’s graduating class on Sunday, Apple (AAPL) CEO Tim Cook broached a topic that has embroiled big-tech in controversy — data privacy. His comments come as Facebook (FB) and other tech giants have been under fire for not adequately protecting users’ privacy. [Yahoo Finance]

For more of the latest news, go to Yahoo Finance

Yahoo Finance Originals

Lots of openings, fewer raises — The current U.S. labor market puzzle

Trump lets drug companies off the hook

There’s now clear evidence that anti-poverty programs like welfare and Social Security work

The world’s most valuable unicorn is a little-known Chinese payment company

—

Like what you just read? Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. And feel free to share it with a friend!

The Morning Brief provides a quick rundown on what to watch in the markets, top news stories, and the best of Yahoo Finance Originals.