Monday’s Vital Data: Facebook Inc (FB), Monsanto Company (MON) and Teva Pharmaceutical Industries Limited (TEVA)

U.S. stock futures are trading broadly higher this morning, putting the major market indices on track for fresh all-time highs. Wall Street is showing little fear ahead of Wednesday’s Federal Reserve meeting, when the central bank is expected to hike interest rates for the third and final time of 2017. Furthermore, the European Central Bank and the Bank of England are also scheduled to make policy announcements this week.

Heading into the open, Dow Jones Industrial Average futures have gained 0.16%, S&P 500 futures have added 0.06% and Nasdaq-100 futures have rallied 0.09%.

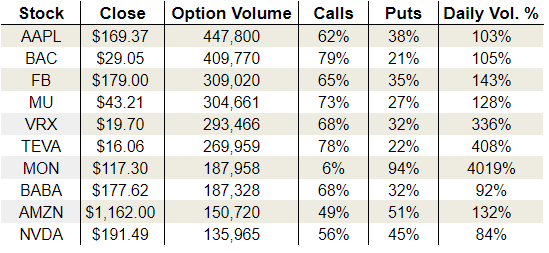

On the options front, volume was relatively normal for a Friday, if a bit call heavy. Overall, about 16.9 million calls and 13.4 million puts changed hands yesterday. As for the CBOE, the single-session equity put/call volume ratio rose to 0.60, while the 10-day moving average held at a 12-month low of 0.58.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Taking a closer look at Friday’s options activity, Facebook Inc (NASDAQ:FB) saw call volume spike after GBH Insights issued a bullish report on FANG stocks. Meanwhile, Monsanto Company (NYSE:MON) was hit with heavy put volume following an EU warning on the Bayer AG (OTCMKTS:BAYRY) buyout. Finally, shares of Teva Pharmaceutical Industries Limited (NASDAQ:TEVA) soared after the company announced it may cut up to 10,000 jobs.

Facebook Inc (FB)

FANG stocks are expected to continue their winning ways in 2018, according to analysts at GBH Insights. The research firm said that Facebook is aggressively adding to its more than two billion monthly active users, leading to continued growth in advertising. The firm also said that Instagram was the “golden jewel” of Facebook’s portfolio.

While FB stock dipped roughly 0.6% on the session, it didn’t slow call options traders in the least. Volume topped 309,000 contracts, or about 1.4 times Facebook’s daily average. Calls ate up 65% of the day’s take.

Looking out to January 2018, the put/call open interest ratio edged slightly higher to 0.69 from 0.68 on Friday. This rise in the ratio is likely attributed to profit taking from call options traders, rather than added put volume given Friday’s heavy call volume. That said, heavy call OI for the series still resides at the $180 strike, hinting that FB options traders expect the shares to take out this technical level heading into 2018.

Monsanto Company (MON)

The EU is set to warn Bayer and Monsanto about the former’s buyout offer for the latter. According to a course close to the matter, the EU feels the deal may hurt competition, and it may move to force Bayer to offer concessions to address the concerns in the $66 billion deal. The buyout would create the world’s largest pesticides and seeds company, and it is already facing heavy criticism from farming groups and environmentalists.

MON options traders appear to be preparing for the worst, as put volume dominated Friday’s trading activity. Volume came in at 188,000 contracts, or more than 40 times MON’s daily average. Puts made up 94% of that excessive volume.

A closer look via data from Trade-Alert.com reveals that the April and June $110 and $95 put strikes were heavily targeted by block trading. Specifically, a pair of blocks totaling 43,621 contracts traded on both the June $110 and $95 put strikes, while the April $110 and $95 puts saw a pair of blocks totaling 42,441 contracts.

In both instances, the $110 puts appeared to be purchased, while the $95 puts were likely sold. MON closed at $117.30 on Friday, hinting that these were bear put spreads betting on a sharp reversal in MON stock — likely anticipating the impact of EU concessions in the Bayer deal.

Teva Pharmaceutical Industries Limited (TEVA)

TEVA stock shot more than 7% higher on Friday after the company announced it is looking to cut as many as 10,000 jobs to reduce expenses. Teva is struggling with massive amounts of debt, and the company has said that it wants to cut expenses by between $1.5 billion and $2 billion in the next couple of years. The job cuts would be a step in the right directions.

TEVA options traders cheered the news, with volume spiking to more than 269,000 contracts, or more than four times Teva’s daily average. Calls gobbled up 73% of the day’s take. Looking out to January 2018, the put/call OI ratio currently rests at a bullish reading of 0.55, with calls nearly doubling puts among back-month options.

Peak January 2018 call OI is relatively tame, however, totaling about 44,000 contracts at the in the money $15 strike. In other words, TEVA options traders are still rather reserved despite the positive news.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Monday’s Vital Data: Facebook Inc (FB), Monsanto Company (MON) and Teva Pharmaceutical Industries Limited (TEVA) appeared first on InvestorPlace.