Missouri weighs tax break for KC nuclear weapons facility expansion amid protests

- Oops!Something went wrong.Please try again later.

Missouri may provide tax breaks for a massive expansion of a south Kansas City federal plant where workers build key parts for U.S. nuclear weapons.

The Missouri House is poised to pass a bill from Rep. Chris Brown, a Kansas City Republican, that would offer a sales tax exemption on all materials needed to expand the National Nuclear Security Administration’s plant in south Kansas City. The facility is operated by manufacturing and technology giant Honeywell International Inc. and builds many non-nuclear parts for the nation’s nuclear stockpile.

The legislation has received bipartisan support from Kansas City-area lawmakers, who argue the expanded facility would create new high-paying jobs in the region. The House gave the bill initial approval on a voice vote last week.

“It’s an incredible economic multiplier for the area for Kansas City,” Brown said. “I think this ask on the sales tax is a small ask if you look at the long-term economic impact.”

But the proposal faces some pushback from legislators elsewhere in the state who compare it to Missouri giving tax breaks to help major corporations. Critics have also taken issue with helping a facility that builds parts for nuclear weapons.

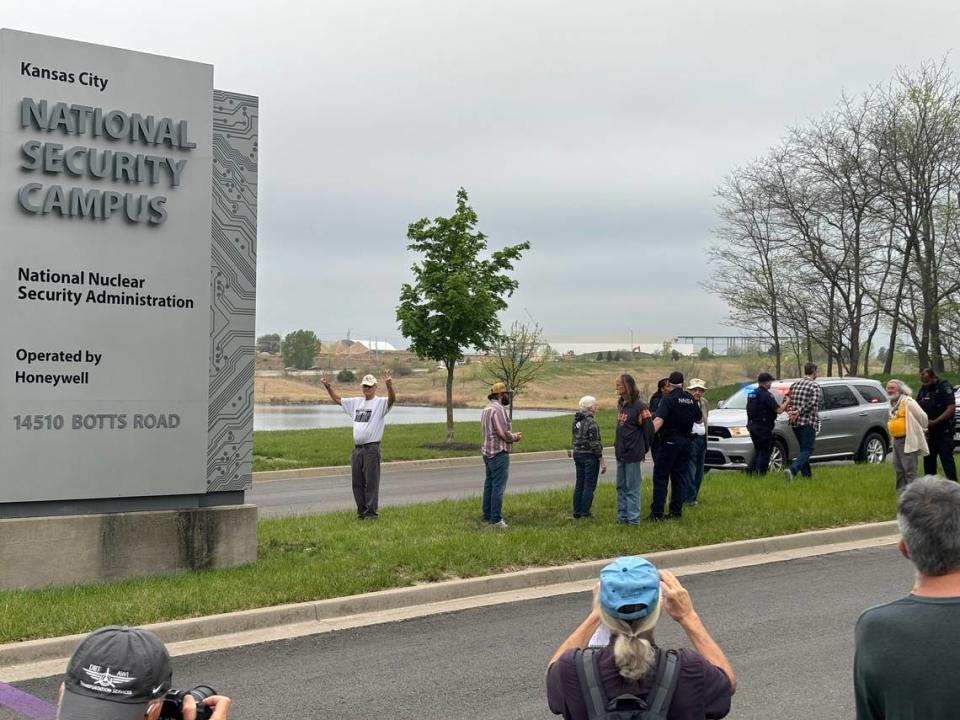

About 50 people gathered outside the entrance to the plant on Monday morning to protest nuclear weapons and the decision to expand the site. Police and security officers handcuffed at least 10 people who either ventured onto the expansion site or onto the plant’s land.

Holding signs such as “No New Nukes” and yelling anti-nuclear weapon slogans, the protestors tried their best to catch the attention of arriving workers. Ann Suellentrop, a local activist who sits on the national board of Physicians for Social Responsibility, sharply criticized U.S. efforts to build new nuclear bombs.

“We’re going the wrong way. We’re manufacturing our doom,” Suellentrop said.

The expansion project would add roughly 2.5 million square feet of office and manufacturing space. It’s expected to begin this year and continue into the “early 2030s,” according to a spokesperson for the federal agency, which is part of the U.S. Department of Energy.

The agency’s website states that it’s focused on “developing, producing, procuring and delivering over 80% of all nonnuclear components in support of the U.S. nuclear deterrent.”

Brown told lawmakers last week that the tax exemptions would go to a local developer who would complete the project and then sell the expanded buildings back to the federal government. He called it a “build to suit” model.

The legislation, Brown said, only provides the developer the same tax-exempt status that the federal government would receive if it were to build the facility itself.

A fiscal note attached to Brown’s bill estimates that the federal agency plans to spend more than $3 billion on the expansion. House nonpartisan staff, however, were unable to determine the total loss in sales tax revenue from the exemptions but assumed “the fiscal impact could be significant.”

Rep. Anthony Ealy, a Grandview Democrat whose district would contain the expansion, pointed to several other benefits of the project, including the possibility that construction jobs will be unionized.

“The federal government also encourages the private contractor to buy supplies from local areas,” he said. “So we have the ability for economic interest, not just in my city but in surrounding cities and counties.”

House Minority Leader Crystal Quade, a Springfield Democrat running for governor, told The Star that lawmakers need to look at ways to make the state more attractive. “I’m always open to having these conversations around incentives as long as they’re keeping jobs and that we’re holding those folks who receive that money accountable,” she said.

Sen. Greg Razer, a Kansas City Democrat, filed a similar bill this year. Razer’s legislation was voted out of a Senate committee last month.

But the tax break push also faces opposition from a few lawmakers from outside the Kansas City-area. Rep. Michael Burton, a St. Louis-area Democrat, called the bill “corporate welfare.”

“Why, as opposed to having sales tax exemptions for regular Missouri folks when it comes to their groceries, do we not do that,” he said during debate last week. “Why do we not do sales tax exemptions for women and their hygiene products, why do we not do that? But we’re doing something like this for all the materials for a giant corporation that’s putting this together?”

Rep. Tricia Brynes, a Wentzville Republican, spoke on the House floor about people in the St. Louis-area who have been hurt by nuclear radiation from the Manhattan project.

“Right now we’re asking for a sales tax exemption for ultimately a federal weapons facility in the western part of Missouri while the federal government has continued to ignore the damage they’ve done in a previous federal weapons facility in St. Louis,” Byrnes said, acknowledging that the Kansas City facility does not have nuclear waste.

“I do want to see great jobs. I do want to see the growth and I do hope they learned,” she said. “Thankfully this isn’t a nuclear waste facility.”

The facility’s website states that it’s involved in non-nuclear components and Brown said during the debate that the facility would not have nuclear waste.

The spokesperson for the federal agency said that since moving to the Kansas City campus in 2014, the facility has grown from 2,400 employees to more than 7,000. The expansion would provide space to accommodate the agency’s “additional volume of work,” the spokesperson said.

At the campus entrance on Monday, protesters said Honeywell employees should use their expertise to address climate change and other global challenges. Charles Carney, an activist in the Catholic Worker movement, called the construction of bombs a “moral outrage.”

“Every bomb that is built here is a theft from our most vulnerable citizens,” Carney said.