Money Basics: What is a bond?

Welcome to Money Basics, Yahoo Finance’s new personal finance series offering quick explanations for some of the most important terms involving your money.

When a corporation or government needs to borrow a lot of money, where does it go to for a loan? Well, unlike the average person who can go to a bank and apply for a loan, large organizations like governments and corporations often issue bonds to cover the costs.

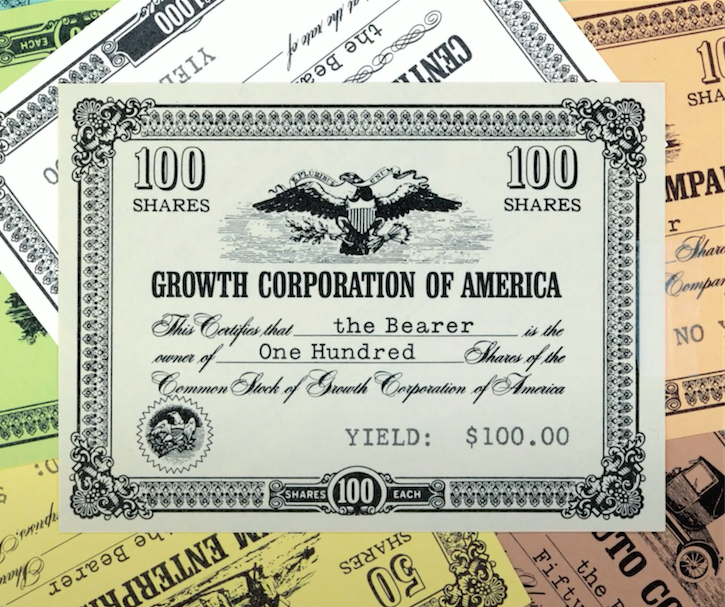

When you buy a bond, you are essentially loaning money to the entity that issued the bond. The company or organization promises to pay you back the total value of the loan, plus interest which gets paid out over the course of the loan, often yearly or semi-annually. When the bond reaches its maturity date, the issuer pays the holder the face value of the note.

Bonds have been around for a very long time. The oldest known bond dates back to 2400 B.C. in what was the ancient civilization of Mesopotamia. Today, when a corporation wants to build a new office, refinance, or undertake an expensive business venture, it can issue bonds to cover the costs. Cities also issue bonds, commonly known as municipal bonds, in order to cover costs for projects such as building roads, bridges and schools.

The interest on a bond is called the yield, or coupon rate. Bonds can be a way to regularly earn a fixed amount of money without a lot of risk. Even if the issuer of the bond goes bankrupt or out of business, it is still obligated to pay back the value of its bonds. Stockholders and other investors don’t have that same level of security. Many bonds are publicly traded on exchanges. Understanding bonds is a good step toward building your finances.

More from Money Basics:

• What is APR?

• What’s your net worth?

• What’s the Dow Jones?

• What’s the NASDAQ?

• What is a credit report anyway?

• What is a stock?