Moderna Stock Options Hot After Rare Downgrade

The shares of Moderna Inc (NASDAQ:MRNA) are floundering today, last seen off 11% at $84.36, after receiving a downgrade from J.P. Morgan Securities to "neutral" from "overweight." The firm also hiked its price target to $89 from $60 noting its bullishness regarding the long-term outlook for MRNA due to being one of the first to put a COVID-19 vaccine on the market. In response, the stock is seeing an unusual amount of options volume today.

So far, 88,000 calls have crossed the tape -- double the intraday average and volume pacing in the 99th percentile of its annual range. Puts are also exchanging hands at a curious pace; 51,000 puts have been traded today, four times the intraday average and volume pacing for the highest percentile of the last 12 months. The most popular overall is the 7/24 90-strike call, where new positions are being opened, followed by the 100-strike call from the same series. This suggests that these traders are speculating on a lot more upside for MRNA by the time these contracts expire.

The longer-term trend skews toward puts. This is per Moderna stock's 50-day put/call volume ratio of 0.42 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits higher than 85% of readings in its annual range. So while calls have outpaced puts on an absolute basis lately, the rate of put buying relative to call buying has been accelerated.

Meanwhile, analysts are optimistic regarding MRNA; not a surprise considering it is not far removed from its July 17 record high of $95.71. Of the 12 in coverage, 11 call it a "buy" or better. Meanwhile, the consensus 12-month price target of $96.58 is a 15.2% premium to current levels.

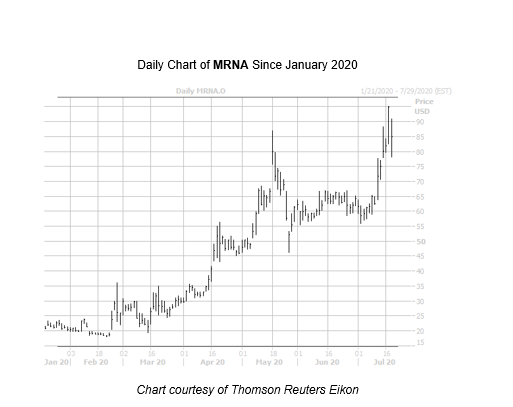

Despite the stock's meteoric 334.2% year-to-date lead, short sellers are building their positions. In the last two reporting periods, short interest rose 25.3%, with the 28.64 million shares sold short representing 9.7% of the stock's available float. This could work in bulls favor, should some of these pessimistic positions begin to unwind.